What happened

Shares of William Lyon Homes (WLH +0.00%) climbed more than 10% on Thursday after the homebuilder said its board had given the company's founding family permission to seek a buyer for the company.

So what

William Lyons Homes in a regulatory filing Thursday said its board has granted chairman and CEO William H. Lyon a limited waiver allowing him to enter into agreements with unaffiliated co-investors about potentially making a proposal to buy the company.

Image source: Getty Images.

Lyon owns 17.5% of the company, according to the filing, while the family's Lyon Shareholder 2012 LLC group owns 16.5%. The waiver is set to automatically expire in one year.

The disclosure came on the same day that William Lyons Homes reported first-quarter earnings of $0.21 per share, beating consensus by $0.01, on revenue of $455.86 million -- well ahead of the $410 million expected.

Now what

The company said that William Lyon has indicated he is not engaged in active discussions, and the company "is not aware of any imminent proposal," so there is no assurance that this waiver will lead to a transaction.

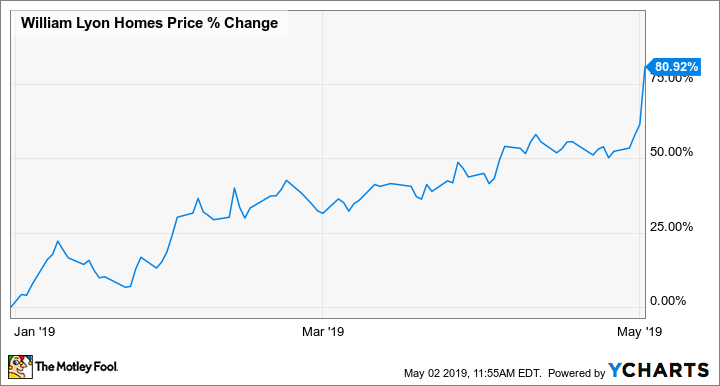

The good news for investors is that homebuilders in general and William Lyons Homes in particular have held up well so far this year despite sobering forecasts early in 2019. Shares of William Lyon Homes were up 50% year to date even before the Thursday jump.

Investing based on buyout speculation is always a dangerous game, and given how high William Lyon Homes shares have already climbed, it is difficult to say for sure that there will be much of a takeover premium above the current price even if a deal does materialize. Existing holders can sit back and watch the process play out, but it's best for newcomers to watch from the sidelines for now.