What happened

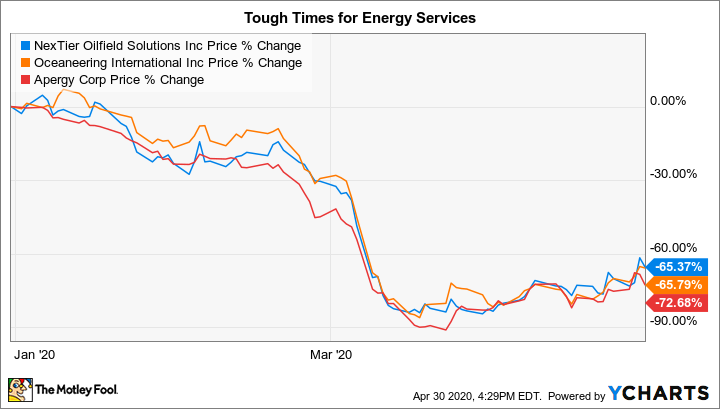

Shares of energy services company Oceaneering International (OII +3.41%) fell as much as 10% on Thursday, with NexTier Oilfield Solutions (NYSE: NEX) dropping as much as 14%, and Apergy (APY +0.00%) down by as much as 15%. By the close of trading, all three were still in the red for the day, but off their lows. Oceaneering managed to work off most of its early losses, closing down just about 1% or so. NexTier wasn't so lucky, finishing out the day with a roughly 10% drop. Apergy pulled up the rear with a 13.5% decline.

So what

Notably, oil was up on the day, going in the opposite direction as these services firms. Higher energy prices would normally be seen as a positive for companies that provide products, drilling, and engineering services to exploration and production companies. But there's a massive disconnect today in the energy sector between supply and demand.

Image source: Getty Images.

The trouble stems from the growth of U.S. onshore drilling over the past decade or two. This is the region on which NexTier is focused, with Apergy generating around half of its revenue from North America. It had been, for many years, a growing sector, as oil and natural gas output rapidly expanded. The problem is that the new production from the region upended long-standing supply/demand relationships in the global energy market.

OPEC attempted to manage the disruption by cutting production. That didn't work well, because U.S. production simply increased to pick up whatever slack was created. Early this year, OPEC and partner Russia ended up disagreeing over further cuts and got into a short price war. The result was extra oil hitting the market and a sharp drop in energy prices. Although OPEC, Russia, and the United States eventually came together on a plan to reduce production, the damage had already been done.

That's because the price war, though brief, took place at roughly the same time that COVID-19 was spreading across the globe. Countries around the world were forced to effectively shut down their economies to slow the spread of the virus. That led to a steep decline in demand for oil and natural gas. It appears that the world's efforts to contain the coronavirus are working, but the cost is highly likely to be a global recession. Which will leave energy demand weak even after countries start to reopen their economies.

The longer-term problem is that there was far too much supply at a time when demand was falling off a cliff. All of the extra oil is being put into storage so it can be used later. That's pushed oil prices so low that energy companies are going bankrupt and the largest and strongest industry players are postponing or even canceling big projects. So even the offshore projects that Oceaneering International usually works on aren't safe. In fact, the company highlighted the oil decline in late March when it retracted guidance. It's now looking to cut costs by an additional 20% over its earlier goals.

Ultimately, all of the extra oil in storage needs to be worked off before oil prices can sustainably recover. And few energy companies are likely to expand their investment programs until the supply/demand equation is closer to being balanced. That's a terrible backdrop for NexTier Oilfield Solutions, Apergy, and Oceaneering International, since oil could easily rise without demand for their products and services increasing.

Note that, like Oceaneering International, NexTier and Apergy are also pulling back on spending wherever they can. NexTier, for example, has reduced its capital spending budget for 2020 by a huge 50%, and Apergy is looking to trim its costs by around 30% more than its original plans for the year. Apergy expects its end markets to remain weak all year, if not longer.

Adding complexity to the picture, Apergy is in the middle of a merger that it hopes to complete around the middle of the year. NexTier, meanwhile, was created in late 2019 via a merger of two companies. It is still trying to work through the integration process. So the demand hit couldn't have come at a worse time for these two energy services names. Already dealing with internal issues, they are now facing material external headwinds as well.

Now what

The energy sector is highly cyclical, with energy services companies perhaps even more volatile than exploration and production names. This is not a sector for the faint of heart. And right now, the mismatch between supply and demand has created an even more tumultuous situation than usual. Most investors should probably stick to the largest, strongest, and most established names in the energy space, like integrated oil majors Chevron and ExxonMobil.