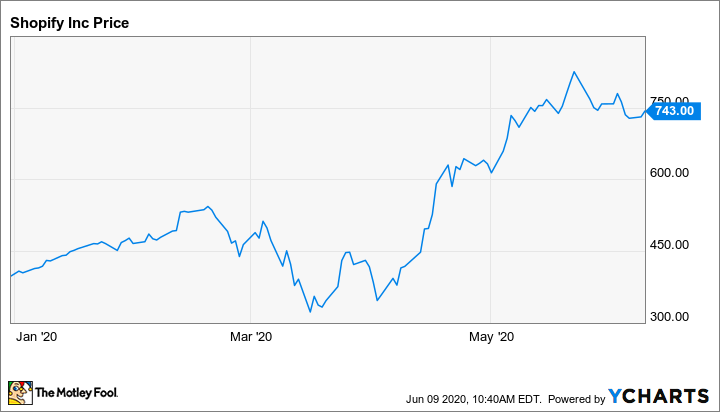

It seems that even a pandemic cannot stop Shopify (SHOP +0.96%) stock for long. Not only did the company recover all of the losses from the sell-off in February and March, but by May, the stock had established a new all-time high.

Shopify benefits from a trend toward e-commerce that will only expand in the years to come. However, given its valuation, investors should avoid this stock now.

Shopify and its valuation

Shopify gives small businesses an easy-to-use platform. It allows them to sell online without the involvement of a bigger player like Amazon or Etsy. Admittedly, the growth Shopify is expected to experience could justify a high multiple. Analysts expect earnings growth to come in at 67% for the year. For the next five years, they forecast that those profit increases will average 75% per year. It also helps that the company turned profitable last year.

However, this has taken the price-to-sales (P/S) ratio to about 49.2. That dramatically exceeds the company's five-year average P/S ratio of 19.1. Additionally, it comes in well ahead of the S&P 500 average P/S ratio of just under 2.3.

The growth of Shopify has helped to drive valuation. In the previous quarter, revenue increased by 47% on a year-over-year basis. This notably exceeds the compound annual growth rate (CAGR) of the e-commerce industry, estimated at 14.7% according to Grandview Research.

This may help to explain why Shopify established new record highs as it recovered from the COVID-19-related sell-off. On May 26, it reached an all-time high of $844 per share.

At its peak, Shopify surged past the Royal Bank of Canada to become Canada's most valuable company. Shopify has since pulled back and one has to wonder if that could point to the Shopify bubble beginning to burst?

Shopify reported revenue of $470 million in the quarter ended in March. For Royal Bank of Canada, net income stood at 1.481 billion Canadian dollars ($1.11 billion) in the quarter ended in April. That also comes after the bank saw a 54% drop in earnings. The 10.333 billion Canadian dollars ($7.72 billion) in bank revenue represents a decline from last year, but also means that the Royal Bank of Canada brings in more than 16 times as much revenue as Shopify.

Moreover, Shopify stock trades at the $750-per-share level as of the time of this writing. With earnings of $0.50 per share forecast for the year, that would imply a forward P/E ratio of approximately 1,500. At the aforementioned 75% average annual profit growth rate, that implies a price-to-earnings-to-growth (PEG) ratio of about 20. A PEG ratio above one is often a sign of overvaluation. Hence, even if Shopify can eventually justify its price, seeing the fundamentals catch up to the stock price will probably take years.

Image source: Getty Images

Competition is also a factor

The company's competitive moat does not appear as robust as its valuation might imply. Yes, the company benefits from name recognition. It also gives small businesses an easy-to-use platform.

However, numerous competitors offer alternative platforms. An analysis by dropshipping company Oberlo found that Shopify was the most popular choice among independent e-commerce platforms. Oberlo, which helps stores add products to their online storefront, estimated that Shopify made up only about 31% of the U.S. market. WooCommerce came in second at 16%, while Adobe's Magento was far behind at 3% according to the study.

Still, in 2019, that market lead amounted to $61.1 billion in gross merchandise volume (total dollar value of orders processed) for Shopify out of a global e-commerce market estimated at $9.09 trillion in 2019. For now, Shopify makes up only a tiny fraction of this industry and if a competitor invents a more appealing platform, the predicted gains may never materialize.

Shopify is a bubble

Shopify will likely remain the most popular e-commerce platform for those who want to sell outside of the Amazon or Etsy ecosystems. However, given its valuation, investors should stay away.

Admittedly, with Shopify stock already so expensive, predicting what it will do in the short term has become difficult. The fact that it briefly became Canada's largest company may or may not serve as a wake-up call. Time will tell whether that level becomes the peak, or if it continues moving higher.

However, at this point, buying Shopify stock is a bet purely on momentum. While it is a bet investors could win, they could also find themselves facing losses for years if the price of Shopify stock collapses. At Shopify's current valuation, the only safe bet is not to bet at all.