Despite being one of the largest and most profitable companies on the planet, Apple (AAPL +4.12%) just reported blowout Q4 results that shattered numerous records. In a departure from recent reporting periods, services revenue actually came in below expectations, although that profitable segment was still able to set a new record in quarterly revenue.

Unlike last year, when Apple started off the year by drastically slashing its guidance and missing its forecasts, the Mac maker is kicking 2020 off with a bang.

iPhone 11 has been a hit. Image source: Apple.

Over $1 billion per day

Total revenue jumped 9% to $91.8 billion, topping the previous record set in Q4 of 2017 of $88.3 billion in sales. Put another way, Apple sold over $1 billion worth of stuff every day throughout the quarter. That top-line result is also well above the $88.5 billion that analysts were expecting, as well as the high end of Apple's own outlook ($89.5 billion).

Gross margin came in at 38.4%, near the high end of guidance. Apple enjoyed margin expansion thanks to seasonal leverage, which offset a 60-basis-point hit related to foreign exchange fluctuations. The company also warned investors last quarter that a higher mix of products instead of services would dilute its gross margin on a percentage basis.

Operating expenses continued to climb steadily higher as Apple invests heavily in things it won't talk about, but that's a continuation of a multiyear trend that the company has explained at length. Besides, Apple's operating margin remains well above its peers'. That all led to record net income of $22.2 billion, or $4.99 per share.

iPhone returns to growth

After posting declines in iPhone revenue every single quarter last year, that core segment has returned to growth. iPhone revenue jumped 8% to $56 billion, driven by strong demand for the iPhone 11 lineup. CEO Tim Cook said the standard iPhone 11 was the top-selling model every week during the quarter.

|

Segment |

Revenue |

Growth (YOY) |

|---|---|---|

|

iPhone |

$56 billion |

8% |

|

Mac |

$7.2 billion |

(3%) |

|

iPad |

$6 billion |

(11%) |

|

Wearables, home, and accessories |

$10 billion |

37% |

|

Services |

$12.7 billion |

17% |

Data source: Apple. YOY = year over year.

Mac and iPad faced tough year-over-year comparisons due to product launches in late 2018, but the booming wearables, home, and accessories segment topped $10 billion in sales for the first time, thanks to soaring demand for Apple Watch and AirPods. The older Apple Watch Series 3 is even suffering from supply shortages, as reducing the price to $199 has unlocked additional demand.

Apple's installed base of active devices has now grown to 1.5 billion, which is to say that the tech giant added about 100 million active devices over the past year. The services business now has 480 million paid subscriptions, putting Apple on track to hit its previously stated target of 500 million paid subscriptions in the first quarter, according to CFO Luca Maestri. That means it's time to set a new goal: Maestri says Apple is aiming to reach 600 million paid subscriptions by year-end.

Outbreak risks

Concerns have arisen recently about the coronavirus outbreak and how Apple's supply chain, which is heavily concentrated in China, may be adversely affected. Cook discussed the public health crisis at length, saying Apple is closely monitoring the rapidly evolving situation while donating to groups that are working to contain the epidemic. Like many companies, Apple has restricted travel to "business critical" situations as it continues to gather information.

Apple's supply chain is heavily concentrated in China. Image source: Apple.

Apple has alternate sources for all of its suppliers in the Wuhan area, and is developing plans to make up for the potential loss of device production. Some suppliers have delayed reopening their factories following the Chinese New Year, and retail traffic across the Middle Kingdom is being broadly impacted. Apple has closed one store so far due to the outbreak.

As a result, the company is offering a wider range for its revenue guidance to accommodate the "greater uncertainty." Major manufacturing partner Foxconn separately said it was still committed to meeting all of its obligations.

Speaking of guidance

Revenue in Q1 should be $63 billion to $67 billion. While Apple's guidance a year ago similarly had a $4 billion range, the forecast for the quarter ending in March typically has a range of just $2 billion to $3 billion. At the midpoint, Apple's forecast calls for 12% growth in the current quarter.

Gross margin is expected to be 38% to 39%, which would be a rare sequential uptick at the midpoint. While Apple will lose some leverage from seasonality, Maestri expects that to be mostly offset by "better mix and cost savings." The mix of product revenue will come back down after the busy holiday shopping season, with services boosting profitability.

Operating expenses are forecast at $9.6 billion to $9.7 billion, with other income of around $250 million.

Buying at the high

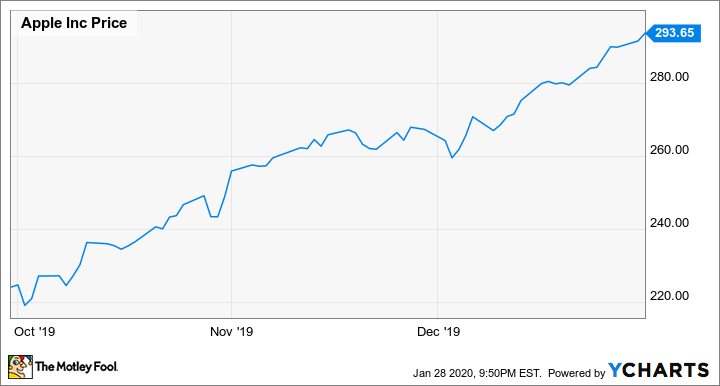

Apple repurchased $20 billion worth of stock during the quarter, split evenly between open market transactions and another accelerated share repurchase (ASR) program. That's more than Apple bought back in the second or third quarters, a powerful sign of confidence considering the fact that the stock kept climbing to new highs throughout Q4.

That brings the tech titan's cumulative buybacks up to an astounding $326.1 billion since beginning its capital return program six years ago. Apple also paid out $3.5 billion in dividends and declared its next quarterly dividend of $0.77 per share, payable to shareholders of record as of Feb. 10. As usual, Apple will provide its annual capital return update at its next earnings release.