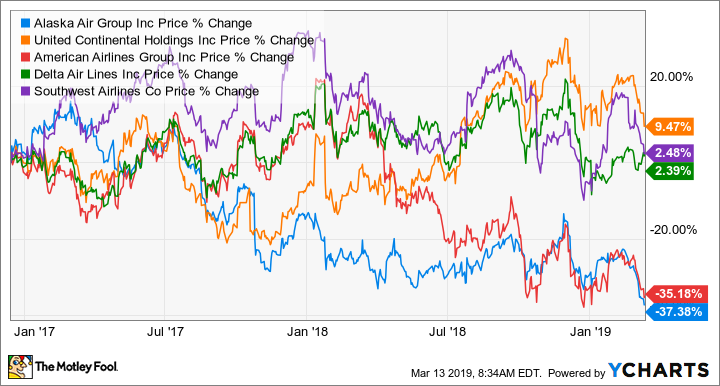

It's been a turbulent ride for Alaska Air Group (ALK 1.14%) holders, with shares down 37% since the company's December 2016 purchase of Virgin America.

Some of the issues have been due to rising fuel costs, which have plagued the entire industry. But Alaska Air has underperformed the other major U.S. airlines due to declining unit revenue as management focused on merger integration.

Top U.S. airline stock performance since Dec. 14, 2016 data by YCharts

Prior to the deal, Alaska Air had a strong reputation as an outperformer, and management has a plan in place to improve profitability and try to restore the airline's place among the highfliers. Here's the outlook for Alaska Air to determine whether the shares are a good buy today.

Rebuilding margins

Alaska Air management used the company's investor day in November to lay out a plan to generate pre-tax margins of between 13% and 15% in the years to come. That's well short of the 24% margin the company briefly enjoyed prior to the merger, but an improvement over the single-digit results of 2018.

Check out the latest earnings call transcript for Alaska Air Group.

Image source: Alaska Air Group.

Much of that plan involves reallocating assets and rolling out a new fare structure. Alaska Air is retrenching around its home Seattle hub, reversing course on a postmerger California expansion that put it in direct competition with Southwest Airlines and ate into yields.

The company is also redeploying the Airbus A320 jets it inherited from Virgin America, taking them off transcontinental flights in favor of larger Boeing 737s with more premium seats. The Airbus jets are being reconfigured from Virgin America's style to Alaska's at a rate of about four to five jets per month, giving the airline additional revenue-producing seats while also offering more higher-fare seating options.

The Airbus retrofit should be completed by the end of 2019, improving revenue per flight.

Alaska Air has also sought to increase revenue via policy changes including increased baggage fees, and in late 2018 introduced a "Saver Fares" basic economy product. Saver Fares should help improve revenue segmentation by allowing the airline to offer discounted fares for price-sensitive travelers while also encouraging less price-sensitive customers to buy more expensive tickets, and management believes that when fully implemented, Saver Fares can increase revenue by $100 million annually.

Challenges remain

Unfortunately, Alaska Air is still flying into headwinds. Earlier this month the company lowered its first-quarter unit revenue range to up 1% to 2%, from up 2.5% to 4.5%, due to competitive pressures and weather issues in Seattle.

The weather issues, which included about 1,100 flight cancellations, can be ignored by long-term investors, but the continued fare weakness is a concern. The bull case calls for fuel price increases to cause airlines to cut back on capacity, allowing for more pricing power. But after climbing steadily higher through much of 2018, jet fuel prices have fallen back to December 2017 levels, easing pressure on airlines to dramatically scale back capacity.

It's hard to know how much to read into first-quarter numbers, given the importance of leisure traffic to Alaska Air and the typical weakness in leisure travel in the early months of the year. But if nothing else it appears the much-anticipated turnaround in 2019 is off to a slow start.

Meanwhile, Southwest is finally selling tickets for flights to Hawaii, a full 16 months after announcing its intention to enter the market. That is going to increase pressure in what is already a competitive fare market.

Is Alaska Air a buy?

Alaska Air has an attractive route network and should see stronger margin improvement this year than most of its competitors. It has historically been a good operator and has a management team I trust.

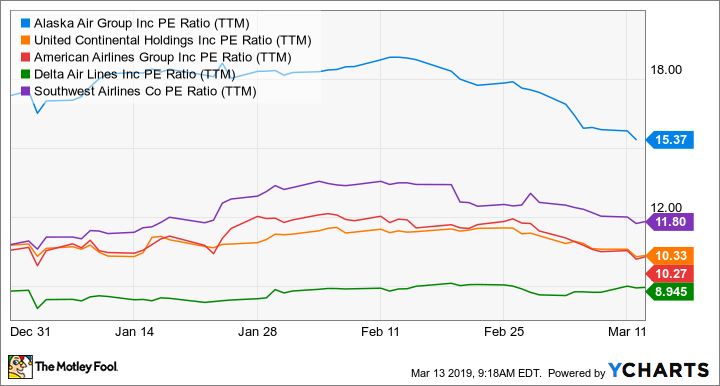

On the other hand, given the competitive dynamics of West Coast flying and Alaska's prudently conservative rollout of Saver Fares, I'm skeptical that the company will be able to achieve its 13%-to-15% margin target as quickly as it hopes. And Alaska Air isn't cheap, trading at 15 times earnings.

Major airline PE Ratios (TTM) data by YCharts

If I were to buy shares of an airline today it would be Delta Air Lines, a company that has been out ahead of the competition in terms of innovation and is now past the transitional period that Alaska Air is currently going through. That said, with the Virgin America integration now largely complete, I expect Alaska Air by midyear will have solid momentum as all the hard work management has done in recent years begins to bear fruit.

The margin improvement might take longer than expected, depending on competitive dynamics, fuel costs, and the success of rolling out Saver Fares. But for a long-term investor, I do expect Alaska Air to be an outperformer.