One of the first pieces of financial advice you'll hear is "get out of debt," and frankly it's excellent advice in almost every situation. That's particularly true for high-interest debt like credit cards that can be absolutely wealth-destroying. Simply put, you can't find anything out there to invest that money in that will give you a higher return than you're paying in interest.

But that's not always the case with every kind of debt, particularly with interest rates at some of the lowest levels in history. Here's one example: I purchased a home in November and locked in a 3.75% fixed interest rate on a 30-year mortgage. Initially, my wife and I were planning to pay an extra $250 each month to pay the loan off early. After all, at 43 years of age, I really don't want to still be paying a home loan when I'm in my early 70s.

Image source: Getty Images.

However, after considering the alternatives, I quickly realized I could almost certainly generate higher returns than I could save in reduced interest by building a portfolio of high-quality, high-yield dividend stocks. Moreover, I could use this strategy in a way that was relatively safe, reducing my risk of losing money over time. Keep reading to learn more about my strategy, and whether it's right for you.

Here's why I'm not paying off my mortgage early

In many cases, it makes sense to aggressively pay off debt. That's because interest expenses are almost always more than we could earn by investing or saving the money. Moreover, the more debt you carry, the more of your income you'll have to dedicate to servicing that debt via regular payments. And that means less money you can put in the bank for emergencies, invest for retirement or a child's college savings, or spend on things for yourself and your family.

But in the case of a mortgage, putting extra money toward the principal may not be the best choice; it's certainly not for me. After all, I have already identified a double-digit collection of dividend stocks that I can buy and hold over the next 10 or 20 years that should consistently deliver better returns than I would get by just paying down my low-rate mortgage. To put it another way, I'm taking advantage of the mismatch between today's low-interest rate environment and the higher yields I can earn to grow my net wealth.

But there's another reason why I'm using this method to build wealth, versus focusing on debt reduction: Access to capital. When you pay extra money toward your mortgage, you reduce the balance on your loan and save yourself interest, but that cash is immediately tied up in your house. Simply put, it's no longer liquid, and that means it's not easily tapped if you need it down the road. By investing in stocks, I have far easier access to that capital. It's as simple as clicking the "sell" button, waiting a few days for the transaction to settle, and there's cash ready to be had.

Some examples of high-quality dividend stocks on my watchlist

Here are some of the stocks I have on my list to buy in coming months, along with the dividend yield at recent prices:

| Stock | Industry | Dividend Yield |

|---|---|---|

| AT&T (T +2.28%) | Telecommunications | 5.37% |

| Atlantica Yield (AY +0.00%) | Renewable energy | 5.16% |

| Wells Fargo (WFC +0.14%) | Banking | 4.13% |

Data source: Yahoo! Finance.

All three pay dividend yields at recent prices that are solidly higher than 3.75%. Simply by owning these stocks, and collecting the dividends they pay, I should end up ahead of the game versus someone who took the same money and paid it toward their mortgage.

When you start looking at the bigger picture, it can get even better. Here's a look at the dividends these three stocks have paid over the past five years:

T Dividend data by YCharts

All three have a history of dividend increases (though Atlantica Yield's has been up and down and back up again) that should continue. That means the money I put work in these companies over time will lead to a higher and higher yield on my original cost basis. And that's before we factor in the potential returns from capital appreciation in the value of the stocks themselves.

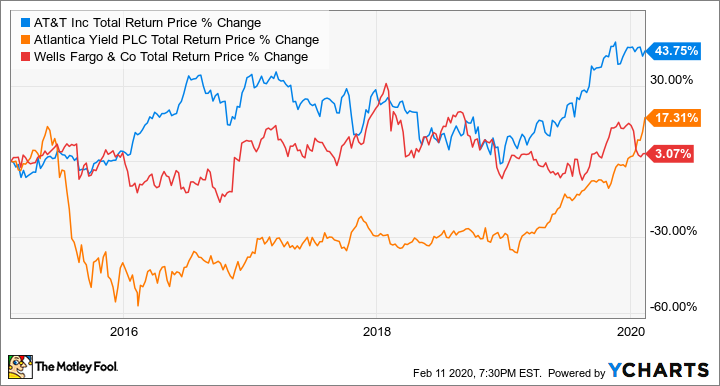

Here's how these three stocks have done over the past five years when we include both dividends and capital appreciation:

T Total Return Price data by YCharts

Stretch that out over a 10- or 20-year period and diversify across another 10 or more high-quality stocks, and it should prove a winning strategy worth far more than 3.75% per year.

The risks, and why this isn't the right strategy for everyone

While higher yields and dividend growth should prove to deliver better returns, it's not a guaranteed moneymaker. For instance, the first stock I bought using this strategy, in December, has lost about 18% of its value. Not exactly an auspicious start. However, that's part and parcel of stock investing. There will be losers, but my biggest winners will more than make up for the losers, and over time my regular monthly purchases will create a diversified portfolio that reduces my risk of losses.

Yet even that diversification may not be enough to make this the right strategy for everyone: Take it from someone who saw his portfolio fall by more than half during the Great Recession. If you're going to sell at the first sign of a market downturn, locking in losses and then missing out the inevitable recovery on the other side, you'd be better off putting that money toward paying down your mortgage.