There's a lot going on in the world, with geopolitical strife centering on tariff and trade issues, and macroeconomic slowdowns in several countries weighing on overall business activity. In the laser industry, IPG Photonics (IPGP +0.36%) is extremely sensitive to the fluctuations of the global economy, and despite hopes that it could overcome tough conditions in the laser market, the company has struggled to reach its full potential.

Coming into Tuesday's second-quarter financial report, IPG Photonics investors expected to be able to see the impact of the difficult environment on the company's core financial results. The laser maker indeed reported weaker results, but it still thinks that it'll be able to overcome headwinds in the long run.

Lasers cool off for IPG Photonics

IPG Photonics' second-quarter results continued negative trends from past quarters. Sales were down 12% to $363.8 million, which was actually somewhat better than the 15% top-line decline that most of those following the stock had expected to see. Net income plunged more than 40% to $72.3 million, however, and that resulted in earnings of $1.34 per share. That missed the consensus forecast among investors for $1.38 per share in earnings.

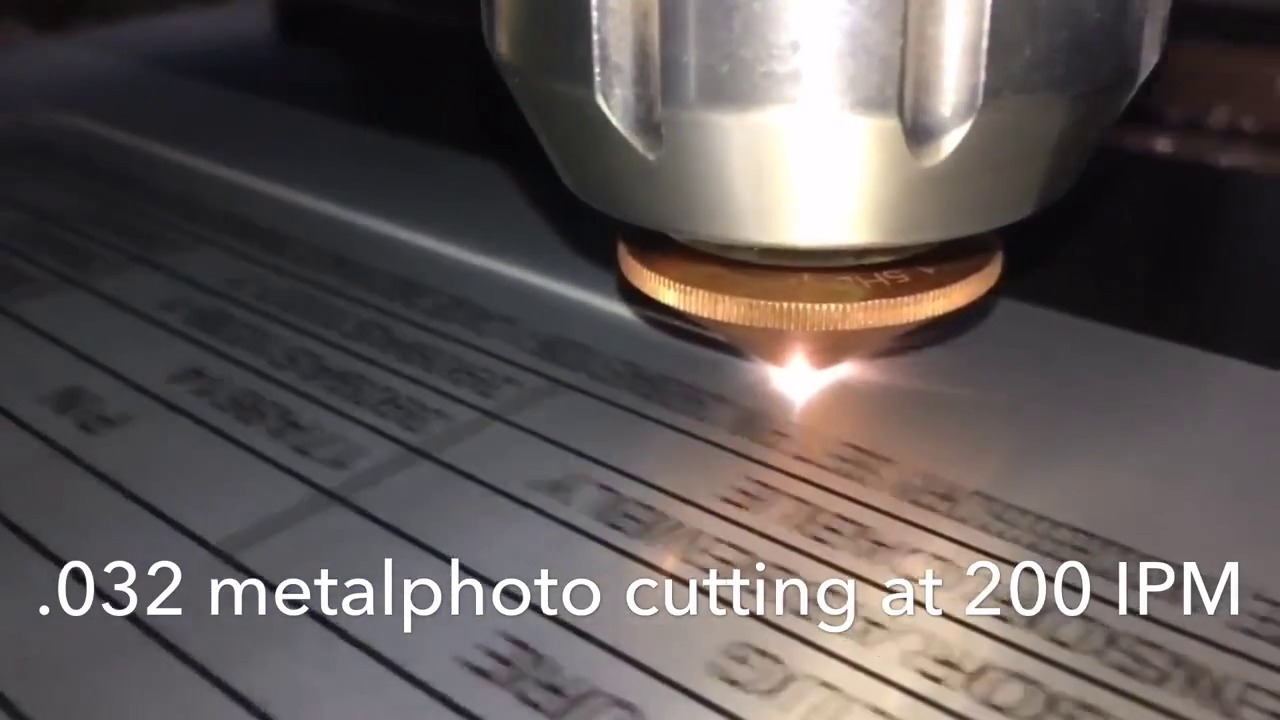

Image source: IPG Photonics.

Key segments within IPG Photonics' business all felt the brunt of sales pressure. Materials processing revenue was down 12%, as IPG reported lower demand for cutting and 3D printing applications. Sales for other applications were down an even steeper 16%. Moreover, revenue would have been even weaker had it not been for IPG's acquisition of Genesis Systems Group, which contributed $22 million in sales during the period.

High-power continuous wave lasers make up a big part of IPG's overall business, and sales of those products plunged 20%. That drop came despite a rise of 16% in revenue from the most powerful lasers of 10 kilowatts or greater. China, Europe, and Japan all weighed on high-power continuous wave laser sales, and even a 34% rise in revenue from North America wasn't able to offset the downward trend.

Macroeconomic issues hit IPG Photonics in a number of ways. Revenue from China was down 19% as orders slowed down following the imposition of U.S. tariffs. Softness in the manufacturing sector in Europe hurt revenue levels there by 22% year over year. Japan's 10% drop and Korea's 14% decline also weighed on results, as did a 31% drop in sales to Turkey.

Can IPG Photonics bounce back?

CEO Valentin Gapontsev tried to stay positive. "Although the macroeconomic and geopolitical environment remains challenging," Gapontsev said, "we delivered results in the upper half of our guidance range, while demonstrating solid traction in new products." The CEO also noted that an emphasis on cost-cutting has been valuable in limiting the damage to IPG's bottom line.

Yet IPG's outlook suggested a less favorable future. Gapontsev noted that manufacturing economies have weakened over the past quarter, and weaker orders in June led to levels of activity that were weaker than the laser maker typically sees this time of year. With demand under pressure, IPG will likely have to deal with lower prices for its products as competition ramps up.

That led to guidance from IPG for third-quarter sales of between $325 million and $355 million, and earnings likely to come in around $1.05 to $1.35 per share. Both of those numbers were quite a bit below what most of those following the laser manufacturer's stock were expecting to see.

IPG Photonics shareholders responded negatively to the news, and the stock declined by 1% to 2% on Tuesday following the announcement. An economic rebound for the laser industry remains possible, but it seems likely that IPG will have to endure a somewhat extended period of weakness before it can return to a more substantial growth trajectory.