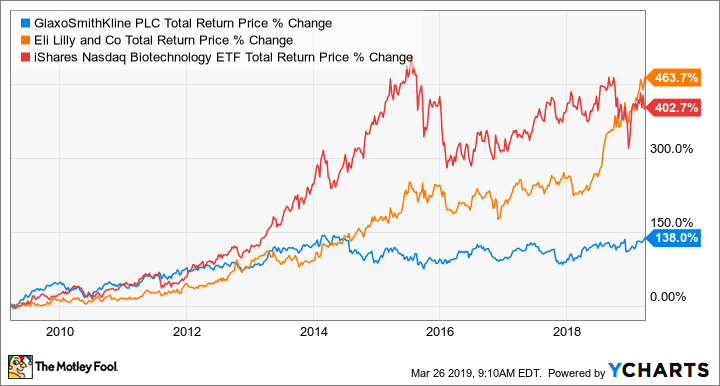

Over the last 10 years, Eli Lilly (LLY +1.61%) and GlaxoSmithKline (GSK +0.00%) have both undergone a dramatic transformation due to key patent expirations, as well as industrywide headwinds. To date, Lilly has been vastly more successful at renewing its product portfolio than its big pharma peer. As a result, Lilly's shares have gone on to produce market-beating returns on capital over the last 10-year period, while Glaxo's stock has dramatically underperformed the broader pharmaceutical industry.

GSK Total Return Price data by YCharts.

However, Glaxo's new leadership team -- headed up by CEO Emma Walmsley -- is determined to change this narrative over the next 10 years. Should investors take a flier on a Glaxo turnaround, or is Lilly still a better long-term pharma play? Let's take a closer look to find out.

The case for Eli Lilly

Eli Lilly has been one of the brightest stars in the red-hot pharma space in terms of total shareholder returns over the last decade even despite the company's struggles with the patent cliff. The core reason is Lilly's ability to generate respectable levels of top-line growth, even as top-sellers like Cialis go generic. In all, Lilly expects its pharma sales to achieve a compound annual growth rate of 7% over the period of 2015 to 2020.

While high-single-digit sales growth may not sound impressive within this particular space, it's important to bear in mind that Lilly's rising top line is occurring against the backdrop of even more major patent expirations in key geographies, as well as political blowback over its pricing policies for star diabetes medications like Humalog.

Image source: Getty Images.

What's Lilly's secret? The company has scored several big wins on the clinical and business development fronts over the past five years. The net result is that Lilly has been able to keep its top line moving in the right direction via a cohort of newer growth products like Basaglar, Cyramza, Emgality, Trulicity, and Verzenio, among several others.

All told, Lilly sports one of the most diversified and overall healthiest product portfolios in the industry right now. That fact should translate into steady revenue growth for years to come.

Check out the latest earnings call transcripts for Eli Lilly and GlaxoSmithKline.

The case for GlaxoSmithKline

Glaxo is a company in the midst of a major overhaul. Within the next three years, Glaxo plans on offloading its consumer healthcare business to unlock the latent value of its pharmaceutical and vaccine businesses.

As part of this planned breakup, Glaxo paid a sky-high premium to acquire Tesaro for its ovarian cancer drug Zejula last year. Glaxo's plan is to make Zejula a central piece of its newly rebuilt cancer portfolio. Once the dust settles, the revamped Glaxo should have a total of five major value drivers: immunology, HIV, oncology, respiratory therapies, and vaccines.

Where does this leave Glaxo as a growth vehicle? That's a hard question to answer at this point in time. The company does have some interesting oncology assets outside of Zejula that could prove to be big moneymakers. But the drugmaker will also be up against some stiff competition in this all-important product category. Stated simply, it's too early to predict how well Glaxo will fare in oncology, which is a major piece of the puzzle.

Which stock is the better buy?

Eli Lilly is the clear winner in this battle of pharma royalty. Even though Glaxo's 5.8% dividend yield dwarf's Lilly's 2% annual payout, Lilly offers a much clearer outlook on a number of fronts. Glaxo's promising oncology pipeline could accelerate the company's return to form, but that's not a guaranteed outcome. Lilly, on the other hand, already has a well-rounded lineup of new growth products, giving investors a fairly clear picture of the road ahead.