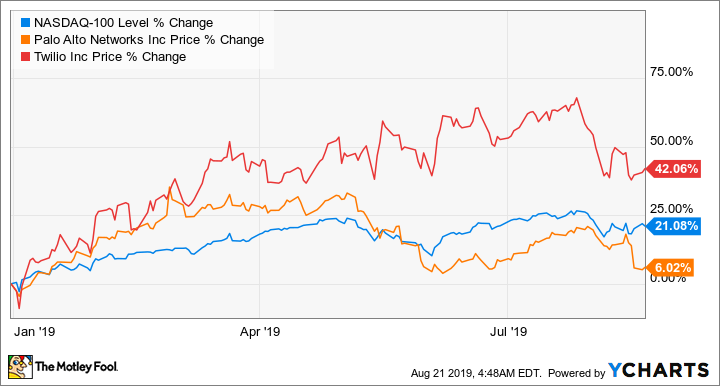

Tech stocks got off to a high-flying start in 2019, but the intensifying U.S.-China trade war has knocked the wind out of the sector. The tech-heavy NASDAQ-100 has started dipping of late, and soaring growth stocks such as Palo Alto Networks (PANW +0.26%) and Twilio (TWLO +2.15%) have taken a hit.

But both Palo Alto and Twilio look all set to step on the gas in the future thanks to recent strategic moves. Let's take a closer look at why the recent dip both these stocks have endured shouldn't last for long.

Image Source: Getty Images.

Twilio's growth keeps getting better

Cloud communications specialist Twilio's revenue has been growing thanks to a mix of higher customer spending and an increase in the customer base. The company is now clocking an annual revenue run rate of $1 billion, having delivered 86% top-line growth to reach $275 million in the fiscal second quarter.

The good news is that Twilio's revenue growth isn't going to fall off a cliff anytime soon as the customer-engagement platform market keeps growing. Twilio's technology is working in the background when, for instance, you get a message from Uber saying that your ride has arrived or from your bank giving you your account balance. Such customer communications are handled by cloud-based contact centers, and Twilio is trying to dig deep into this space to tap into the massive opportunity.

Mordor Intelligence estimates that the cloud-based contact center market will clock 24.5% annual revenue growth through 2024, generating more than $33 billion in revenue by the end of the forecast period as compared to $8.9 billion last year.

Twilio recently expanded into the cloud-based email delivery solutions market by acquiring SendGrid for $2 billion. This gives Twilio access to the email marketing vertical, which is reportedly posting an annual growth rate of more than 15%.

What's more, Twilio expects that the acquisition of SendGrid will send its margins higher. CFO Khozema Shipchandler pointed this out on the latest earnings conference call, saying, "Historically, we said you expect gross margins in the [mid-50% range], but with the benefit from SendGrid, we expect to see our margins in the mid- to high-50s for the foreseeable future."

This isn't surprising, since SendGrid has brought 84,000 new customers into Twilio's fold. This means that the company now has a vast pool of customers to whom it can sell its own products, while its original customers can also choose to buy SendGrid's offerings.

So Twilio will ideally have to spend less money on customer acquisition, and it can enjoy stronger top-line growth and boost profitability.

Palo Alto's near-term hiccups shouldn't matter in the long run

Palo Alto Networks has been a victim of the U.S.-China trade war. The cybersecurity specialist had to slash its fiscal fourth-quarter guidance thanks to acquisition costs and the negative effects of tariffs imposed on Chinese goods.

Barring these one-time adjustments, Palo Alto's guidance would have been right in line with Wall Street's expectations, and its stock wouldn't have taken a beating. But now that Palo Alto stock has receded, it would be a good idea to go long, because its growth metrics can keep getting better in the long run.

Palo Alto's revenue jumped 28% annually in the fiscal third quarter, better than the 23% annual jump the company had originally expected. It has guided for 21% to 22% revenue growth for the fourth quarter, but don't be surprised to see Palo Alto exceed that mark because of its history of beating guidance.

What's more, the company's customer base has been swelling at a nice pace. The company exited the fiscal third quarter with around 62,000 customers as compared to 51,000 customers in the prior-year period. The fact that the company's revenue grew at a faster pace than the jump in its customer base indicates that users are spending more money on its products and services. In fact, the lifetime value of Palo Alto's top 25 customers jumped 35% annually in the most recent quarter.

What's more, the lifetime value of Palo Alto's customers should increase further thanks to its recent acquisitions of Twistlock and PureSec, which give the company access to the fast-growing markets of container security and serverless cybersecurity.

These acquisitions will bring new cross-selling opportunities to Palo Alto, which should lead to higher customer spending and boost the company's top and bottom lines.