Investors who've held Shopify (SHOP 4.49%) stock for the last four years are sitting on a 10-fold gain (or more) in its value. If you've missed out on this fantastic run, you might be wondering if now is a good time to get in on further gains as the stock's recent pullback from its all-time high appears to present the opportunity to buy at a discount.

Let's dive into what investors need to know to make an informed buying decision on this e-commerce platform specialist.

Shopify stock price over the last 12 months through Monday, April 6, 2020. SHOP data by YCharts

It's a great business

Shopify's platform online tools make it easy to start and run an online business. Merchants can use the platform to build their own branded websites and connect to other well-known retailers such as Amazon (AMZN 2.31%), Facebook, or Ebay. The platform features centralized product management and sales tracking across all sales channels, and allows the merchant to keep its brand front and center.

The e-commerce platform makes money in two ways -- subscription fees and transactional fees for services like payments or shipping. The transactional fees are part of its merchant solutions segment and are tied tightly to merchants' success; when merchants sell more, the company benefits too.

Growth has been incredible with its top-line increasing at a compound 65% annual growth rate (CAGR) since 2015, and its merchants solutions segment growing faster at a 76% CAGR.

Data from Shopify's earnings releases. Chart by author.

During its earnings call in mid-February, Shopify management projected first-quarter revenue to increase 38% year over year and 2020 full-year growth at 42% (at the midpoint of guidance) to $2.145 billion.

But that was all before the coronavirus pandemic hit.

There are short-term challenges

On April 1, the company suspended its full-year outlook due to the unknowns related to the pandemic. With strong January and February results, it will exceed its projections for Q1, but for the remainder of the year, smartly, the company isn't making any guesses. Management also shared that it's seeing its brick-and-mortar shops pivoting sales to online and online sellers discounting products to help drive sales. Both of these observations point to potential larger issues.

With much of the globe under stay-at-home orders and non-essential businesses closed, many people are getting laid off, and it's likely to get worse. Even if you feel your job is safe, with all of this uncertainty, your appetite for spending beyond the bare necessities has likely diminished. Shopify's strength has been to empower small brand-forward businesses, and the demand for many of these products will drop.

With a looming recession, discretionary online shopping may take a hit. Image source: Getty Images.

Even high-end Shopify Plus merchants, which make up 27% of its monthly recurring subscription revenue, aren't immune. Three companies that launched on the Plus platform in Q4 are "houseware brand KitchenAid, footwear brand Toms, [and] beachwear apparel fashion brand Panama Jack." These are examples of brands that don't really have a recession-proof product line.

What makes things worse is that a majority (59%) of revenue is fees tied to merchants' sales. Even if subscription revenues remain steady, transactional-based revenue will decline along with the slowing sales.

There's no doubt Shopify will weather this economic storm, with a rock-solid balance sheet of $2.46 billion in cash and marketable securities and no debt. But for shareholders, the stock price could be more volatile.

Even with the stock on sale, it's still pricey

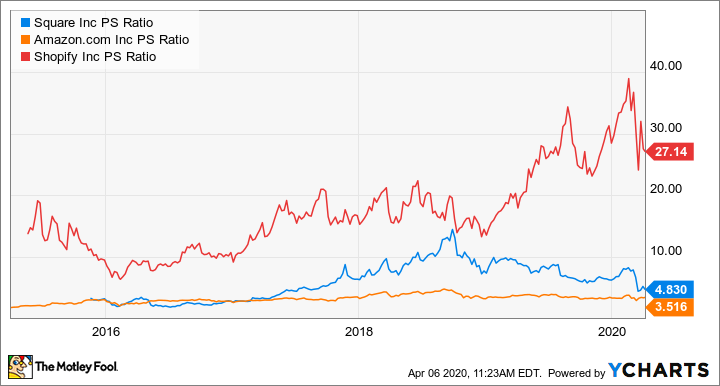

Shopify has always traded at a premium valuation. For most of its public life, its stock has sported a lofty price-to-sales (PS) ratio between 10 and 20.

PS ratio over the last five years through Monday, April 6, 2020. SQ PS Ratio data by YCharts

Not surprisingly, this range is significantly higher than the e-commerce giant Amazon, with its capital-heavy fulfillment network and a supply chain of purchased inventory. But Shopify's P/S ratio is also much higher than asset-light payments specialist Square (SQ +1.02%), which had a similar revenue growth rate for 2019 (41%) and is also highly dependent on small businesses.

In the past year, the P/S ratio climbed into the 20s and even the 30s, making it priced more like enterprise software-as-a-service single-sign-on specialist Okta (OKTA +1.35%) (PS of 24). Okta has similar revenue growth (47% for full-year 2019), but it has a stronger recurring-revenue model that makes up 95% of the top line and doesn't have the same small business concentration. Okta seems to have more support for a P/S in the 20s than Shopify does at this point.

With its shares trading at a premium valuation and the possibility of an extended recession affecting merchant sales, the stock could take a double-whammy hit.

The bottom line for investors

Shopify will survive this crisis and will lend a hand to help its merchants too. Recent actions of extending free trials to 90 days, adding gift card capabilities to all subscriptions, and releasing $200 million for loans will be appreciated by its customers, but it may not be enough.

The long-term future is bright, its market opportunity is massive, and I still 100% believe this can be a millionaire-maker stock. But prospective buyers should know that an extended stock decline through this economic downturn is entirely in the realm of possibility.