It's been a tough couple of years for Cognex (CGNX 4.89%) investors. After suffering through slowing economic growth in China and a trade war that added insult to injury, it's fair to say the COVID-19 pandemic couldn't have come at a more challenging time for the company.

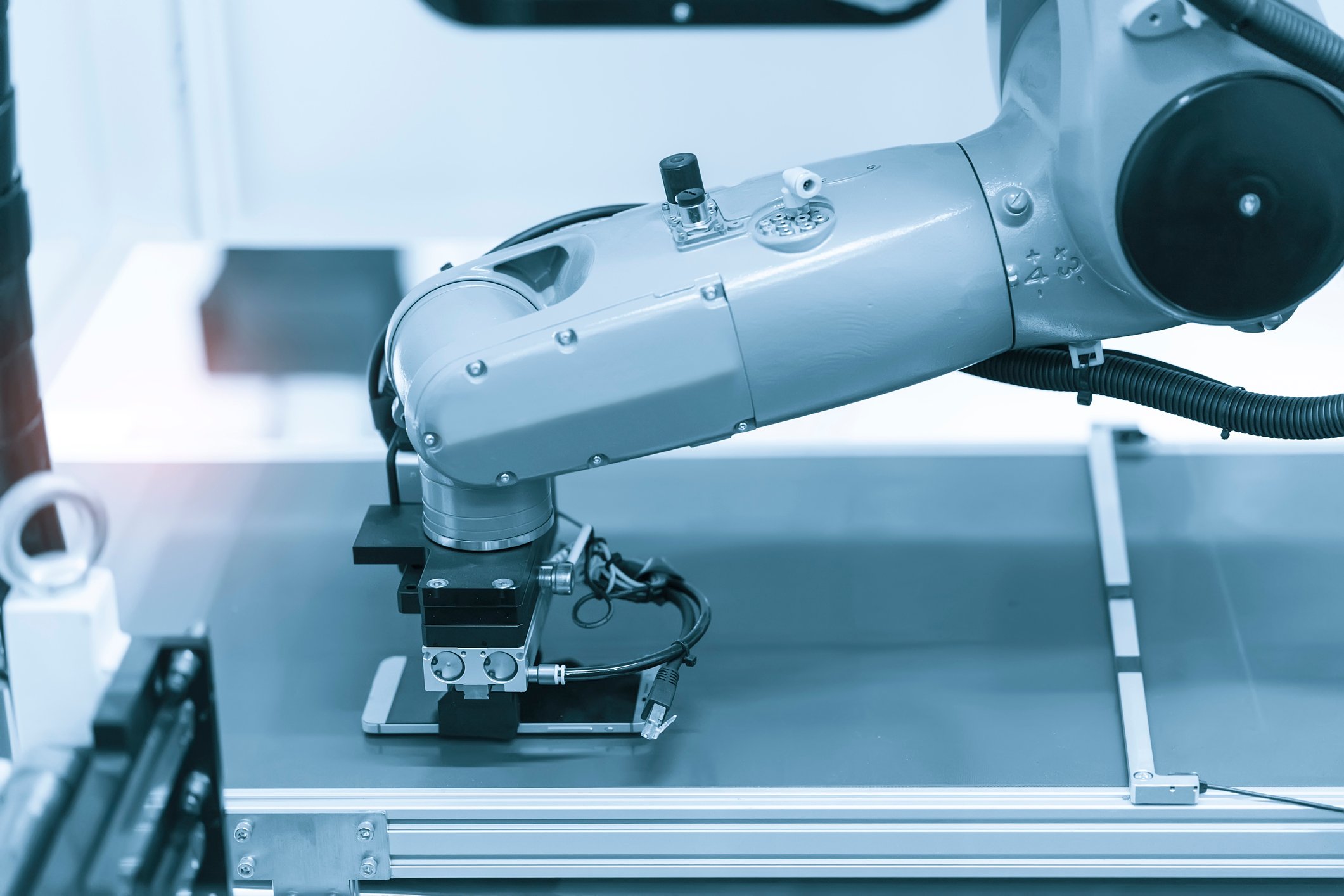

Its industry-leading machine-vision systems help ensure quality control on production lines, read barcodes to keep track of packages and inventory, and automate measurements and calibration in products. With many of these facilities shuttered in the face of coronavirus, the company's much-needed recovery has been put on hold.

Cognex reported first-quarter results that were in line with management's guidance, but it said, "that is little comfort in these very challenging times." The company cited "significant disruptions" to its business, suggesting that the worst may not be over.

A robotic arm using machine vision on a cell phone assembly line. Image source: Getty Images.

"Not bad" is good enough

Cognex reported revenue that declined to $167.24 million, down 4% year over year but in line with the company's guidance range of $155 million to $170 million issued three months ago. The news was enough to send the stock up more than 12% on a mixed day for the market.

Gross margin was 75%, falling within the "mid-70% range" management had targeted, and up from 73% in the prior-year quarter. Operating income was pummeled by fixed costs, declining 30% year over year to $20.95 million. This resulted in net income of $20.48 million and diluted earnings per share of $0.12, down from $0.19 in the prior-year quarter.

Another contributor to the weaker bottom line was research, development & engineering (RD&E) expenses, which increased 19% year over year. The incremental costs were primarily related to the recent acquisition of Sualab, which Cognex acquired in the fourth quarter.

Not all bad news

Cognex didn't sugar-coat the growing risks to its business, given the current restrictions, but it did highlight some cause for optimism.

Management noted that some companies were seeing significant disruptions to their business and struggling to adapt capital spending plans in the current environment, which would continue to make things tough for Cognex in the near term.

The news wasn't all bad, as some customers, particularly those involved in e-commerce, as well as companies in China, were experiencing accelerated activity.

"Our Q1 results were in line with our guidance, but that is little comfort in these very challenging times," said Dr. Robert J. Shillman, founder and chairman of Cognex. "The risks to our ongoing success have increased significantly due to the economic impact of the limitations on travel and other restrictive measures mandated by governments around the world in recent weeks."

Shillman went on to say that the combined experience of the company's management team, its strong balance sheet, and corporate culture would help Cognex through the current difficulties, while also potentially gaining ground on its competition, citing previous downturns as evidence.

A stark reality

Cognex noted lower demand for its products in certain industries, supply chain disruptions, extended customer delivery times, higher shipping costs, and customer facility shutdowns as weighing on both current and future results.

The company provided extremely broad guidance given the current challenges, expecting a decline in both revenue and earnings per share, but refusing to elaborate further. Cognex did provide a few bare-bones metrics, expecting gross margin in the mid-70% range, but lower than in Q1. The company also expects operating expenses to decline by more than 10% as it reins in discretionary spending.

A secret weapon

As noted in the company's prepared remarks, Cognex has a strong balance sheet. It ended the quarter with $845 million in cash and no debt, which gives the company the financial flexibility many others are lacking.

For a cyclical stock like this, things won't be improving in the short term, but Cognex has the experience and resources to ride out the storm and emerge even stronger on the other side.