As Americans have spent weeks staying put at home to slow the spread of COVID-19, the stock market has gone on a wild ride, first crashing and then rallying even as unemployment reached record highs.

With so much volatility and the future of the U.S. economy still largely uncertain, it's natural to be worried about what the stock market has done and will do in the coming months. But there are four big reasons this worry is a waste of time and could even be detrimental to your investing success.

Image source: Getty Images.

1. The performance of your stocks doesn't necessarily mirror the performance of the market

As the coronavirus crisis unfolded, the market saw its worst month in March since the Great Depression, with the S&P 500 dropping by more than 12% and the Dow Jones Industrial Average (^DJI 0.77%) (DJINDICES:^DJI) falling by more than 13%. But not every stock saw its share price tumble. Walmart (WMT 0.83%) gained 6% in March, while Amazon (AMZN 1.62%) shares rose 3.5%. And that's just two of many companies that actually did well as the market was in free fall.

The point is, your individual stocks may not mirror the performance of the market as a whole. They may perform well when the market goes down, or go down with the broader market but decline by less or recover more quickly.

You don't need to worry about what the market is doing, but instead focus on whether you still believe in the future success of companies you've invested in.

2. Long-term investors almost always win in the end

When you buy and hold for the long term, swings in the market aren't your concern. Long-term investors won't try to time the bottom, as it's too easy to miss a bargain since news always looks worse when the market is nearing its lows. They also won't take profits early as soon as the market begins to rally, risking losing out on potential gains.

If you bought Amazon and paid more than $2,000 a share in September 2018, seeing the share price go under $1,400 in December that year would've been disheartening. Of course, if you'd sold, you'd have missed out on seeing prices climb. Likewise, if you'd been tempted to sell early this year when the price first topped $2,100, you'd have missed the chance to see share prices go above $2,400 in recent weeks. And that's just a small snapshot in time. Going back a few years further, would you care if you'd bought in at $400 or $600 or $700 when you look at the astronomical gains you could've made by holding over half a decade?

Smart investors know timing the market and paying attention to short-term swings simply isn't the way to success. Instead, the key is picking a company you believe in and being patient.

3. History shows investing in the market is the right move

Whenever you're tempted to worry about the current state of the market, these two charts should put your mind at ease.

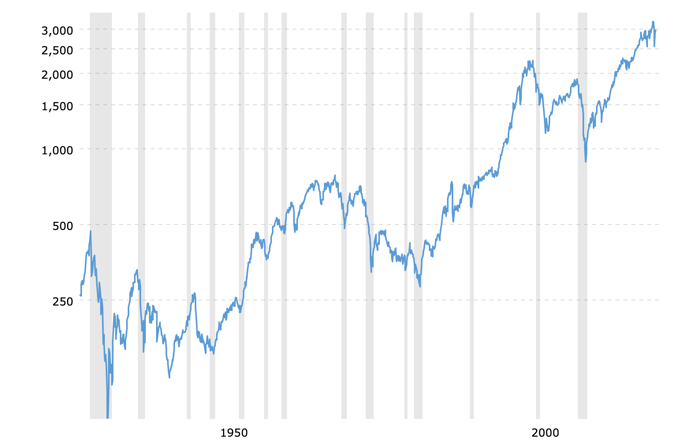

This one's the 90-year performance of the S&P 500, with historical data adjusted for inflation:

Image source: MacroTrends.net

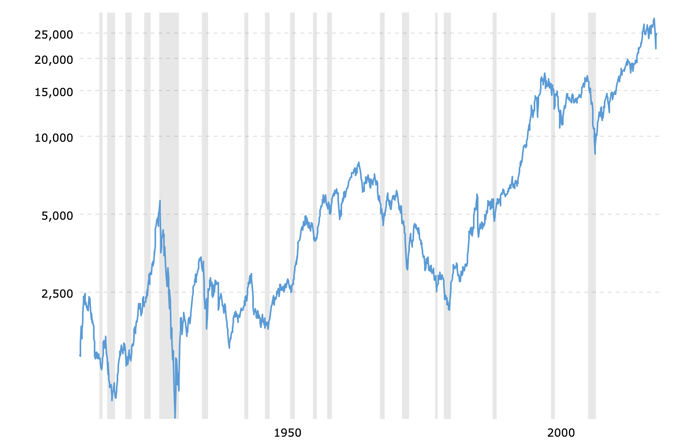

And this one's the performance of the Dow Jones Industrial Average over the past 100 years, adjusted for inflation:

Image source: Macro Trends.net

Despite a cycle of ups and downs, investors with diversified portfolios and sound investments who stayed the course over decades essentially always saw gains -- even if they had bad timing and bought during rallies but sold during a downturn.

The bottom line is, stocks have historically provided a better ROI than real estate, bonds, CDs, or other investments presenting a reasonable level of risk. Because of that, the best way to build wealth is putting your money into the market and leaving it there no matter what black swan events happen.

4. Worrying can get you into trouble

Still not convinced the market isn't worth worrying about? Then keep this in mind: Making investing decisions based on emotion is a recipe for disaster.

By the time you know there's something to worry about, chances are good you'll have already lost money -- and selling your stocks will simply lock in losses. And concern about short-term trends could also cause you to miss out on buying opportunities since no one can predict when a rally will start.

To make sure you don't give in to fear and make decisions that'll cost you, don't even look at the day-to-day performance of the market if it worries you. Instead, spend your time reviewing the fundamentals of the stocks you've bought and your asset allocation. Once you've confirmed you still believe in the companies and that you're properly diversified, it's time to spend your days in lockdown doing just about anything but stressing about what the market is doing.