Walgreens Boots Alliance (WBA +0.00%) hasn't delivered great bottom-line news lately. The pharmacy giant reported lower year-over-year earnings in its third-quarter results in June along with lackluster revenue growth. The main problem in Q2 was its weakening gross margin.

The company announced its fourth-quarter results before the market opened on Monday. Yet again, it reported that its bottom line was headed in the wrong direction. But this time around, there was a surprising reason behind the earnings decline.

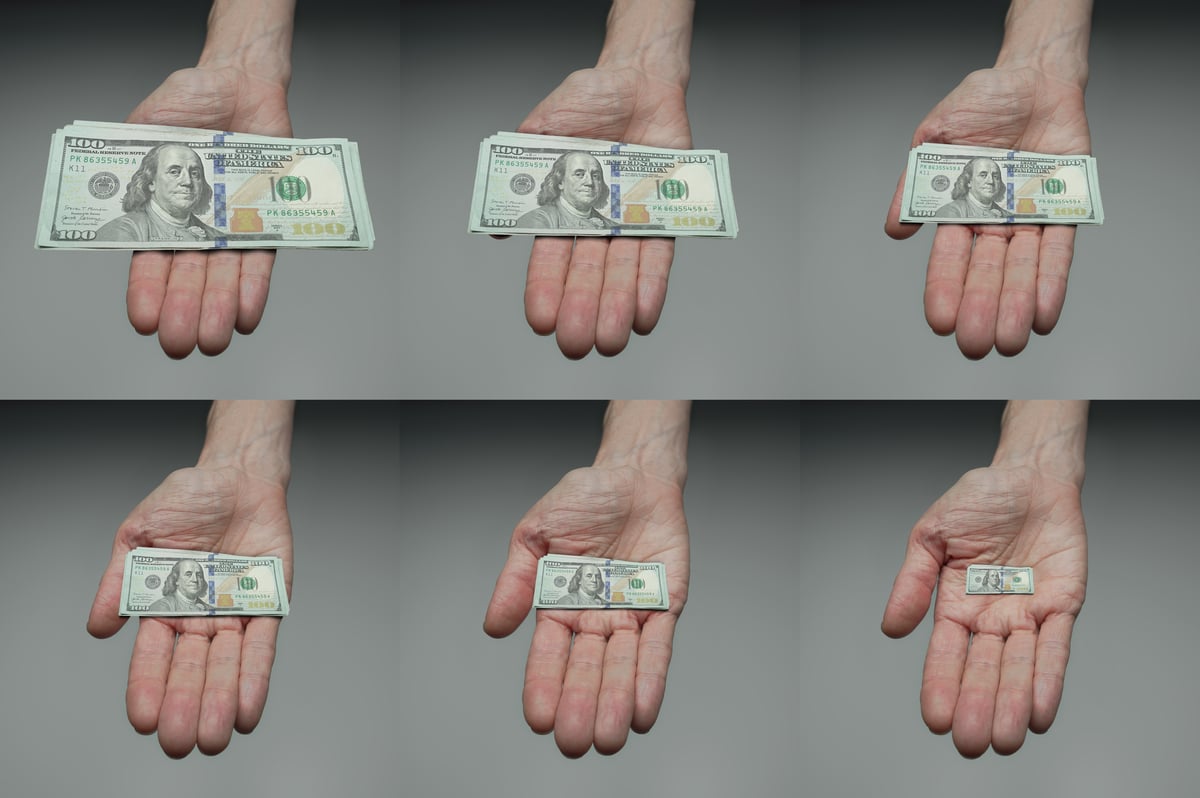

Image source: Getty Images.

By the numbers

Walgreens reported that Q4 revenue rose 1.5% year over year to $34 billion. Analysts estimated that the company's revenue for the fourth quarter would come in at $33.9 billion.

The company announced Q4 net income of $677 million, or $0.75 per share, based on generally accepted accounting principles (GAAP). This result was barely over half of the $1.5 billion, or $1.55 per share, reported in the same quarter of 2018.

On a non-GAAP (adjusted) basis, Walgreens' net income in the fourth quarter was $1.3 billion, or $1.43 per share. This reflected a decrease from the prior-year period adjusted net income of $1.4 billion, or $1.48 per share. But the company beat the consensus Wall Street adjusted earnings estimate of $1.41 per share in the quarter.

Behind the numbers

Walgreens' revenue growth would have looked a little better were it not for foreign exchange fluctuations. On a constant-currency basis, the company's revenue increased by 2.6% in the fourth quarter. Two of the company's three business segments delivered year-over-year sales growth.

Retail pharmacy USA revenue rose 2% year over year to $26 billion. Pharmacy sales, which make up around three-quarters of the segment's total revenue, increased by 4.2% over the prior-year period. However, retail sales for the segment fell by 3.9% year over year.

Revenue for the company's pharmaceutical wholesale segment increased 3.1% year over year to $5.7 billion. This growth was primarily fueled by stronger sales in emerging markets and in the United Kingdom.

Walgreens' weak spot, though, was its retail pharmacy international segment, with revenue falling 6.3% from the prior-year period to $2.7 billion. The company's Boots UK business continued to struggle, with both lower volume and lower funding from the National Health Services.

The company said that its deteriorating bottom line stemmed from the acceleration of its Transformational Cost Management Program. Aren't cost-cutting programs supposed to lead to increased earnings instead of lower earnings? Yes, but the issue for Walgreens is that it's incurring the short-term pain up front with this program in the form of higher costs. Over the long run, however, the cost-cutting program should boost earnings through cost reductions of more than $1.8 billion by 2022.

Looking ahead

Don't expect tremendous growth from Walgreens anytime soon, though. The company provided guidance for fiscal 2020 that called for flat adjusted earnings-per-share growth on a constant-currency basis.

Although many healthcare stocks have great growth prospects driven largely by aging populations, Walgreens continues to experience what CEO Stefano Pessina called "a challenging operating environment." The company's international businesses face reimbursement headwinds. And its decision to de-emphasize tobacco products is weighing on its retail sales in the U.S.

Walgreens Boots Alliance is in the middle of trying times. Its cost-cutting will help on the bottom line -- eventually. But it won't help bolster revenue growth.