If you're a bargain hunter, now is a good time to buy some quality stocks that can be great, long-term investments to add to your portfolio. While the coronavirus pandemic may cripple many businesses, the three stocks listed below are strong, stable companies that are safe bets to come out of this. They're all trading near their lows for the year and pay investors a dividend as well.

1. Walgreens

Walgreens Boots Alliance (WBA +0.00%) is currently trading close to its 52-week low of $39.41. The company released its second-quarter results on April 2, and it failed to impress investors. For the fourth quarter, Walgreens reported same-store sales growth of 2.7% in the U.S., which fell short of the 3.1% that analysts were expecting from the company. Here's the good news: The company's adjusted earnings per share of $1.52 came in above analyst expectations of $1.46, and total revenue of $35.82 billion was also better than the $35.27 billion that Wall Street was looking for.

The pharmacy retailer did initially see a boost in sales as a result of panic buying in March only for things to taper off by the end of the month. Despite the coronavirus pandemic, management remains steady in its course. CFO James Kehoe states that "Our fundamentals are sound and we are convinced we will exit this global crisis in a strong position." With many businesses shut down and delivery options available to its customers, Walgreens can be a go-to store for people loading up on supplies during the pandemic.

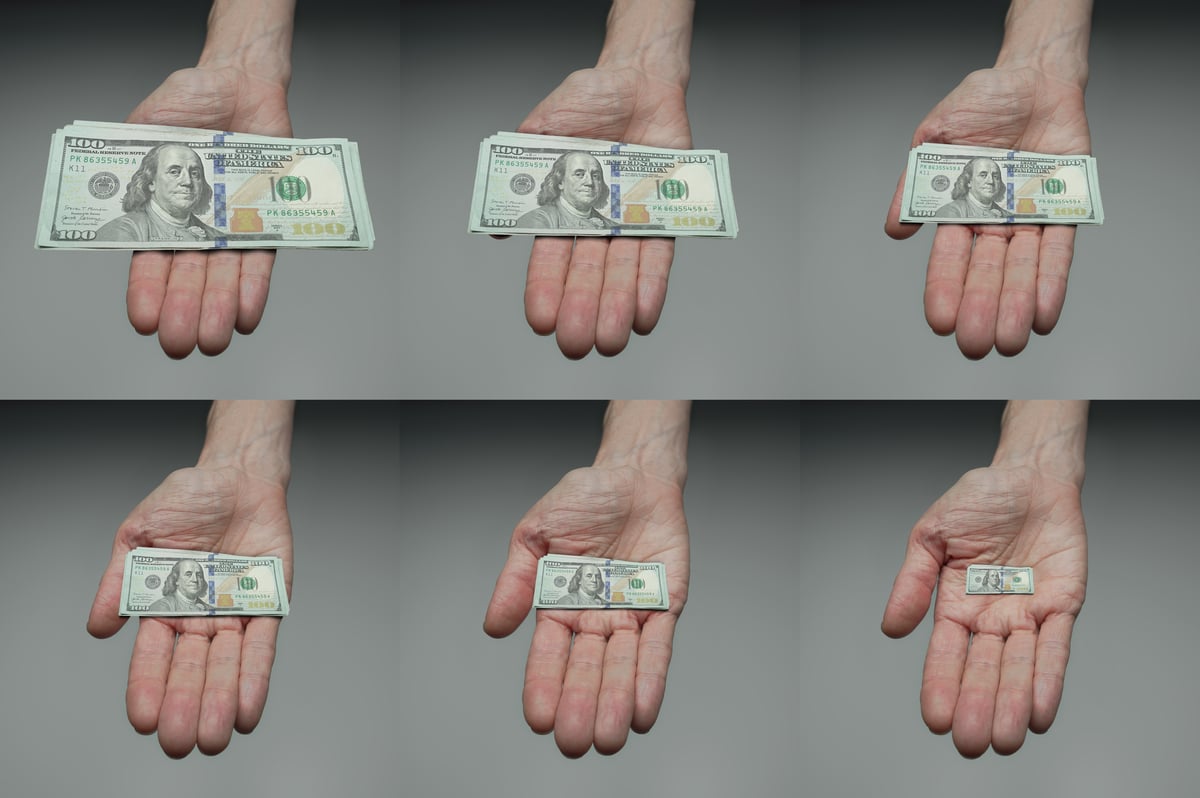

Image source: Getty Images.

Walgreens also indicated it plans to continue buying back shares and paying its dividend as well. Currently, the company pays investors a quarterly dividend of $0.4575, which now yields 4.6% annually -- which is well above the 2% that investors can normally expect to earn from the average S&P 500 stock. The Dividend Aristocrat has raised its dividend for 44 straight years.

The stock trades around 10 times its earnings and at a book value of less than two. Walgreens has consistently posted a profit in each of its past 10 quarterly results.

2. Waste Management

Waste Management (WM +0.85%) may be an even safer buy than Walgreens at a time like this. The company provides essential services in waste management and recycling -- something consumers can't do without. It's recession-proof because Waste Management will continue to see strong demand for its services throughout the business cycle. And if it's one thing that investors can expect from the stock, it's consistency; during the past six quarters, only once has quarterly revenue fallen below $3.8 billion. Its profit margin is also normally above 10%, falling below that threshold only twice in the past 10 quarters.

Currently, shares of Waste Management are trading at around 23 times earnings and 19 times future earnings. The stock also pays a quarterly dividend of $0.545 that today yields 2.4% annually. Waste Management announced its plans to increase the dividend in December; it's the seventeenth straight year that the company has done so. The company's President and CEO Jim Fish called dividend payments Waste Management's "top priority for capital allocation after we invest in the business to drive long-term profitable growth."

Near its low, offering a good and reliable payout, Waste Management is a solid pick up today for long-term investors.

3. Comcast

Comcast (CMCSA +0.59%) started out 2020 strong with an earnings release in January that saw the company's most recent quarterly earnings up 26% year-over-year. Revenue was up a modest 2% in the fourth quarter but for the full year, Comcast's top line was up over 15%. However, it's plummeted since then and is now just a few dollars away from its 52-week low.

The company plans to launch its new streaming service, Peacock, in July of this year. The service will compete with Netflix and other streaming services. One way it will differentiate itself is by offering sports in a paid package, something that many streaming services currently lack. Peacock could give Comcast another way to grow its business and get back some of those customers which it lost and who have cut cable.

Comcast currently pays its shareholders a quarterly dividend of $0.23, which on annual basis yields 2.7%. Comcast increased its dividend by 10% this year; it's the 12th year in row that shareholders are seeing a boost to their quarterly payments.

Shares of Comcast currently trade at a relatively modest 12 times earnings, which is a bit lower than the 15-17 times earnings that the stock was trading at in 2019 and before the coronavirus hit.

Which is the best stock to buy right now?

All three of the stocks listed here are cheap and have struggled this year, right along with the S&P 500:

However, they're also all likely to come out of the pandemic and continue being solid stocks to invest in.

For value and dividend investors, the best stock to buy right now looks to be Walgreens. It's suffered the largest losses but in a sense, it may have the most ground to make up as well. Its long dividend streak and steady management approach should give investors confidence that the company isn't going to make any rash decisions related to the coronavirus. If you're a risk-averse investor, however, Waste Management may be the safest pick you can make today.

Lastly, for growth investors, Comcast is the more appealing buy here. The company's grown its revenue by more than 58% in five years, and it's still working on more growth initiatives to try and drive more value for its shareholders. There's lots of value there, and the stock also pays a dividend.

No matter which dividend stock(s) you choose, it's hard to go wrong with any of the companies listed here if you're willing to hang on for the long haul.