Top video game companies are in a good position right now. Spending on digital games hit a record of $10 billion in March, according to SuperData, driven by home confinement as a result of the COVID-19 pandemic. But the leaders still have plenty of opportunities for long-term growth in a promising industry.

Activision Blizzard (ATVI +0.00%) owns some of the most popular franchises in gaming, including Call of Duty, World of Warcraft, and the mobile title Candy Crush. The company has a player base of over 400 million active users as of Dec. 2019.

Nintendo (NTDOY +1.47%) should report strong results for the March-ending quarter. The Nintendo Switch has been sold out in recent weeks after the successful release of Animal Crossing: New Horizons, which was the top-selling video game last month.

I personally own shares of both stocks, but let's compare these gaming rivals to see which one is the better investment for the long haul.

Image source: Getty Images.

Key differences

Activision Blizzard and Nintendo are two different breeds of video game company. The most obvious difference is that Activision is focused on making games, whereas Nintendo generates most of its annual sales from hardware, primarly the Nintendo Switch. Hardware sales made up 55.6% of Nintendo's revenue for the nine-month period through Dec. 2019. Over the last decade, Activision has maintained a higher operating margin than Nintendo, largely due to the lower margins that hardware generates compared to selling games.

Data by YCharts.

However, as you can see, Nintendo's operating margin has been steadily climbing as hardware sales drop as a percentage of the top line. The Nintendo Switch launched in 2017 and has sold 52.5 million units, but it's getting harder for Nintendo to move the needle, since it has to sell more and more hardware units each year to maintain the same level of growth.

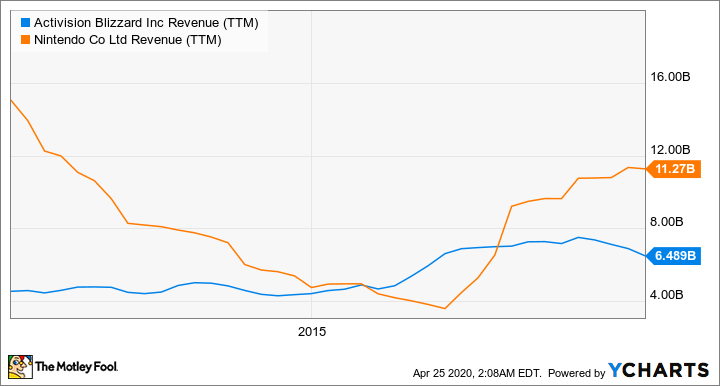

As you can see in this chart, Nintendo's revenue growth is starting to flatten out.

Data by YCharts.

Nintendo's pre-coronavirus guidance called for revenue to grow 4% in fiscal 2020 (which ended in March). It could exceed that guidance, depending on how the strong Switch sales in March translate on the books.

Also, Nintendo's digital sales have reached nearly a third of total revenue. This includes subscriptions to Nintendo Switch Online, downloadable content, and digital versions of packaged games sold directly through the Nintendo eShop on the Switch device. Further growth in digital sales should continue to benefit Nintendo's profitability.

On the other hand, Activision Blizzard generated 53% of its revenue from in-game content, such as the virtual items players purchase within the game. That means, unlike Nintendo, Activision doesn't need to release new games as often to generate sales.

Nintendo's business is largely built around console hardware cycles that last about five to seven years. A new console sends sales surging in the first few years after launch, as the Wii did in 2006 and as the Switch has over the last few years. But eventually, the growth curve flattens out.

For this reason, I believe Activision Blizzard is fundamentally a better business. It's still monetizing the players in World of Warcraft, an online multiplayer title that has been around since 2004. Overwatch and Hearthstone also still have active player bases since debuting several years ago. The only game that Activision releases on an annual basis is Call of Duty, which is typically one of the best-selling games of the year.

Overall, Nintendo's dependency on hardware innovation makes its future growth path more challenging than what Activision faces. By comparison, Activision can develop new content for existing games and launch a new franchise every so often.

We'll review below how this strategy has translated to much superior returns for Activision Blizzard shareholders.

Growth is crucial for better returns

The chart below illustrates the two companies' revenue growth over the last 10 years. While Activision has seen a gradual improvement of its top line over time, Nintendo revenue cratered early in the decade as the launch of the Wii U console failed to capture an audience.

Data by YCharts.

While Nintendo has grown revenue faster than Activision since the launch of Switch three years ago, Activision has a pipeline of new games that should fuels its results over the next five years.

For example, the company has had enormous success so far with Call of Duty: Mobile, a free-to-play title that exceeded 150 million installs after its launch in Oct. 2019. In March, the company released a new free-to-play battle-royale shooter called Call of Duty: Warzone, which attracted 50 million new player accounts. The Call of Duty franchise has a lot of momentum behind it right now and positions Activision to see its monthly active users expand in 2020, providing the company with a larger audience to monetize and pad the bottom line.

What's more, management has numerous projects under development, including Overwatch 2 (the original Overwatch sold 50 million copies). There is also Diablo 4, and a mobile version called Diablo: Immortal in the works. These are popular franchises that will likely sell millions of copies after their release.

Activision Blizzard has focused on developing mobile versions of several of its most popular franchises to take advantage of the fast-growing mobile-game market. Over the next five years, the company has the opportunity to reaccelerate revenue and earnings growth just as Nintendo begins to see its business stagnate from Switch saturation.

The final verdict

If it's not already clear, I believe Activision Blizzard is the better long-term investment. This chart sums up why:

Data by YCharts.

Over the last two decades, the returns between the two stocks are not even close. Nintendo's lower rate of return reflects the cycle of hits and misses with its console launches. The Japanese game maker has valuable brands like Mario and Zelda, and it should continue to deliver positive returns, but Activision has the better record of delivering phenomenal returns for investors over the long run.

Activision Blizzard CEO Bobby Kotick has steered the company into the right opportunities, such as orchestrating the Activision-Blizzard merger in 2008. Kotick has also been willing to discontinue certain franchises that don't earn a good return on investment, such as Guitar Hero in 2011 and Destiny in 2018. The company has proven for many years that it can tackle the big opportunities in the industry, such as the popularity of the first-person shooter category with the original Call of Duty in 2003 and most recently esports with Overwatch League.

The next 10 years should be equally rewarding for investors as the company expands further into mobile games, which is the fastest-growing category for global game sales.

That said, Nintendo is still a good investment, which is why I hold some shares. But if you're looking for optimal exposure to the video game industry, Activision Blizzard should be your No. 1 pick -- think about adding shares of Nintendo later.