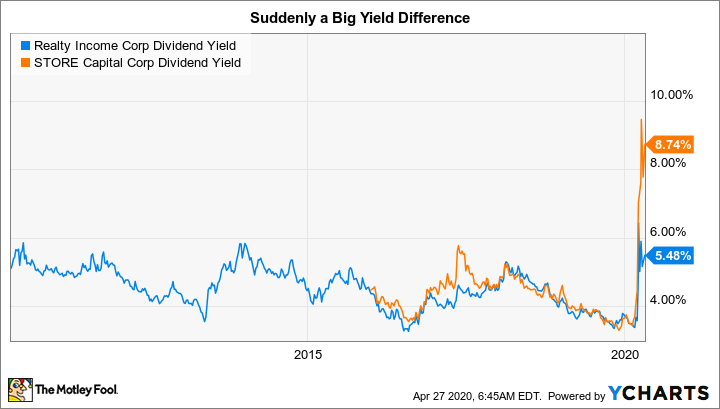

Real estate investment trusts (REITs) with exposure to retail assets are getting hit hard these days. Realty Income (O -0.09%) and Store Capital (STOR) are down from their recent highs by about 33% and 50%, respectively. The yields on these stocks are higher than they have been in a very long time. However, is one of these net lease REITs a better buy? That requires a little more digging.

1. Business model

Both Realty Income and Store Capital are net-lease real estate investment trusts. That means that they own properties, but their tenants are responsible for most of the operating costs of the assets they occupy. It's a fairly low-risk and low-maintenance approach, with the REITs basically making the difference between the rents they charge and their financing costs. So, at the core, they do basically the same thing, making this issue a wash (though still important to understand).

Image source: Getty Images

2. Portfolio

Realty Income generates around 83% of its rents from retail properties, with the rest largely from industrial and office assets (a tiny amount comes from an opportunistic investment in vineyards). Store Capital gets around 83% of its rents from retail assets, with the rest largely from manufacturing properties, which are basically industrial assets. So, roughly similar. And both have pretty high occupancy levels.

That said, Realty Income owns around 6,500 properties, a handful of which are in Europe (only about a percentage point or two of the portfolio). Store Capital's portfolio is roughly 2,500 assets, a much smaller number. On the plus side, that means smaller investments can move the needle at Store Capital, which prefers to do deals on a one-off basis so it can originate the lease and control its terms. However, Store Capital clearly doesn't have the same scale or diversification as Realty. Right now, when investors are worried about safety, bigger is probably better, so Realty Income gets the nod.

3. A brief history

Store Capital's smaller scale is partly the result of the fact that it hasn't been around quite as long as Realty Income. The younger REIT only went public in the second half of 2014. That's actually pretty important here, because the last recession occurred between 2007 and 2009. So Store Capital's entire history as a public company has come during an economic upturn. Realty Income is one of the oldest net lease companies around. Having IPOed in 1994, it has lived through several economic contractions. Thus, Realty Income has experience navigating difficult periods that Store Capital doesn't. And since the efforts to slow the spread of COVID-19 are likely to push the United States into a recession, that gives the "old hand" an edge.

O Dividend Yield data by YCharts

4. Dividends

Realty Income has increased its dividend annually for more than 27 consecutive years. At only around six years old, Store Capital obviously can't claim to match that. It has, however, increased its dividend every year since going public. It's hard to knock a company for providing investors with annual dividend hikes, but Store Capital clearly doesn't match up to Realty Income here.

That said, Realty Income's yield of around 5.7% is relatively modest compared to Store's nearly 9% yield. They have similar business models, so it's not unreasonable to think that dividend-focused investors would be attracted to Store Capital's yield. There's even more to like when you consider that Store's payout ratio based on adjusted funds from operations (which is like earnings for an industrial company) came in at 70% -- lower than that of Realty, which ended the year at around 80%. Both have some room to deal with near-term adversity, of course, but Store's dividend appears a little more secure right now.

All in all, this is a tough call. But Realty Income's dividend history and longer corporate history hold a lot of weight during a difficult economic period. The REIT has proven that it can survive a rough patch and keep paying its dividend. Store Capital's payout ratio is a bit better right now, which is notable, but the REIT has never lived through a downturn. Yes, its yield is high, but so is the uncertainty here. It's probably best to err on the side of caution if you are looking at this pair today and take the lower -- though still material -- yield on offer from Realty Income. That yield, by the way, is near its highest levels since the last recession, suggesting it could be a decent time to jump in.

The final call

For conservative investors, Realty Income is the better choice here right now -- a fact that wasn't quite so clear when economic times were better. That's not a knock on Store Capital per se, which has achieved a great deal in a very short period of time. However, COVID-19 has shifted retailers into survival mode, and that's going to have a material impact on both of these REITs.

The big question is whether or not they'll get paid the rent they're due. To give you an idea of the concern, Realty Income has drawn down a revolving credit facility to raise cash and pulled its earnings guidance for the year. Those are the right moves, but they show just how uncertain the operating environment is today. Store Capital believes its portfolio will hold up well in the current environment (and it's probably right), but with no history to back that up, only more aggressive investors should be looking to invest in the REIT at the moment.