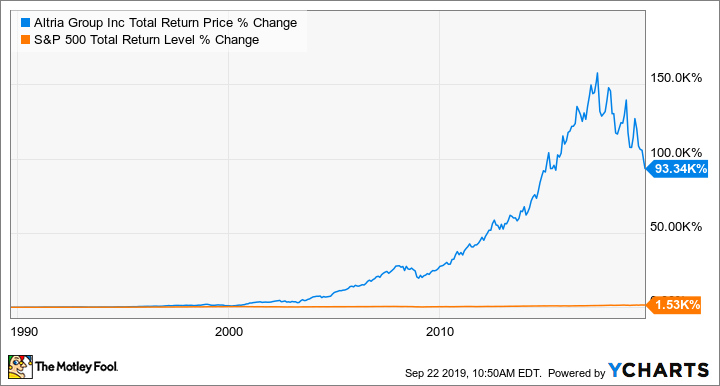

Over the past three decades Altria (MO 1.02%) has a total return of more than 93,300% for investors, compared to just 1,530% from the S&P 500 index. The power of raising its dividend for 50 consecutive years has paid off for those willing to hang on through thick and thin for the tobacco giant.

But Altria is going through some pretty lean times now, and its stock has fallen 35% over the last 12 months. It's a different market for the Marlboro Man, so here's my take on whether Altria's stock is a buy.

MO Total Return Price data by YCharts

Severe challenges ahead

Declining numbers of smokers is nothing new for Altria investors, as the cigarette industry has been in a secular decline for decades, but the rate at which they're falling is accelerating.

In its second-quarter earnings report, Altria forecast a 5% to 6% decline in U.S. cigarette volumes in the U.S., the second time it had to revise its outlook downward after originally estimating volumes would fall by 3.5% to 5% this year. It attributes the faster falloff to more people switching to electronic cigarettes.

It was the immense popularity of e-cigs that led Altria to invest $12.8 billion in leading manufacturer Juul Labs in exchange for a 35% stake in the company. Moreover, a marketing agreement with Philip Morris International (PM 1.81%) to market and sell the leading global heated tobacco device IQOS in the U.S. under its Marlboro brand gave Altria a stake in what were the two biggest cigarette alternatives in the world at the time.

Image source: Getty Images.

However, the U.S. e-cig market is suddenly under attack. High rates of teen use of e-cigs have led the Food & Drug Administration to declare it an "epidemic," leading it to consider a ban all e-cig flavors except tobacco from the market. A sudden spike in lung disease and even death has also caused the regulatory agency to investigate what role vaping is playing in the incidents.

The new scrutiny is also leading retailers to reevaluate their participation in the market. For example, Walmart just announced it would no longer sell e-cigs in its stores.

Worse for Altria, Juul is being investigated for its role in causing teens to take up vaping in alarming numbers, while the Federal Trade Commission is also looking into the company. And because it is the overwhelming leader in the industry, it is being looked at for the rise in vaping-related illness.

Not a foregone conclusion

Those are some considerable hurdles, but there remains the underlying strength of Altria's business.

Although cigarette volumes have fallen, profits remain strong due to the inelastic nature of cigarette sales. Altria has already raised prices twice this year, and analysts expect it will raise them a third time before the year is out.

Also, the market share of Altria's leading brand of cigarettes, Marlboro, stands at 43.3%, which is greater than the next seven biggest brands combined.

The leading tobacco company also owns equity investments in Anheuser-Busch InBev (BUD 0.98%), where it holds a 9.6% stake, and a 45% position in marijuana producer Cronos Group (CRON 0.60%). The brewer gives Altria a foothold in a stable, global business with important brands and growth opportunities as well as in a business that holds considerable promise for future expansion.

A beaten-down leader

Altria's stock is down 34% over the past year, and it trades at 12 times trailing earnings and just nine times next year's estimates. As a result, its dividend of $3.36 currently yields over 8% annually, reflecting the risk the market is assigning to its business.

There are certainly challenges confronting the tobacco giant, particularly with regard to electronic cigarettes, but e-cigs remain an important tool in smoking cessation, suggesting they won't be stubbed out by regulators.

Moreover, the investments in other businesses -- beer, marijuana, and even its wine business -- give Altria further chances to grow. At its discounted valuation, this tobacco stock looks like a buy.