What happened

Shares of Weatherford International (NYSE: WFT) finished trading Monday down 9.8%, after falling as much as 13% in early afternoon trading.

As has been the case in recent months, today's decline wasn't due to anything material or specific for Weatherford's business or its prospects -- or at least anything that wasn't already public information.

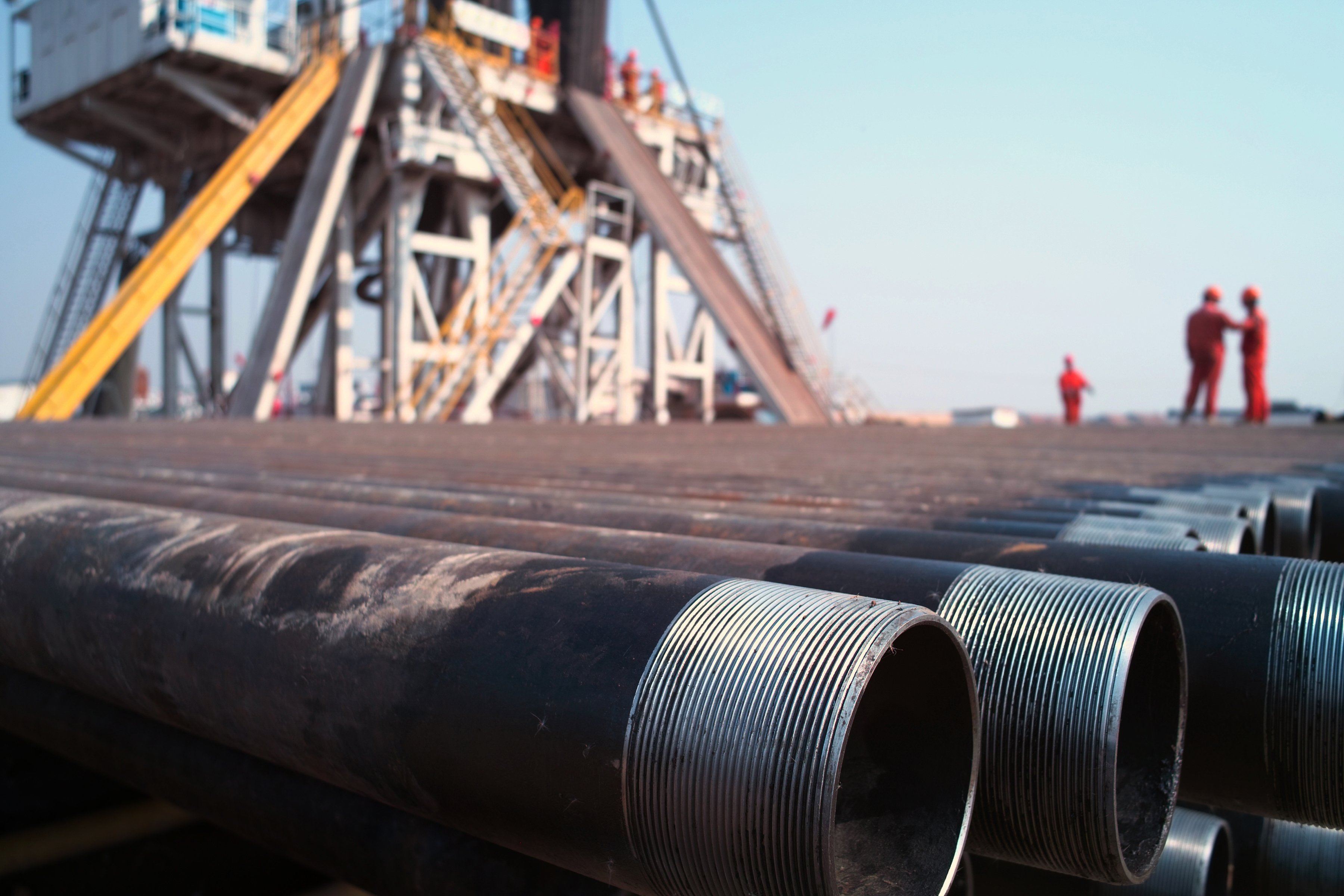

Weatherford is facing rough seas. Image source: Getty Images.

So what

The reality for Weatherford is that the company is deeply troubled. Despite being one of the largest equipment and service providers in the oil and gas industry, Weatherford has struggled for years with poor cash flow. And management has struggled to implement a strategy to improve the business, only just recently generating its fourth quarter of positive free cash flow since 2016:

WFT Free Cash Flow (Quarterly) data by YCharts.

Over that period, Weatherford burned through a substantial amount of cash on a free basis, and continually had negative cash flow from its operations.

Check out the latest earnings call transcript for Weatherford International.

Now what

As things stand today, one recent "good" quarter doesn't a turnaround make. Furthermore, there's a reasonable chance that it will prove to be too little, too late since Weatherford has a substantial amount of debt and other liabilities on its books, with much of that coming due within 12 months:

WFT Cash and Short Term Investments (Quarterly) data by YCharts.

Weatherford has over $2 billion in liabilities due within 12 months, only $602 million in cash and equivalents, and a long history of negative cash flow.

Those liabilities will need to be satisfied. I'm not convinced Weatherford's operations can pull it off, and it's unlikely the company will find lenders willing to extend even more to the already-overextended company.

There's a reason Weatherford's stock trades for less than a buck per share, and it's not because it's a cheap investment. Sure, there's a chance management could turn things around and make it a steal at recent prices, but that's very, very unlikely at this stage.

My suggestion is to take your dollar to the nearest fast-food joint; you won't be any healthier or wealthier for it, but at least you'll get some calories to go along with the indigestion.