Dividend stocks can be a portfolio's best friend. They can help boost good returns and prevent or offset losses during times like these, when the markets have turned red. Having some dividend stocks in your portfolio is a good way to protect yourself against a downturn, and National Health Investors (NHI +0.98%), Apple (AAPL 0.13%), and ExxonMobil (XOM +3.98%) can give investors some great diversification.

1. National Health Investors

National Health Investors is a low-volatility stock that can be a great pick for investors who want to avoid the market's wild rides. One of the reasons it can provide stability is that the real estate investment trust (REIT) invests in healthcare properties and has a portfolio made up of nursing facilities, specialty hospitals, assisted-care communities, and many other healthcare-oriented properties. Through 36 operating partners across the country, National Health has a portfolio of 238 properties spanning 34 states.

Not only does that make National Health a diversified investment, it means the company can benefit from recurring income, which helps minimize the chance that sales will be down. National Health's revenue has nearly tripled in recent years, from $118 million in 2013 to $318 million in 2019. And with operating margins typically about 70%, National Health has had no problem posting profits along the way.

Image source: Getty Images.

REIT investors also often look at a company's funds from operations (FFO), which can be more indicative of a REIT's true performance, because the calculation doesn't include non-cash items like amortization. In 2019, National Health's FFO was $239.7 million, up 6.2% from the prior year.

On Feb. 19, the company announced it would be increasing its quarterly dividend to $1.10, for a bump up of 5% from its most recent payment. It's the 11th straight year that National Health has hiked its payouts, and the dividend now yields more than 5% per year.

2. Apple

Apple is an easy pick for investors who want a stock they can hang on to for many years. Sitting on cash of more than $100 billion, the iPhone maker is in an ideal situation to do whatever it wants to fund more growth. The fact that it relies more on services and recurring revenue makes Apple a safer and more appealing stock than an unknown or up-and-coming tech company.

The company's financials are strong, with Apple netting a profit margin of at least 18% in each of the past 10 quarters. And although sales were down in fiscal 2019, the launch of its Apple+ streaming service could turn things around this year.

Currently, Apple pays a dividend of $0.77 every quarter, which yields a little over 1% per year. It's a nominal amount, well below the S&P 500 average of 2%. However, with the company increasing dividend payments since 2013, there's potential for it to become much higher in the future.

3. ExxonMobil

ExxonMobil is an attractive buy because the stock could be a steal. Although it's down 24% in the past three months, the company is still performing fairly well. In its year-end results released Jan. 31, Exxon's adjusted earnings per share of $0.41 fell just shy of analyst expectations of $0.43. Revenue of $67.2 billion, however, came in well above the Wall Street forecasts of $64.2 billion.

Exxon's margins aren't as high as Apple's, but the oil and gas giant has had no trouble staying in the black over the years. The Texas-based company is more than 100 years old and has a market cap of more than $200 billion. The company produces and exports crude oil and natural gas all over the world, and a lot of its struggles can be traced to poor oil prices, which are down in recent months on concerns about travel as a result of the COVID-19 coronavirus outbreak and SARS-CoV-2, the novel coronavirus causing the illness. The price of West Texas Intermediate crude oil fell below $50 in February for the first time since January 2019.

The last time Exxon's stock was trading this low was back in 2005, and that could make it an attractive opportunity for investors to buy on the dip and lock in a solid yield. It's the only dividend aristocrat on this list, having raised its payouts by an average of 6.2% each year for 37 straight years. Currently, the company pays its shareholders $0.87 every quarter for each share they own, for an annual yield of 6.7%.

Which stock should you buy today?

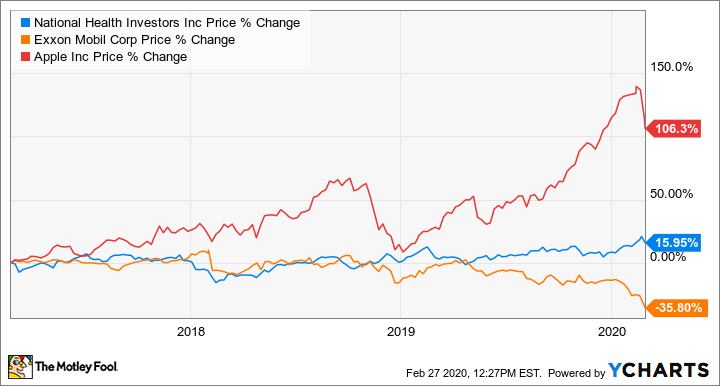

Here's a quick snapshot of how the three stocks' returns look over the past three years:

Data by YCharts.

National Health's lack of share appreciation may turn off investors looking for more than just a dividend, but its minimal price movement means it's a great place to let your money sit and earn 5% per year. But for investors who value a high yield, Exxon can be an appealing buy -- as long as you're OK with seeing red and aren't in a hurry to pull out your money. Exxon still looks like a solid long-term investment, but it's not suitable for risk-averse investors.

Apple is an underdog dividend stock, and its small dividend yield could look a lot different years from now. Buying the stock today, as its payouts are still growing, may be a good position to stake out. If you're willing to wait for the dividend to continue increasing, this has the potential to be the best dividend stock of the three.