Two brick-and-mortar retailers that have continued to thrive despite the push to e-commerce are home improvement specialists The Home Depot (HD +0.27%) and Lowe's (LOW +0.20%). Both have been growing the top and bottom lines, becoming more efficient, and rewarding shareholders with ever-increasing dividends. But one is clearly a better long-term buy. Let's find out why.

Growth

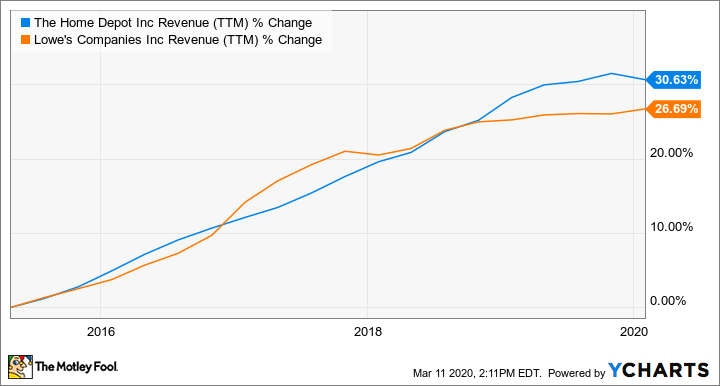

Looking at the last five years of top-line revenue growth, it looks like both companies are pretty close, with Home Depot edging out Lowe's by around four percentage points.

HD Revenue (TTM) data by YCharts

But if you look at the 10-year numbers, Home Depot's top-line growth is almost 65% versus Lowe's 51%. This is especially impressive given that Home Depot is considerably bigger, with 2019 full-year revenues coming in at $110 billion versus its competitor at $72 billion.

Image source: Getty Images.

The past doesn't always predict the future, but in this case, the story is the same. For the upcoming fiscal year, Lowe's is projecting 2.5% to 3% growth, and Home Depot is a full point higher on the range (3.5% to 4%).

Winner: Home Depot

Value

Both stocks have soundly beaten the S&P 500 over the last 10 years, but which is a better value today? The table below shows common valuation metrics for both companies.

|

Company |

Price-to-sales ratio |

Trailing P/E ratio |

Forward P/E ratio |

|---|---|---|---|

|

Home Depot |

2.3 |

22.9 |

22.3 |

|

Lowe's |

1.2 |

19.6 |

16.3 |

Data source: Yahoo Finance, table by author.

The market has rewarded Home Depot with higher valuation ratios across the board, so Lowe's looks like a better value now. Lowe's CEO, Marvin Ellison, is in the middle of a multi-year transformation plan that focuses on retail basics and improving its online capabilities. This has some investors believing that Lowe's stock is underappreciated at the current share price, and as the turnaround plan is executed, the stock could outperform in the years ahead.

Winner: Lowe's

Income

Lowe's is one of the few companies that is a member of the dividend aristocrats.The entry criteria for this club is to have 25 years of increasing dividends, and Lowe's has a total of an incredible 57 years of increasing dividends. Home Depot pales in comparison with only 11 years of yearly increases. Despite the amazing run that Lowe's shareholders have enjoyed, Home Depot's dividend has increased a larger percentage over the last five years, and it sports a higher dividend yield of 2.5% versus Lowe's 2.1%.

HD Dividend data by YCharts

Home Depot just announced it's increasing its dividend for 2020 by a respectable 10%. Lowes usually executes its increases in the summer, so we don't know what the current year will bring. Last year's increase was a solid 15%, but given where the company is today, a more modest increase might be in the works.

Winner: Home Depot

But wait, there's more

Home Depot won two out of the three of our comparison categories, but if you are still on the fence about which company to invest in, check out these other key retail metrics for Q4-2019.

|

Company |

U.S. comp sales |

Comp average ticket |

Online sales growth |

Comparable transactions |

|---|---|---|---|---|

|

Home Depot |

5.2% |

4.4% |

20.8% |

+0.8% |

|

Lowe's |

2.6% |

3% |

3% |

(0.5%) |

|

Winner |

Home Depot |

Home Depot |

Home Depot |

Home Depot |

Note: Comp sales=comparable same-store sales year-over-year growth, Comp average ticket=growth in average purchase "ticket" or receipt, Comparable transactions=growth/(loss) of the number of transactions over the period. Lowe's quarter ended Jan. 31, 2020.

Home Depot is executing on all cylinders and Lowe's is in a turnaround situation. Both companies should be able to grow as homeowners make improvements to their aging homes, but Home Depot looks to be a winner on just about every measure and is a better place for your money today.