Investing in growth stocks can be risky, but it can also lead to outsized returns when buying the right kind of company. Alteryx (AYX +0.00%), DocuSign (DOCU 5.03%), and MercadoLibre (MELI 1.05%) are all executing well, serving huge markets, and have created a loyal customer following.

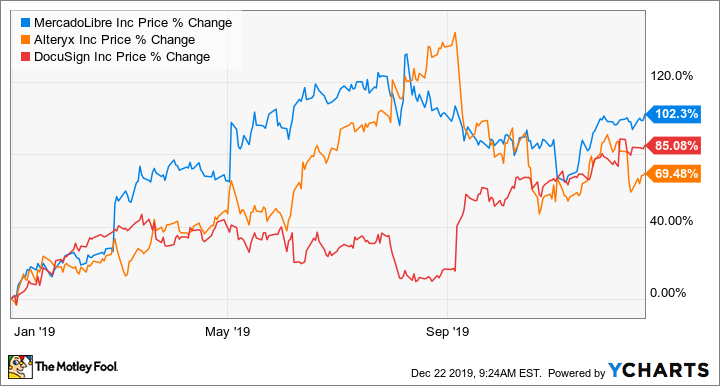

These three have a ton of momentum, and the market has rewarded investors with gains between 69% and 102% year-to-date. But there's still plenty of opportunity for those with a long-term mindset. Before we review each of them individually, let's look at some key metrics for the bunch.

Key metrics to note about these three stocks

From the table below, the first thing you might notice is that these companies weren't born yesterday. Each has a long history of serving customers and built proven business models that have helped drive growth. You may also notice that with excellent growth numbers often come high valuations (like double-digit price-to-sales ratios), but these companies are worth the price.

|

Metric |

Founded |

Market Cap |

TTM Revenue |

MRQ Revenue Growth |

P/S Ratio |

|---|---|---|---|---|---|

|

Alteryx |

1997 |

$6.5 billion |

$0.35 billion |

65% |

19 |

|

DocuSign |

2003 |

$13.2 billion |

$0.82 billion |

41% |

16 |

|

Mercado Libre |

1999 |

$29 billion |

$2.1 billion |

70% |

14 |

Data from Yahoo! Finance and Company documents. Table by author. TTM = trailing-twelve-month. MRQ = most-recent-quarter. P/S = price-to-sales.

1. Alteryx: Helping data analysts be more productive

With more data available than ever before, the job of a data analyst is much harder. Information is spread out all over the enterprise in different formats and applications, so analysts can spend much of their time doing administrative data manipulation rather than real analysis. Alteryx provides a suite of powerful tools that can be used by the average knowledge worker or the highly skilled data scientist and makes the process much more productive. Once users in an organization discover the power of Alteryx's toolset, word spreads, and the company's land-and-expand strategy grows the business through peer endorsements. This fuels the company's dollar-based net expansion rates, which have been consistently around 130% for the last several years, meaning that 30% more dollars are spent, on average, per customer over the prior year.

Image Source: Getty Images.

In addition to the impressive retention, Alteryx is growing customer count and, most importantly, top-line revenue. Its third quarter of 2019 saw an additional 335 new customers, 27 from Forbes' Global 2000. Over the last two years, the customer count grew from 3,054 to 5,613, an 84% increase. For revenue, Q3's growth actually accelerated to a 65% mark versus 59% in Q3 2018. But what's more exciting is the opportunities ahead.

Alteryx only serves 34% of the Global 2000, and its international revenue is only 28% of the $103.4 million total in Q3. The company is eyeing the 47 million data-intensive spreadsheet users as potential customers for a total addressable market of $73 billion. This puts Alteryx's market share at under 0.5%, with a huge runway for a company that is growing like crazy.

2. DocuSign: Moving beyond e-signatures

If you've signed anything official lately, you may not have actually used a pen, but confirmed your agreement via an online signature. DocuSign is most known for its electronic signature capabilities, but it has built an entire business around the agreement process with its suite of agreement cloud software products. Its top line grew 40% in Q3 2019, 95% of which is subscription-based revenue. Total customers grew 24%, and the subset of large enterprises grew faster at 30%. This is not surprising when you understand the benefits that come with the platform.

DocuSign saves customers time (83% of documents are signed within a day) and money ($36 saved on average per transaction). But what is most impressive about this product is the way it can expand within large organizations. Examples include Comcast, which spends 22 times more than it did 10 years ago, Salesforce, which spends 36 times more than eight years ago, and T-Mobile, which spends triple what it did five years ago. Its ability to improve a customer's operation is a huge competitive advantage for DocuSign as it eyes the $25 billion addressable market. With only about 3% of the market, this document agreement platform has a world of opportunity ahead.

3. MercadoLibre: E-commerce and payments for Latin America

MercadoLibre has been running an e-commerce fulfillment business in Latin America since 1999. It has become the No. 1 place that consumers in the region go to purchase goods online. But in its early days, it found that many of its potential customers didn't have bank accounts or credit cards to initiate online transactions. So in 2003, it launched a payments service called Mercado Pago, which has been a huge hit. In the most recent quarter, Mercado Pago users spent more on "off-platform" purchases such as gas and groceries than they did on its e-commerce platform. This shows the broad acceptance this service has for merchants and consumers alike.

MercadoLibre is growing by any way you measure it. In addition to the revenue growth highlighted above, in the most recent quarter, its total value of goods shipped grew 50%, items sold grew 17%, and payments volume grew an amazing 94%. Even with the torrid growth, there's still a huge opportunity ahead, as e-commerce represents only 4% of all retail spending in Latin America.

A word of warning and an endorsement

My favorite thing about these three companies is that customers love them -- using the products or services makes their lives better in big and small ways. But it's important to know that these three aren't regularly posting profits, as investing to grow is a higher priority. For investors with a growth mindset and an eye for what's possible, these three look like a buy today. I'm not just talking the talk; I added to my position in each of these stocks earlier this month.