What happened

Amidst all the market turmoil we've experienced this week, this little tidbit of space news slipped right by me:

On Tuesday, investment banker Morgan Stanley -- the company that lit the fuse on Virgin Galactic (SPCE 0.67%) stock by positing a $22 valuation back in December -- quietly upped its estimate once again (to $30 a share, said TheFly.com).

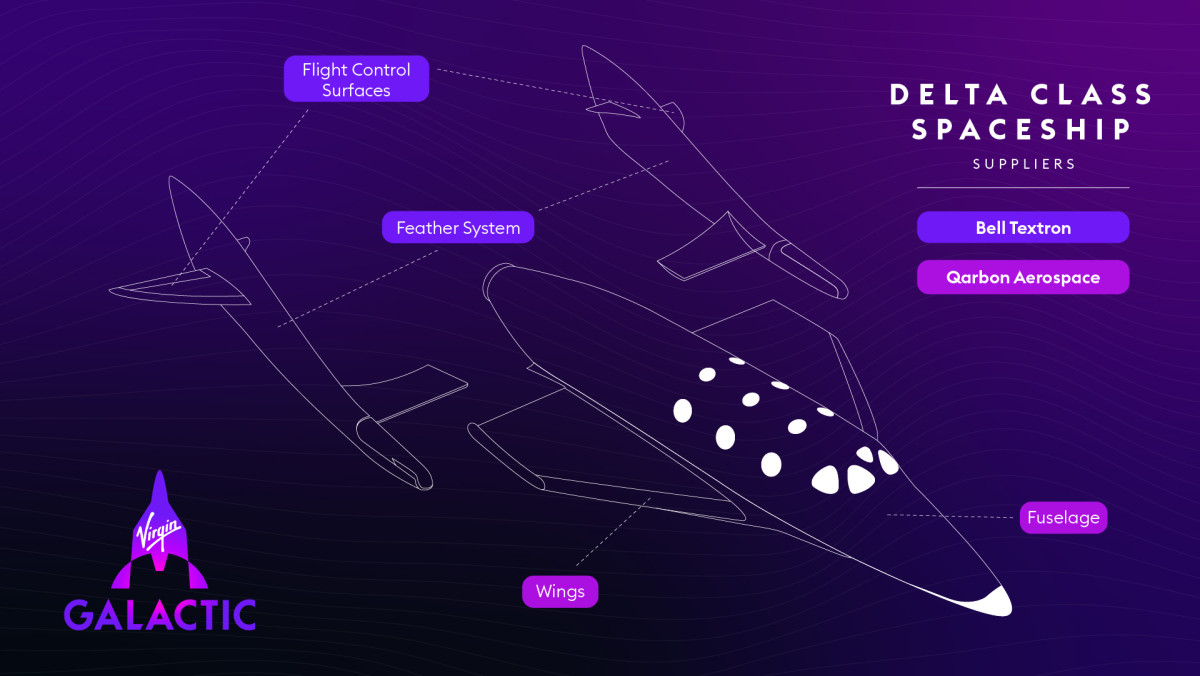

Image source: Virgin Galactic.

So what

I wasn't the only one to notice. Lost in the turmoil of other stocks tumbling right and left, Virgin Galactic stock actually sank 5% on the day Morgan Stanley made its target price switcheroo. And today, Virgin Galactic shares are down another 8.4% as of 10:15 a.m. EST, thanks once again to the coronavirus.

Currently the stock sits not all that much higher than Morgan Stanley's initial, now almost conservative-looking $22 price target. But does it still deserve to go higher?

Now what

Morgan Stanley thinks so, musing that as America makes progress toward returning humans to the moon, news updates on that project "can have a powerful impact on public and investor support" for a space stock like Virgin Galactic. With many prominent space stocks still private and unavailable for direct investment, this kind of makes publicly traded Virgin Galactic the only pure-play spaceport in the storm.

Morgan Stanley even sees what it thinks might be the next catalyst to lift Virgin Galactic higher, when SpaceX (maybe) launches a Crew Dragon spacecraft to the International Space Station on May 7 -- with astronauts on board!

If that happens, Virgin Galactic shares could make up today's losses, and more.