What happened

Shares of Chinese electric-vehicle maker NIO (NIO +0.66%) were up sharply on Wednesday after the company announced that it had secured nearly $1 billion in new financing from economic-development authorities in China.

As of 11:00 a.m. EDT, NIO's American depositary shares were up about 17.5% from Tuesday's closing price.

So what

Here's why the stock is way up: This deal will remove the risk of insolvency that's been hanging over the company for months. Once the deal closes, NIO will have enough money to build out its distribution network and launch its upcoming new models.

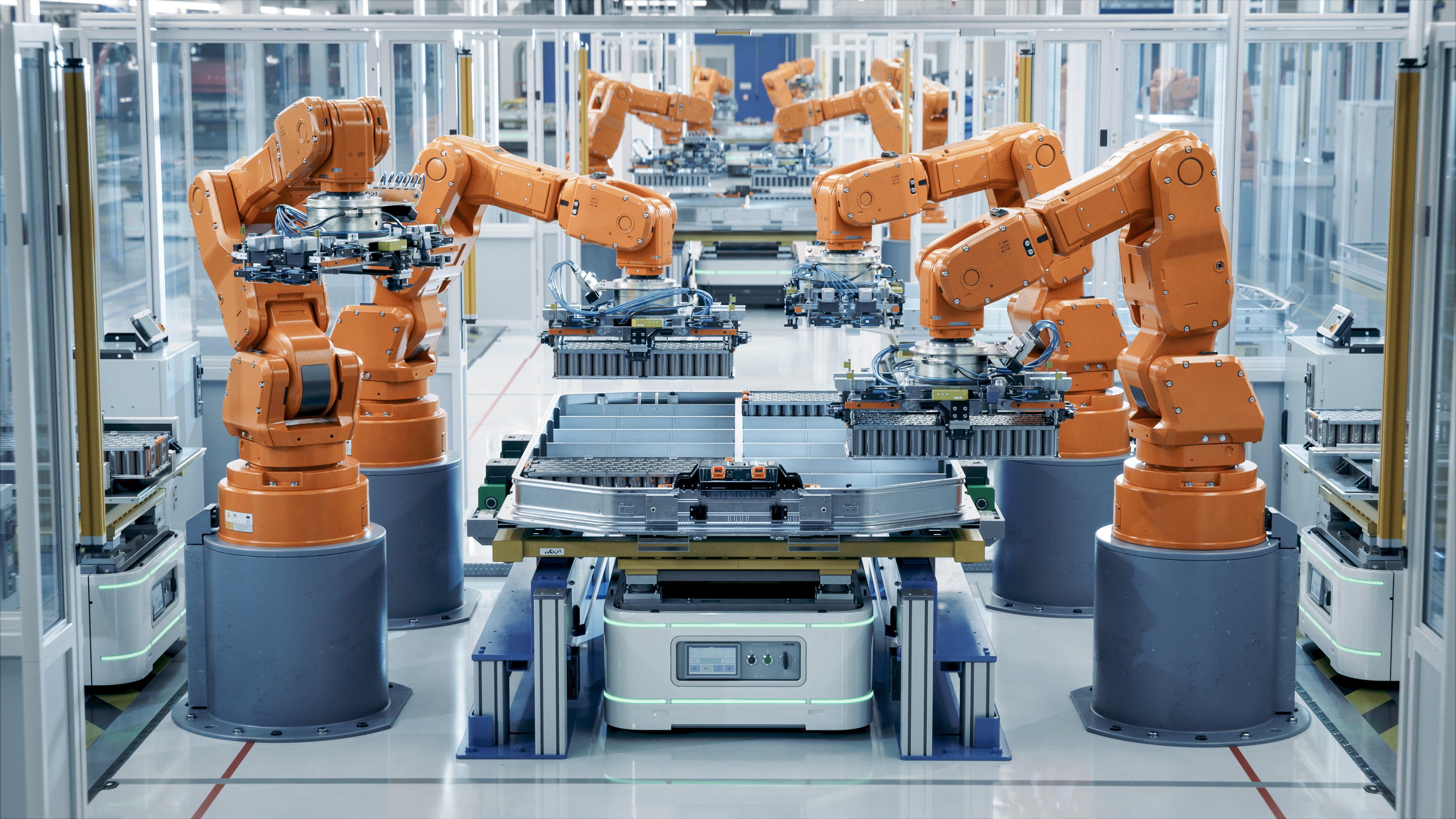

NIO launched a revamped version of its ES8 SUV in March. Image source: NIO, Inc.

That certainly seems like great news, but there are also reasons for caution.

The deal is a bit complicated, and there are some important things we don't know yet, but here's the gist: In exchange for an agreement to relocate to the city of Hefei, in China's Anhui province, and to help nurture a smart-vehicle business ecosystem there, economic-development funds controlled by the governments of Hefei and Anhui will invest 7 billion Chinese yuan and take a 24.1% stake in NIO.

That's the simple explanation, but the deal is actually more complicated than that. The parties are creating a new company, called NIO (Anhui) Holdings Ltd., into which NIO will put substantially all of its assets in China, plus some money, in return for a 75.9% stake.

In other words, the entity that U.S. shareholders have a stake in will actually own 75.9% of this new NIO holding company.

That might turn out to be a good deal, but there are some things we don't know yet.

Now what

First, what happens to the rest of NIO, meaning its holdings outside of China (including in the United States)? Second, what happens to NIO's debt? The company had about $1 billion in long-term debt as of the end of 2019, its most recent report. Does that go into this new company, too, or is NIO giving up most of its assets and keeping its liabilities?

Auto investors will have to wait until NIO files its 20-F form with the Securities and Exchange Commission to find out. But in the meantime, they can celebrate what appears to be very good news: NIO now has funding secured.