Stocks are always rising and falling based on sentiment in the market, often with very good reason. If a company's growth prospects increase, the stock's price-to-earnings ratio goes up; if its prospects dim, the P/E falls.

Today, I want to highlight three stocks that I think are being overlooked by the market. They have P/E ratios of 10 or lower and businesses that are more solid than the market gives them credit for. Here's why Sony (SNE 0.86%), CBS (CBS +0.00%), and Honda (HMC 0.49%) are great values in today's stock market.

Image source: Getty Images.

Sony

Sony has been flying under the radar for the last few years, but the stock has nearly tripled in the last five years, far outperforming the market. Still, shares are trading for just 10 times trailing earnings because investors put very little value on its legacy businesses.

There may not be a lot of growing businesses under the Sony umbrella, but the company's current properties are stalwarts in their market segments. The PlayStation is a perfect example, with more than 94 million monthly active users around the world, and it's leaning into streaming gaming on platforms like PC and mobile.

Sony's other segments may face some challenges, but there's an upside for each in the future. The music business has seen record profits with the growth of streaming services. Sony Pictures continues to be up and down, but it has valuable intellectual property (IP) like Spider-Man, Men in Black, and Charlie's Angels under contract. At worst, one of the aggregators would be interested in buying the company's IP and library.

The electronics and imaging-solutions business segments may not be growing, but Sony holds a leadership position that isn't going to evaporate overnight. Consumers will seek out its TVs, cameras, speakers, and even medical devices for years to come, and I think they'll continue to be great in Sony's product lineup.

A P/E ratio of 10 and business segments that are steady -- or even have upside in a potential sale -- make this a great value for investors today.

CBS

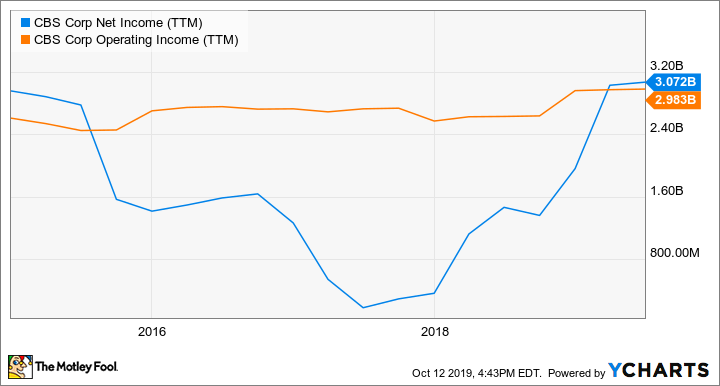

CBS currently has a P/E of 4.7, which is a bit misleading because the company has tax benefits and a $386 million gain on the sale of CBS Television City. But you can see that operating income has been steady over the last five years and even rising slightly.

CBS Net Income data by YCharts. TTM = trailing 12 months.

CBS isn't terribly compelling as a stand-alone company long term, but it is a great buyout target given its $14.6 billion market cap. That's ultimately where I think CBS's low P/E will pay off for investors: with a buyout from a company with a much higher P/E.

Honda

Automakers aren't particularly highly valued by investors from a P/E standpoint, but I think Honda Motor Company deserves more respect than investors are giving it based on its long history. The stock trades for just 8.2 times trailing earnings, as you can see below, and pays a nice 3.9% dividend yield.

HMC Net Income (TTM) data by YCharts.

What Honda brings to the table is a diversity that other automakers can't match. It makes small engines, motorcycles, boat motors, and even private jets, which spreads out its market exposure.

There will still be ups and downs for the company depending on end-market demand, which you can see above with margins being squeezed the last year. But if there's a manufacturer built to weather any storm, it's Honda.

Buying value in a hot stock market

Low P/E stocks aren't always market beaters, but if investors can find value in stocks that are built for the long haul, they can beat the market over time. Right now, I think Sony, CBS, and Honda have a lot more going for them than the market is pricing in, and that's why they're my low P/E picks today.