Owning companies that grow much faster than the economy over the long term can be one of the best ways to beat the market. Investors often have a hard time valuing a company that grows five times or more in the course of a decade, but hindsight can make those stocks look cheap if they hit high growth numbers.

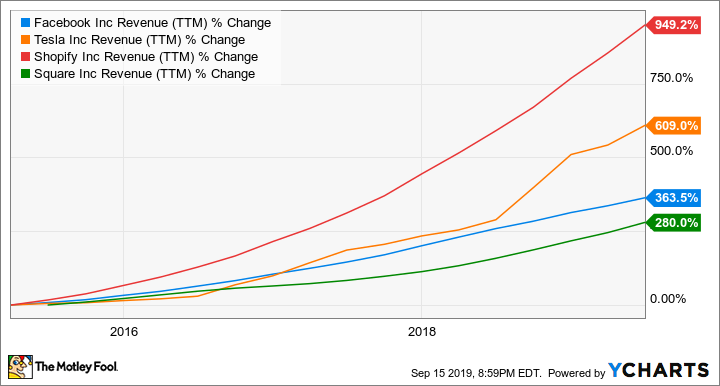

Four companies that are among the market's leaders in growth are Facebook (FB 3.28%), Tesla (TSLA 3.76%), Shopify (SHOP 4.49%), and Square (SQ +1.02%), and they all still have a lot of growth ahead.

FB Revenue (TTM) data by YCharts. TTM = trailing 12 months.

Facebook is still a growth machine

It's hard to overstate how powerful Facebook has become -- not only in people's lives, but for businesses trying to reach customers. Running a Facebook page and Instagram account are two of the best ways to interact with customers and reach a wider audience. And it's the value Facebook offers to businesses that's the real moneymaker: $16.6 billion of Facebook's $16.9 billion of revenue in the second quarter of 2019 came from advertising.

As fast as Facebook is growing in the U.S. (nearly doubling revenue in the past two years), what's incredible is how much growth potential it has internationally -- 48% of the company's revenue comes from the U.S. and Canada, but just 10% of its monthly active users live there.

Not only can Facebook grow its core business internationally, I also don't think we're done seeing it grow its business units. The company's marketplace function is a huge success, and it's rolling out a dating platform, too. With 2.4 billion monthly active users worldwide, there are many more ways it can engage users and continue growing.

The future of automobiles

There's a lot of debate in the market about whether Tesla's business is sustainable long term, but there's no question that it's been a growth machine. The company has generated $24.9 billion of revenue in the past year and has obliterated every other auto manufacturer in electric vehicles.

TSLA Revenue (TTM) data by YCharts.

I don't have any doubt that Tesla will continue to grow; the question is at what cost? Its operating margin is just 1.3% over the past year, and it's seeing its solar business shrink into oblivion, losing a once-promising channel to build a larger sales organization and product ecosystem.

If Tesla can stay a few steps ahead of the competition in EVs, it'll continue to command the market's respect. But that will be harder to do in the future. Competition is heating up with Porsche, Nissan, Volkswagen, and more companies introducing new EV models in the next year, so all eyes will be on whether or not Tesla can keep sales momentum going and push margins higher with real competition in the EV space.

The growth stock in retail

You can see in the chart above that Shopify has grown revenue by nearly 10 times over the last five years, an amazing feat for any company. The genius of Shopify is that it's providing tools that make building an e-commerce business easy, and that's a booming category today. The platform provides an online store, a point-of-sale (POS) system on- and offline, social media tools, and even simple shipping tools that can be indispensable to new companies.

E-commerce companies today don't want to be experts in building a website or logistics, they want to focus on building a brand and creating products people want. For a modest fee, Shopify handles a lot of the rest of the tools needed to run a business so management can spend time on adding value, rather than thinking about details that can distract entrepreneurs from more important aspects of their businesses. Given the tools Shopify is adding to make building an e-commerce site more easily, I don't see any competitor catching up soon, which bodes well for its long-term growth.

Image source: Getty Images.

Another online payment tool

Square is a little like Shopify's older brother, offering some of the same tools but with some different end markets in mind. Square's bread-and-butter customers are salons and food-truck-type businesses, which want an easy-to-use payment solution on the go. Some of them use tools like scheduling, payroll, and even capital services. But the initial pitch to these operators was a simple 2.9% fee for every swipe. No need to set up merchant accounts or deal with payment processors -- Square was one-stop shopping.

Today, it has built out a portfolio that you could use to run a restaurant or bakery, power a retail shop, or operate virtually any other business. Its back-end tools make it a valuable ecosystem of products that tie together complex systems smoothly.

What I like about Square's position today is that it's building a suite of offerings that aren't likely to be matched by another company anytime soon. The POS device is the center of the offering, but for a fee, customers can add dozens of services that work seamlessly with the POS system. And the more services customers use, the stickier this business is, which will keep Square growing for a long time.

4 great ways to bet on growth

There are no sure things in investing, but these companies look sure to keep their growth momentum going for the foreseeable future. They've built great moats and they're becoming staples in their respective markets. Unless people stop using social media or shopping online, I think they all have great futures.