What happened

Shares of Qutoutiao (QTT +0.00%) rose 26.5% in February, according to data from S&P Global Market Intelligence. The Chinese online content company's stock posted gains that corresponded with momentum for the country's technology sector.

Despite concerns about the impact of the novel coronavirus officially known as SARS-CoV-2, February saw relatively strong performance for Chinese tech stocks. There wasn't much in the way of business-specific news for Qutoutiao in the month, and it looks like the company's strong share price gains were facilitated by initiatives taken by China's central bank to aid the country's stock market.

Image source: Getty Images.

So what

China announced on Feb. 2 that it would pump roughly $174 billion into its markets in hopes of stemming volatility caused by the SARS-CoV-2 outbreak. The liquidity injection was one of a variety of measures implemented by the country's government to stave off economic instability, and the efforts to bolster its markets in February appear to have been at least temporarily effective.

However, global markets have been volatile early in March trading, and volatility could persist until uncertainty about the novel-coronavirus situation dissipates.

Now what

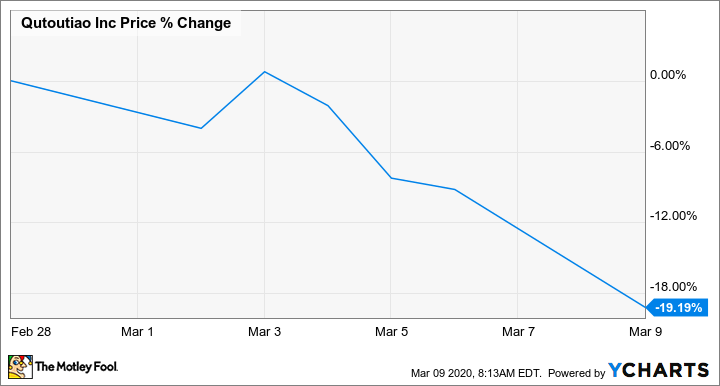

Qutoutiao stock has lost ground in March's trading amid reports that many factories in China remain closed and signs that the virus is spreading rapidly around the globe. The company's share price is down roughly 19% in the month so far.

Qutoutiao reported third-quarter earnings early in December and will likely publish its fourth-quarter results sometime this month or early in April. The company is guiding for revenue to come in between 1.6 billion yuan and 1.2 billion yuan (or roughly $230 million based on the current exchange rate) and is currently valued at roughly $1.6 billion -- which is in line with the average analyst sales target for next year.