What happened

Investors in restaurant stocks endured a choppy session on Monday, as the markets rose and fell with headlines on whether a stimulus package was coming out of Washington, as well as talk of what the competitive landscape might look like when the COVID-19 pandemic is finally behind us.

Among major movers, BJ's Restaurants (BJRI 2.73%) and Dave & Buster's Entertainment (PLAY +1.86%) each opened with a more than 20% gain before retreating somewhat. McDonald's (MCD 0.38%), meanwhile, swung between being up 3% and down 6% during the trading day.

So what

Restaurants have been hard hit by the pandemic, with the federal government urging citizens to practice social distancing and some local jurisdictions imposing curfews and ordering nonessential businesses to close. Given that restaurants have razor-thin margins even in the best of times, that is a formula for disaster for the industry.

Image source: Getty Images.

In an interview over the weekend, Grubhub CEO Matt Maloney predicted that upward of 30% of restaurants could close permanently, saying there isn't enough carryout demand to keep everyone profitable.

While the companies would never admit it, that sort of a projection would help these larger restaurant concepts in the long run because once the pandemic is over, they would face less competition.

The restaurant stocks were fluctuating in midday trading as it seemed a much-hoped-for economic stimulus package, which could include some relief for the hospitality industry, was getting blocked in the Senate. Even without direct aid for restaurants, some sort of economic stimulus could get consumers spending again, helping restaurants.

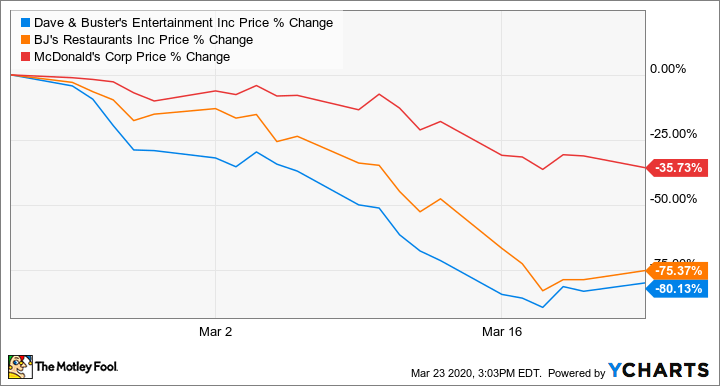

Restaurant data by YCharts.

McDonald's was weaker than either BJ's or Dave & Buster's, but its shares have only fallen 35% in the last month, compared with BJ's 75% fall and Dave & Buster's 75%-plus decline. McDonald's price target was lowered to $171 from $199 at Deutsche Bank, in part following the chain's decision to temporarily shut down locations in the United Kingdom and Ireland.

Now what

The pandemic is a worst-case scenario for restaurants, with populations around the globe simultaneously sheltering in place instead of being out on the town. It is going to create at least a quarter's worth, if not more, of poor results. But all three of these restaurant companies have the wherewithal to survive the downturn and wait out an economic stimulus plan.

Investors on Monday seem to be reading the drops of the last month as potential buying opportunities. It is OK to nibble here, just be prepared for a long wait before you get a full payoff on that investment.