What happened

The stock of PagSeguro Digital (PAGS +0.31%) gained 30.4%% in February, according to data from S&P Global Market Intelligence. The e-commerce payment company's shares saw substantial gains following fourth-quarter results that evidenced impressive momentum for sales, net income, and gross payment volume.

PagSeguro reported fourth-quarter and full-year results after market close on Feb. 21, delivering substantial revenue and earnings beats as well as encouraging guidance for 2019. Shares climbed roughly 14% in the next day of trading and continued to gain ground as the month went on.

Image source: Getty Images.

So what

PagSeguro's revenue for the fourth quarter came in at $336.9 million after converting from Brazilian currency to U.S. dollars, topping the company's own guidance and the average analyst estimate for revenue of $332.5 million. Sales for the period were up roughly 52.5% year over year when not adjusted for currency, total payment volume climbed 80.7%, and net income for the quarter rose 60.6%.

The company closed out 2018 with 4.1 million merchant partners, up from 2.8 million at the end of 2017. That's impressive customer growth, and taken in conjunction with other promising signs from PagSeguro's recent earnings report, it looks like the business is heading in the right direction.

Check out the latest earnings call transcript for PagSeguro Digital.

Now what

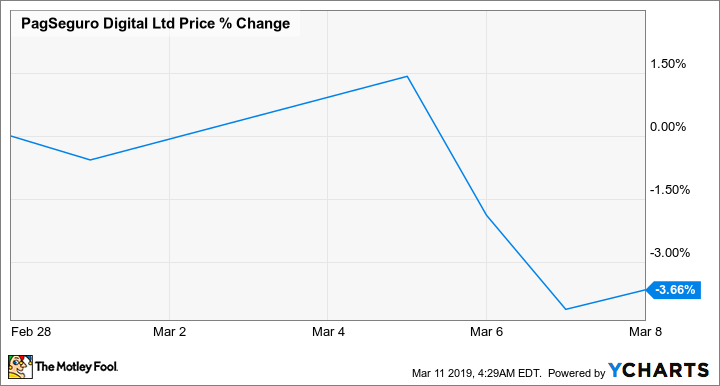

PagSeguro stock has lost a bit of ground in March, with shares trading down roughly 3.7% in the month so far.

PagSeguro stock trades at roughly 22 times this year's expected earnings, a level that could look very cheap down the line if the business continues to deliver such strong sales and earnings performance. The company expects GAAP net income for 2019 to come in between $1.182 billion and $1.36 billion -- and non-GAAP net income to be between $1.322 billion and $1.5 billion. Hitting the midpoint of its non-GAAP income target would suggest roughly 32% year-over-year growth, but management thinks that growth could actually come in closer to 40%.