When it rains it pours, at least when it comes to cannabis stocks. Charlotte's Web (CWBHF +0.00%) shareholders have seen few green days this year, as the stock's been sliding rapidly since the start of 2020. The stock is trading at the lowest price it's ever seen, and as dangerous as it may seem to try to catch this falling knife, it's hard not to consider it given the long-term value that Charlotte's Web possesses. And that makes it at least worth taking a second look at the stock to see if it's a good buy today and whether it may rebound.

Why the stock is still an attractive long-term buy

Charlotte's Web is definitely facing some serious headwinds in the markets. Not only is the Food and Drug Administration (FDA) warning people about the company's key product, cannabidiol (CBD), but hemp prices are falling, and the number of suppliers willing to sell hemp -- from which CBD can be derived -- is large. Unlike marijuana, hemp is legal federally and can be transported across state lines, making it less of a logistical nightmare than pot; marijuana producers effectively have to manufacture products in every state they want to sell it in.

But the problems Charlotte's Web is facing today are short-term, and here's why: Once the U.S. government legalizes marijuana (which could happen sooner rather than later), producers will shift to the harder stuff and sell more potent products containing higher levels of tetrahydrocannabinol (THC). Hemp products contain no more than 0.3% THC, meaning users looking for a high will be sorely disappointed. It's not unlike what happened in states that had legal medical marijuana and went on to legalize recreational pot -- consumers and producers shifted toward THC-focused products. That left medical marijuana users more focused on CBD struggling to find products.

Image source: Getty Images.

In Illinois, just a month into the state's launch of recreational pot sales, patients were complaining that they weren't able to find medical marijuana products due to shortages. In states that have legalized recreational pot, there's been a decline in the number of medical marijuana patients. Colorado had more than 100,000 before regulators legalized pot there. As of January 2020, that number was down to fewer than 82,000 people.

In 2016, medical marijuana sales in Colorado peaked at $445.6 million. That's fallen 24% to just $338.5 million in 2019. Recreational pot sales of $1.4 billion in 2019 were more than four times medical sales. Three years earlier, that ratio was not even 2:1.

Many former medical marijuana patients in these states no longer need to qualify for a card and can now just buy directly from the recreational market. The initial demand was artificial, and producers have had to adjust and shift focus to recreational products. The same is likely to happen nationwide; both demand and supply will move away from hemp.

And that means big suppliers like Canadian-based Canopy Growth (CGC 1.80%), which obtained a hemp license in New York last year, won't be as tempted to focus on hemp -- not when they can sell to mainstream cannabis consumers looking for non-hemp products that possess significantly higher amounts of THC. That's why over the long term, focusing on hemp could still be a solid strategy for Charlotte's Web.

Charlotte's Web may be the best value play in the industry

What's appealing about Charlotte's Web is that it's a strong business. It's coming off a quarter in which it posted a rare net loss -- this was the only quarter in its past 10 where Charlotte's Web wasn't in the black. Its operating margin is normally at least above 10%, and with the company going through a lot of change and growth during the period, the expenses were explainable and shouldn't necessarily be a cause for alarm.

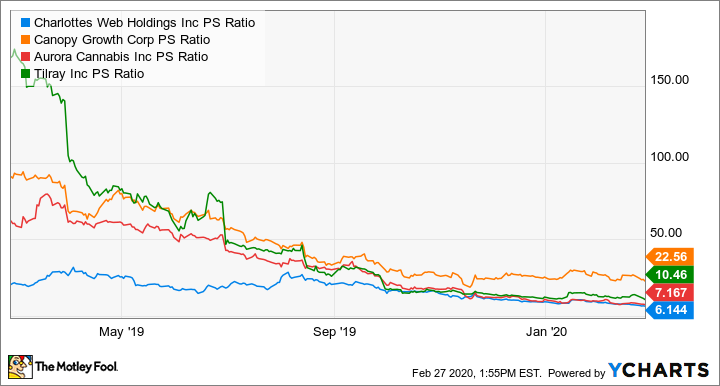

The company compares favorably to some of the bigger pot stocks in the industry when looking at their price-to-sales ratios:

Data by YCharts.

Charlotte's Web is arguably a lower risk than many marijuana stocks, and that's why this sharp decline may be an opportunity to buy the stock at a cheap price. Over the past year, Charlotte's Web stock is down 65%, which is in line with how the Marijuana Life Sciences ETF has performed during that time.

Should you buy the stock today?

Given the state of the markets over the past several days, now may not be the best time to invest in Charlotte's Web -- or anything, for that matter. But once the markets show some signs of stabilizing, Charlotte's Web is a stock cannabis investors should consider given the value it offers, as well as the likelihood that it can bounce back with a good fourth-quarter result.