Concerns about the global economy have started to plague investors, and even some of the hottest industries in the business world have seen the impact. In the realm of laser production, IPG Photonics (IPGP +0.36%) has seen impressive performance for years, but with ongoing trade tensions between the U.S. and China showing few signs of ending anytime soon, the threat of tariffs and other impediments to free market trade have made some people nervous about whether IPG and its peers can stay on their steep growth trajectory.

Coming into Tuesday's fourth-quarter financial report, IPG Photonics investors expected to see pressure on sales and profits, and those expectations proved to be appropriate. Yet IPG is optimistic that it can handle a difficult economic environment and still produce strong growth in 2019, and that has longtime shareholders feeling more positive about the report.

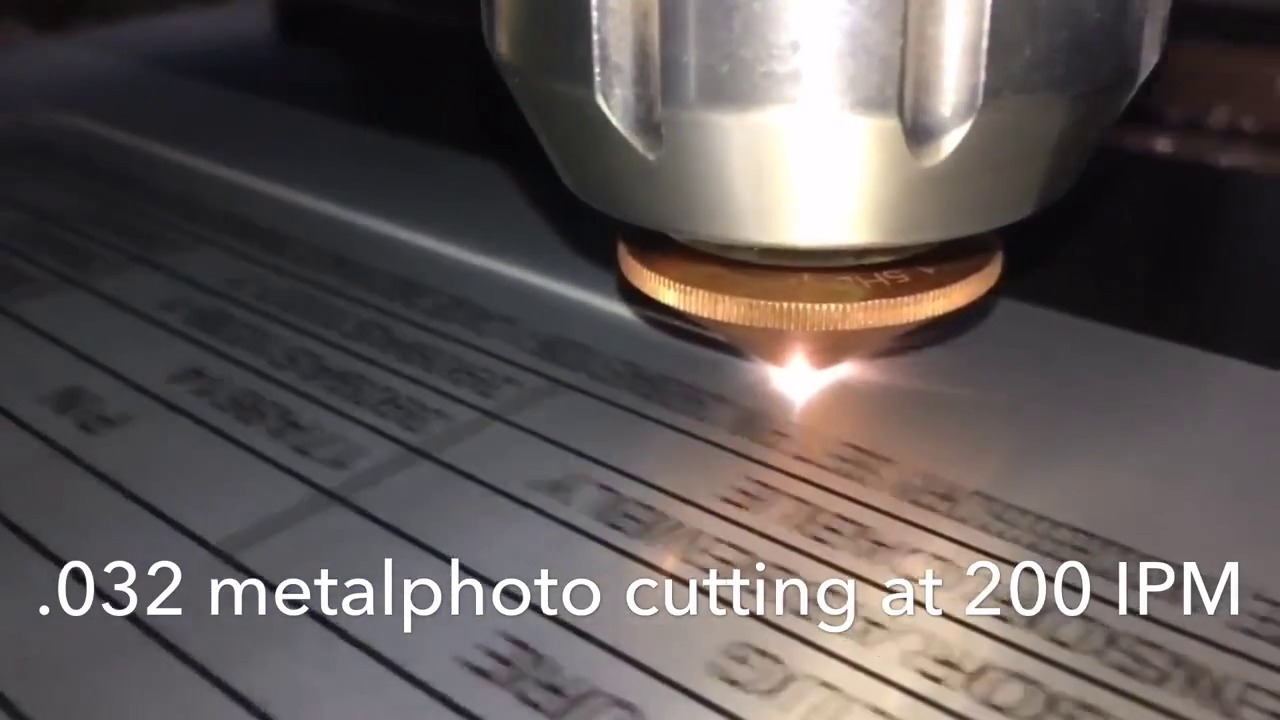

Image source: IPG Photonics.

What's holding IPG back?

IPG Photonics' fourth-quarter results showed the continuing pressure that the laser maker faced. Revenue was down 9% to $330.1 million, which was still better than the 13% decline that most of those following the stock were expecting. Net income jumped 43% to $75.6 million, but after accounting for the one-time hit to earnings that IPG suffered last year as a result of tax reform, earnings of $1.40 per share were down almost 25% from year-earlier levels and missed the consensus forecast among investors by $0.01 per share.

IPG's performance would've been even weaker had it not been for recent acquisitions. The purchase of Genesis Systems Group added between 2 and 3 percentage points of revenue growth, without which sales would've been down double-digit percentages from year-earlier levels.

IPG reported areas of strengths and weaknesses in its business performance. At the broadest levels, lower sales in metal-cutting and 3D-printing applications were only partially offset by higher sales in welding applications, contributing to the overall sales decline. IPG got incremental gains from growth in lasers for use in communications, medical, and government applications, but those businesses are only a tiny part of the company's overall market.

The worst declines for IPG came from its medium-power continuous wave laser segment, where sales fell 29%. But the key high-power continuous wave laser market suffered a 20% drop, and with that market representing more than half of the company's overall revenue, it was a big hit for IPG. Quasi-continuous wave laser sales fell 12%, and gains in pulsed laser sales and systems sales weren't enough to pull IPG's performance up. Regionally, North America and Japan were sources of strength for the company, but weakness in China and Europe pulled down overall results. Backlog figures fell slightly, with a 4% drop to $712 million.

CEO Dr. Valentin Gapontsev tried to put the company's performance in perspective. "Despite further weakening of the macroeconomic climate in our largest markets," Gapontsev said, "we were able to deliver results in line with our guidance." However, the CEO went on to emphasize the fact that "we have made meaningful strides in key new product areas and undertaken strategic acquisitions that help us capitalize on the long-term growth opportunities for our laser solutions."

Check out the latest IPG earnings call transcript.

Can IPG Photonics bounce back?

IPG has high hopes for 2019. Gapontsev noted that there've been some encouraging signs in recent months, including a pickup in order activity since late December that could point to a turnaround. The CEO remains cautious about China, where conditions are difficult to predict, but IPG is working hard to shore up its relationships with key customers while looking to secure new business opportunities.

In terms of financial performance, though, IPG's optimism didn't entirely shine through. The company expects revenue of $290 million to $320 million in the first quarter, and earnings should be between $1 and $1.20 per share. That's quite a bit worse than the $1.43 per share in earnings and nearly $330 million in sales that investors had hoped to see, and it signals that further declines are likely -- at least during the first part of 2019.

IPG Photonics shareholders weren't initially happy with the news, and the stock fell 8% in pre-market trading following the announcement before recovering to rise sharply during the ordinary trading session. Until the situation with China and other key trading partners gets clearer, it's going to be increasingly difficult for IPG and its peers in the laser industry to get the reassurance they need that global economic conditions will allow them to sustain their long-term growth.