Check out the latest Verizon Communications earnings call transcript.

The last five years have been eventful for Verizon Communications (VZ +0.41%). The company acquired the 45% of Verizon Wireless that it didn't own from Vodafone, and bought tech companies AOL and Yahoo. It's also tried to become more of a tech and media company than just a telecommunications giant, although it's had limited success outside of its core wireless business.

The next five years will be similarly transformative for Verizon, but this time it'll focus on its core business. And faster wireless connections from 5G technology could make this stock a great long-term buy for investors.

Image source: Getty Images.

Verizon will be 5G

The mobile telecommunications industry has been promising speedy 5G connections for years, and we're finally starting to see them in the field. Verizon is offering 5G connections -- 5G Home -- in Sacramento, Los Angeles, Houston, and Indianapolis, with more cities set to launch in 2019. Getting fiber-type speed with a mobile device will be incredible for advancing mobile devices to another level of performance. And it'll also allow for new technologies such as self-driving vehicles and virtual reality.

The rollout of 5G will be slow, and for the next few years, 4G LTE networks will likely remain the standard for most users. But five years from now, the U.S. should be blanketed with 5G, likely from a leader like Verizon. So investors looking at the stock today should understand that when the company is operating at 5G speeds, that will ultimately transform Verizon's business.

Entering the home

5G speeds won't just impact mobile phones; the bigger impact will be in the home.

Verizon's first 5G product to launch isn't a mobile phone at all -- it's an in-home router. Thanks to 5G Home, customers will be able to cut their cable broadband connection and replace it with a wireless 5G connection. This could actually increase internet speeds to the home and allow Verizon to enter the home market in areas it's never been able to reach before.

A fiber-optic service was once Verizon's path into the home, but that required billions of dollars of investment and a physical line running into each home. 5G Home will allow Verizon to serve the same physical markets as mobile phones -- or nearly the entire country -- and enter the home as well. Cable companies should be on notice.

Growth markets we can't imagine

As a 5G company, Verizon will play a big role in the next wave of innovations in connected devices. We know industries including self-driving vehicles, connected cities, and virtual reality are eyeing 5G as a way to improve their own technologies on the go. But there will be additional impacts that we don't know about yet.

Faster connections will allow for new innovations and business performance. "Edge computing," or pushing the computing power from devices to central servers, will become more popular and allow companies to build services in the cloud and distribute them to consumers. The smartphone and 4G enabled advancements like ride sharing, mobile video services, and even online shopping like we've never seen before. We simply don't know what businesses 5G will bring about until the technology gets into innovators' hands.

What this means for investors

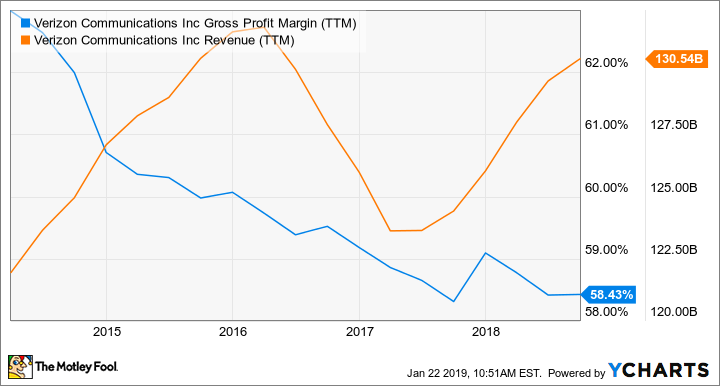

Investors have watched revenue stagnate and margins fall as competitors have grown competing 4G networks to challenge Verizon's former dominance. But when 5G arrives, I think it will come with higher prices and margins, and if the home product is successful, it could drive growth as well.

VZ Gross Profit Margin (TTM) data by YCharts.

Verizon's stock doesn't look cheap today, trading at 17.6 times trailing earnings, while the company's margins are falling. But the 4.2% dividend yield is a nice respite for investors, and if the company is able to expand margins and grow as I think it can over the next five years, the stock could be a big winner. 5G is going to disrupt technology more than we can predict, and Verizon will keep investors in the center of that innovation.