Heating, ventilation, air-conditioning, and refrigeration (HVACR) equipment and parts distributor Watsco (WSO 0.24%) is a business with a balance sheet built to withstand a recession. Better yet, it's a company with a business model built to actually come out of a recession in stronger shape then when it entered into it. Throw in a 4.4% dividend yield and there's a lot to like about the company. Here's the lowdown.

Introducing Watsco

To understand why Watsco is an attractive stock in a downturn, you have to understand its business. The company is the leading player in the highly fragmented market for HVACR distribution. Management estimates there are more than two-thousand distributors, with its nearest competitor being Johnstone Supply.

For an idea of Watsco's leading position in the market, consider that Johnstone Supply passed the $2 billion in sales mark in 2017, compared to Watsco's $4.8 billion in 2019. Watsco also competes with original equipment manufacturers (OEM) that also have distribution companies in some markets.

Image source: Getty Images.

Watsco's dominant position is a consequence of its so-called "buy and build" strategy. The "buy" bit refers to an acquisition-led growth strategy of buying smaller distributors in order to grab market share or expand into new geographies. Watsco has bought Sixty-three HVACR distributors since 1989. The "build" part of this strategy is where Watsco implements practices designed to encourage growth at the acquired companies.

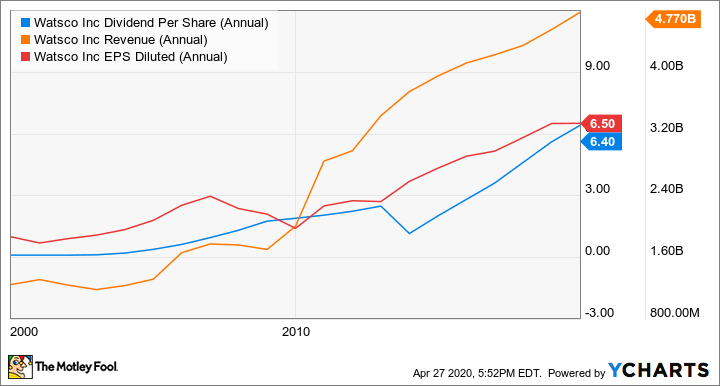

It's proven to be a highly successful strategy, and Watsco has experienced strong growth in revenue, earnings, dividends, and free cash flow over the last couple of decades.

Data by YCharts

A key part of the growth comes from its joint ventures with HVACR OEM Carrier (CARR 1.29%) -- a company that's recently been spun out of the former industrial conglomerate United Technologies. The three joint ventures with Carrier contributed 58% of Watsco's revenue in 2019. Moreover, around 62% of the equipment Watsco purchases in order to distribute comes from Carrier. I'll come back to this point in a moment.

The business model

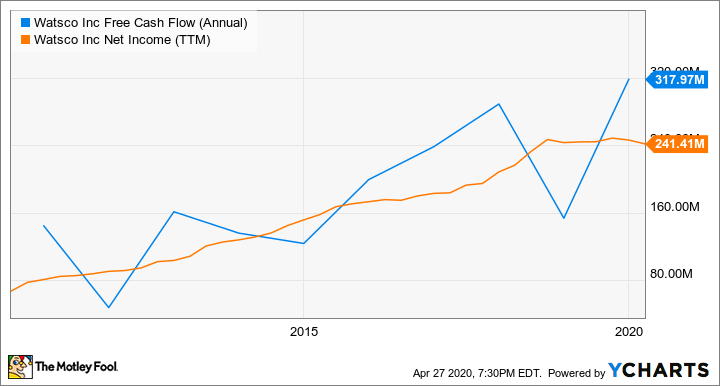

Watsco's business model is quite simple. HVACR contractors get called out to repair units, and they then go to Watsco to buy equipment, parts, or a replacement unit. As such, Watsco serves over three hundred thousand customers with no single customer accounting for more than 1% of its total revenue. It's a business model which results in excellent free cash flow generation even in a downturn. When contractors reduce orders, then Watsco simply slows purchasing from OEMs, and cash flow builds up as inventory is sold off.

As the leader in the industry, Watsco is using its scale to roll out digital technologies (mobile apps and e-commerce) which can make a contractor's work much more efficient. In fact, this is a key component of its growth strategy: E-commerce sales as a percentage of its total sales now make up around 36% on an annualized basis.

Why Watsco is resilient in a downturn

Putting all of this together, there are four main reasons why Watsco is well set to handle an economic slowdown:

First, HVACR is deemed an essential item by customers, and in any case, 65%-70% of Watsco's sales actually go toward the replacement market, with only 10%-15% coming from the more economically sensitive new housing market. In other words, Watsco is largely reliant on servicing an installed base.

Second, Watsco's cash-generative business model means that, in the words of Executive VP Barry Logan on a recent earnings call, " This is a business where if revenues go down, working capital responds within a few days" and " we're placing orders with OEMs every day. We're collecting money every day." In other words, Watsco could see a bounce in cash flow as a result of a near-term decline in revenue.

Data by YCharts

Third, the company is run conservatively, with very little debt. This is a key point because financial strength during a slowdown will enable the company to follows its "buy and build" strategy and acquire businesses at good prices in downturn.

Data by YCharts

Fourth, the recent spinout of Carrier will allow Watsco's key partner to be fully focused on the HVACR market. Moreover, one of the reasons why Carrier was separated from United Technologies was to free up the business so it could potentially take part in an overdue consolidation in the HVACR industry. That would be good news for Watsco as Carrier is its key partner and supplier.

A stock to buy

Watsco is highly likely to take a revenue hit from the coronavirus. After all, consumers might not be so willing to allow an HVACR contractor into their home in the current environment. However, its business model provides some flexibility and it has a rock solid balance sheet. Moreover, the downturn could create an opportunity for some earnings-enhancing acquisitions. It's an interesting option for income-seeking investors.