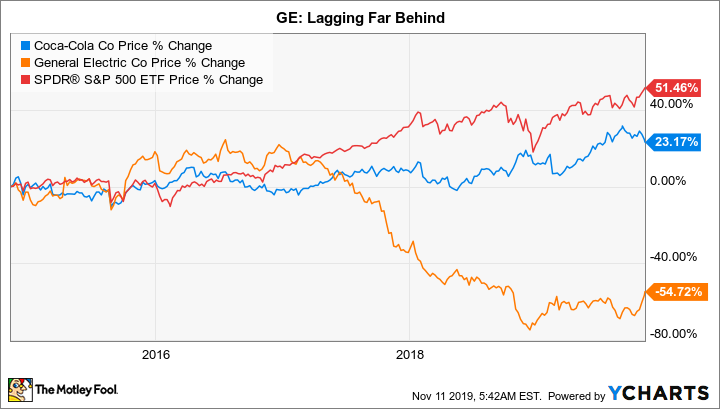

If you pay any attention to investing, you know the names General Electric (GE 1.45%) and Coca-Cola (KO +1.24%). They are storied companies with rich and long histories. Each, at various times, has made headlines for its successes and failings. Investors looking at this pair today will likely find one of these icons an easy better option, but don't jump so fast. The better choice here may still not be worth buying.

Cross it off your list

GE has fallen on hard times, a fact that has been emblazoned in news headlines for at least a couple of years now. With a token $0.04 per share per year dividend, meant only to allow institutional investors with a dividend mandate to continue to own the shares, this stock shouldn't be on any dividend investor's buy list. The company's struggles with growth, highlighted by a painful string of red ink and stagnant top line, should keep it off of growth investors' lists, too.

Image source: Getty Images

Value investors, meanwhile, should also take pause. The price to earnings ratio isn't a great guide because of the red ink. The price to sales and price to cash flow ratios are below their five-year averages, which hints that there's some value here. However, price to book value is elevated, largely because of one-time items that have reduced shareholder equity. And that last fact highlights the big problem.

GE is working through a turnaround. The process hasn't been particularly smooth, and progress hasn't been very impressive. At this point, the big push is to shore up the balance sheet, which has involved selling assets. A lot has been done so far, but the next big step is selling a piece of the company's healthcare division. As of this writing that deal hasn't closed yet, and until it does the industrial giant is still working with a heavily leveraged balance sheet (the debt to equity ratio is nearly 3.3 times, a worrisome number). In fact, even after that asset sale, debt will likely remain elevated.

And then there's the fact that two of General Electric's four main operating divisions are struggling. In the third quarter the Power and Renewable Energy groups had negative segment margins. These two businesses accounted for roughly 40% of the company's top line. Management needs to get these businesses sustainably profitable again. The other 60% of industrial revenue comes from the comparatively strong healthcare and aviation segments (both had margins in the 20% area), so there's a foundation to build on. But it is far from clear that Power and Renewable Energy are going to be easy fixes, and the fact that GE had to sell a piece of one of its best-performing businesses to shore up its balance sheet is a worrying sign.

In other words, even value-oriented investors should take pause here. Right now GE looks more like a turnaround stock than anything else. There's really no way to tell how long it will take the company to fully stabilize its balance sheet and turn two of its core businesses around. And with effectively no dividend, you aren't getting paid to hang around. Most investors would be better off elsewhere until further signs of progress are made.

So what about the fancy water?

Coca-Cola, on the other hand, has a very reliable business, effectively selling flavored water to people all over the world. Generally, these are small purchases made across lots of different customers, so the top line doesn't really fluctuate all that much over time. Add in the intangible of an iconic brand portfolio and there's a lot to like here, including a roughly 3% dividend yield. That's about one full percentage point above what you would get with an S&P 500 Index fund. The dividend, meanwhile, has been increased for 57 consecutive years, with an annualized increase in the mid-single digits over the past decade -- more than enough to outpace inflation and grow the dividend's buying power over time.

Dividend investors should clearly be interested. Growth investors -- well, that's less clear, since Coca-Cola is really more of a reliable tortoise than a hare. But if slow and steady is your speed (top-line growth has been in the mid-single digits over the past decade, with bottom-line growth in the low-double digits), then it's worth a closer look.

Only it doesn't look particularly cheap today. The price to sales, price to cash flow, and price to book value ratios are all above their five-year averages. Price to forward earnings is also above its longer-term average. So, at best, you are paying full fare, and at worst you could be overpaying. That means that value investors should definitely hold off here, and even income investors might want to put Coca-Cola on the wish list rather than the buy list.

But there's more to the story here as well. Coca-Cola has been working to change with the times, which is laudable, but it recently made an acquisition that pushes outside of the company's comfort zone. For the most part, this beverage giant sells its wares to intermediaries, which then sell to the public. In late 2018, it paid roughly $5 billion to buy coffee company Costa. Expanding its reach in coffee is a good idea, but the acquisition came with nearly 4,000 stores largely located in Europe. That's a very different business from what underpins the rest of the company. That's not the only growth initiative the company has on its plate, either. It is also playing around with alcohol and energy drinks (potentially upsetting a key partner in the space, Monster Beverage). Coca-Cola has a lot to prove on the growth front, even though its core remains fairly reliable.

The balance sheet, meanwhile, has become a bit bloated. Long-term debt has increased roughly 250% over the past decade, pushing debt to equity higher by 370% and debt to EBITDA up by nearly 260%. It's not that Coca-Cola is in financial trouble, it still covers its interest expenses a robust 30 times over and management has been reducing leverage of late. Moreover, the debt it has taken on has been used, at least in part, to reduce the share count at a time when interest rates are historically low (a move that helped push debt to equity even higher). But Coca-Cola's foundation isn't quite as strong as it was a decade ago.

With a stock that appears, at best, to be fully valued, Coca-Cola isn't really looking like a great buy. It is certainly a better option than General Electric, but it is hardly a slam dunk for most investors.

Nothing to do here but wait

At the end of the day, General Electric is a stock that may have huge turnaround potential, but the risk-reward trade-off right now is still not appealing. A huge amount of work remains to be done before the industrial giant can say it's back on the right path.

From that perspective, slow and steady Coca-Cola is easily a better option. But it still isn't a great pick for most, because shares look fully valued -- at best. Add in some new ventures that push the boundaries of its historical business model (coffee shops and alcohol) and there's probably more risk here than meets the eye. Value, growth, and dividend investors are all probably better off putting the soda giant on their wish lists rather than their buy lists -- at least until the valuation is a bit more compelling or the company proves its growth plans are working out as hoped.