Warren Buffett's position on airline stocks has attracted a lot of investor attention, and rightly so. His Berkshire Hathaway went from being a buyer of airline stocks earlier in the year to famously dumping its stakes in Delta Air Lines (DAL +4.84%), Southwest Airlines (LUV +4.41%), American Airlines Group (AAL +2.93%), and United Airlines (UAL +4.92%), with Buffett declaring that he'd made a mistake. What does this mean for aviation industry investors?

Buffett was right about airlines, up to a point

To shed light on the matter, it's useful to go back to 2013, when Buffett described the airline business as having been a "death trap for investors."

Image source: Getty Images.

He was right about conditions up until 2013, because, until then, the global airline industry hadn't reported a single year in which its return on invested capital (ROIC) exceeded its weighted average cost of capital (WACC). Don't worry too much about these metrics. Just know that ROIC measures how well a company makes money from the debt and equity put into it and WACC measures the cost of that debt and equity. In general, investors want to see ROIC exceeding WACC.

Simply put, the airline industry traditionally hadn't covered its cost of capital up until 2013.

However, just a couple of years later, the International Air Transport Association (IATA) declared that for the first time ever, airline industry ROIC would exceed WACC. In other words, equity investors would finally start to see value generated for them. Moreover, North American-based airlines led the way by starting to do this toward the end of 2013 -- the year Buffett called the industry a death trap!

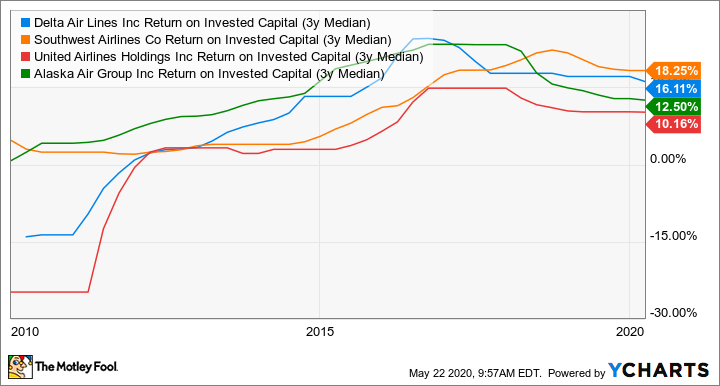

I've used three-year medians in the chart below to smooth out the figures, but you can clearly see that airlines were generating very healthy ROIC from around 2013 onward. (For reference, the current WACC on the air transport sector is roughly 5.9%.)

As a consequence, North American airline stocks soared between 2013 and 2019, with Alaska Air returning 215%, United Airlines 277%, Delta Air 392%, and Southwest 427%.

Data by YCharts.

Turning to a global view, the increase in profitability can clearly be seen in the chart below. In particular, note that passenger traffic growth was also high before the recession in 2008, but airlines weren't making money then as they have been doing in the last decade.

Data source: IATA. RPK = revenue passenger kilometers; measures actual passenger traffic.

What's next for the airline industry?

All of which leads to a series of questions about the kind of airline industry to expect in the future. Specifically, which of the following scenarios is more feasible in a world still dealing with the COVID-19 pandemic?

- Will a slow recovery take place as North American airlines get back to generating post-2013 ROIC -- meaning that airline stocks could be significantly undervalued right now?

- Will the aftermath of the pandemic cause the airline industry to revert to pre-2013 conditions in which investors simply don't have value generated for them overall?

- Will the aviation industry face long-term issues with overregulation, traffic restrictions, a lack of demand, and difficulty in finding funding?

It's impossible to answer these questions fully, because it's very difficult to know how long traffic restrictions will be in place and, consequently, what kind of financial position individual airline stocks will be in. Clearly, some airlines are stronger than others, but picking airline stock winners in this environment is a difficult exercise.

Image source: Getty Images.

The best place to invest

One way to deal with the uncertainty when it comes to picking a particular airline winner is to argue that the airline industry will grow again, and the best place to invest is in its suppliers. For example, Raytheon Technologies (RTX +0.08%) looks a very good value with its Pratt & Whitney aircraft engines and Collins Aerospace systems. Similarly, Honeywell International's(HON +0.02%) largest profit center is its aerospace operations and the stock also looks attractively priced right now.

It's an argument based on the idea that, while the airline industry hasn't traditionally been a great place to invest for equity investors (particularly before 2013) it has been attractive for debt investors. As such, history suggests capital will flow into the industry, with new airlines being created or the more financially sound airlines being expanded. Pre-2013 history suggests that capital then gets transferred to the aviation suppliers while airlines fail to generate significant returns for investors.

As the IATA points out in a report on performance, "On average, during previous business cycles, the airline industry has been able to generate enough revenue to pay its suppliers' bills and service its debt." In other words, debt investors have tended to profit from the industry.

Moreover, airline debt is normally backed by assets (the airplanes) that can be sold in a liquidation -- great for debt holders but not so great for equity investors, who are paid last in a liquidation.

All of which suggests that, although the COVID-19 pandemic is obviously going to negatively impact demand for a few years, there will be an underlying support for a slow recovery in the industry. This applies even if some of the airline incumbents go bust in the meantime, and/or don't return to previous levels of ROIC or profitability.

What to buy

In short, if you want to play a recovery in the commercial aviation industry, the safest way to do it is through the suppliers (aircraft manufacturers and engine and component makers like Raytheon Technologies and Honeywell) rather than the airlines themselves.

History suggests the suppliers can make money even when airlines are not particularly lucrative for equity investors. Moreover, the difficulty of picking winners among the airline stocks in the current environment is possibly why Buffett dumped them.