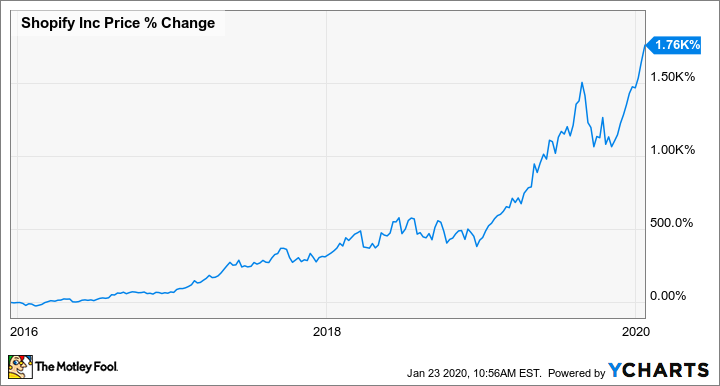

Shopify's (SHOP 1.12%) shareholders are a happy bunch. Those who were lucky enough to invest $57,000 in the stock anytime between mid-December 2015 and early March 2016 would be sitting on a cool million today. But if you missed it the first time, could this e-commerce platform be a millionaire-maker stock again?

First, let's agree on a definition. Fellow Fool Brian Stoffel wrote about Shopify last year and suggested that a millionaire-maker would be a stock that could return 10-fold its initial investment over a 20-year time horizon. Since 10-baggers are a rare breed, let's use that as the target.

What should investors look for in a company that has millionaire-maker potential? Although there are many attributes you could look at, three key factors need to be present: a large and growing market, a competitive advantage, and an ability to remain relevant over the long term. Let's dive into the details to find out if Shopify has what it takes.

How big is Shopify's market?

Determining the size of a potential market is as much an art as it is a science. Despite the challenges, Shopify has published a target for its potential market using reasonable assumptions. Based on its 2018 average revenue per merchant of $1,484 and an estimate of 47 million retail businesses globally, it calculates a $70 billion addressable market for small and medium businesses.

This number serves as a good reference point for investors, but it's important to understand that it will never serve all of those customers. On the plus side, this estimate isn't counting its new fulfillment network, enterprise opportunities with Shopify Plus, or the fact it's helping to create new businesses that haven't existed before. Compared to its $1.4 billion in trailing-12-month revenues, it's only tapped 2% of the addressable market, and that's what's important for investors.

Another way to look at the opportunity is to view it through the lens of online retail purchases. In this recent article, I estimated Shopify's gross merchandise volume (the amount spent on goods on its platform) to be $61.5 billion for 2019, about 2% of the total spent online last year globally. With e-commerce only representing 14% of global retail purchases for 2019 and growing to 22% by 2023, the company has a huge and growing market, and that's attracting attention.

Image source: Getty images.

This space is getting crowded

A big untapped opportunity attracts competitors, and the e-commerce back-office software market is no exception. Microsoft, Square, and Facebook have all recently announced competing products, but Shopify's largest competitors are WooCommerce and Magento.

WooCommerce is a free open-source plug-in for WordPress, the software that is used to power millions of websites. Even though it is the most widely used tool for online commerce, the sales running through the platform are a fraction of Shopify's. In 2018, it had less than $15 billion versus $41 billion for Shopify that year. For those running more than a hobby business, this open-source platform may not provide the support and stability that a commercial software product offers.

Magento is a larger commercial platform supporting sales of around $155 billion annually which eclipses Shopify's $54.5 billion over the last four quarters. The company was acquired by Adobe (ADBE +1.20%) in 2018 and it is now part of its Experience Cloud, a software suite of marketing, analytics, and e-commerce modules. In Adobe's most recent quarterly earnings call, it reported Magento's 40% bookings (dollar value of contracts) growth year-over-year. With its size and momentum, and the backing of a large, cash-rich parent company, Magento looks to be a worthy competitor. But Shopify has an ace up its sleeve with a tremendous head start on Magento and other new entrants.

Shopify's competitive advantage

One example that demonstrates Shopify's lead is that Adobe-Magento only recently announced its integration with Amazon.com (AMZN 0.31%) last May. Shopify's partnership with Amazon started four years earlier in 2015 when Amazon first allowed its Webstore customers to migrate to Shopify's platform. In late 2016, Shopify announced full integration with Amazon.

But its greatest competitive strength is that Shopify makes it easy to get started on its platform and can scale as your business grows. This has been a focus for the company since it was founded in 2004. In a recent comparison of leading e-commerce website platforms, WebsiteBuilderExpert rated Shopify as its top choice, describing the process to get started as "easy peasy" and concluding that it is "the best and most comprehensive e-commerce builder on the market today." Even though WooCommerce and Magento weren't part of the comparison, these accolades are evidence that Shopify's focus is paying off.

But the real proof of the competitive power of the platform is the breadth of the customers it serves and how it enables their success. Currently, there are more than 1 million stores powered by Shopify and the value of all goods (gross merchandise value) sold by merchants on the platform has tripled over the last 10 quarters.

Data source: Shopify. Chart by author.

These are incredible statistics, but CEO Tobias Lutke knows the company can't rest on its past success.

Can Shopify remain relevant for the next 20 years?

In his March 2018 letter to shareholders, Lutke highlighted the company's efforts to ensure its solutions for e-commerce stores stay relevant. "For Shopify, that means a lifetime commitment to keeping our software, features, and strategies ahead of the curve," he said.

Shopify started as a browser-based platform for PCs but moved to enable mobile capabilities early on. It added a physical card reader when merchants demanded the flexibility to take payments in person. It's added low-cost business loans, shipping services, high-end features for enterprises, and a smart fulfillment network. It's exploring solutions for augmented reality, virtual reality, and other technologies to make commerce better.

Innovation is part of Shopify's DNA and will enable it to bring value to anyone that wants to sell products online for many years to come.

The bottom line for investors

Even though it has all the factors of a millionaire-maker, the future isn't guaranteed. A lofty price-to-sales ratio of 38 means that high expectations are already built into the stock and any miss in quarterly expectations could depress the share price in the short term. But with a 20-year horizon, Shopify's demonstrated abilities, and a world of opportunity ahead, the odds to reach a new level of millionaire-maker status again are in its favor.