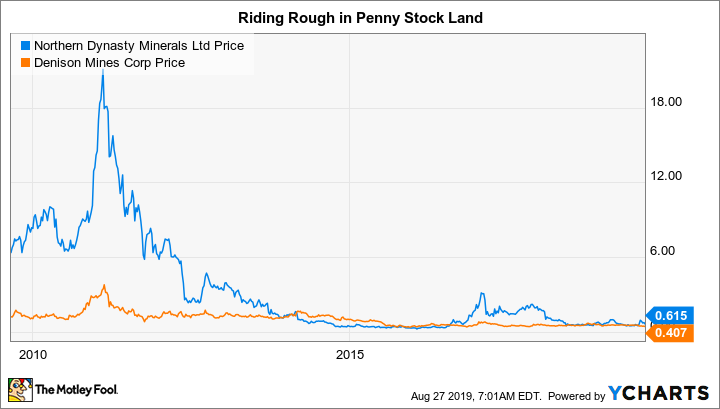

Investors tend to be an optimistic bunch, often buying into Wall Street's stories of huge growth potential. Sometimes those stories are built on a solid foundation, but other times they look like nothing more than hopes and dreams. Penny stocks, which generally trade for less than $1 a share, often fall into the "hopes and dreams" category. Here are two real-life examples of why most investors should avoid penny stocks like the plague, no matter how pretty a picture management paints.

The gold mine that could be

Northern Dynasty Limited (NAK 9.73%) is looking to build a mine in Alaska. On paper, the Pebble Project looks fantastic. According to the company, it is the largest undeveloped copper and gold resource in the world. The measured and indicated reserves (the amount the company thinks it can pull out of the ground) are huge, with 57 billion pounds of copper and 71 million ounces of gold. There are also silver (345 million ounces) and molybdenum (3.4 billion pounds) in the mix, too.

Image source: Getty Images

If the Pebble Project gets completed, Northern Dynasty's stock could take off like a rocket. But there's a reason why it trades hands for less than $1 a share: The outlook for Pebble is at best complicated. For example, there is material local resident, government, and environmental pushback because the project could impact salmon breeding grounds. In fact, Northern Dynasty is still trying to work through the permitting process, and so far, it hasn't been a particularly smooth ride.

Meanwhile, the company has been losing money for years and still faces material construction costs, assuming it is even allowed to to build a mine. That likely means it will have to sell more shares, which would further dilute current shareholders. In fact, the outlook for Pebble is so tenuous that Northern Dynasty's main financial partner, First Quantum Minerals, pulled out of the project in mid-2018. That will make it even harder for the company to get Pebble done.

Sure, Northern Dynasty's Pebble Project could be a huge success and the stock could take off. But at this point the mine is years away from completion and facing stiff opposition. And the would-be miner has limited financial resources, other then selling more and more dilutive shares. Most investors are better off waiting for Northern Dynasty to actually produce some gold and copper before jumping on the stock, even though the story it is telling sounds great and its shares are trading below $1.

Banking on the future of nuclear energy

Next up is Denison Mines (DNN 6.60%), which is also trading hands for less than $1 today. This company is working on the Wheeler River Project, which holds material uranium resources. Denison is looking to build two mines, which are projected to produce an average of around 7.5 million pounds of uranium a year over a 14-year timespan. But, again, that's only if the mines actually get built.

Denison is still working through the permitting process. Construction won't actually start until 2021, if everything goes as planned. The first of the two mines on the site, meanwhile, won't begin producing until 2024. Then the company needs to start working on the second mine, which won't begin until 2026, with start-up projected for 2030. A lot can go wrong between now and then...but that's not the biggest problem here.

At this point, the company is projecting operating margins of roughly 90% for the first mine and 77% for the second. Both require uranium prices to rise from current levels, with the second mine's operating margin projections built on a near-doubling of the nuclear fuel's price. Worse, these operating margins are well above what some of the industry's best miners currently achieve.

If Denison can live up to these projections and get both of its uranium mines built, the stock would likely move sharply higher. But there's a lot of work to be done before any uranium starts coming out of the ground and its projections seem pretty optimistic. This is another penny stock that is best avoided by all but the most aggressive investors.

A risk/reward imbalance

When it comes to penny stocks, the risks usually don't justify the potential rewards for most investors. And the word potential here is key, since often these companies have little more than big plans -- which is all that Denison and Northern Dynasty are really offering investors today. Sure, if a good story works out, a small stock could turn into a big winner. But as these two companies show, a positive outcome is often far from certain when you are dealing with penny stocks. Most investors are better off waiting for penny stocks like these to prove their businesses have real a future before putting hard-earned savings at risk.