There are two main investment sectors that are currently at risk for dividend cuts in the wake of the recent economic downturn and recession.

The first one is largely for political reasons, and that is the banks and other financial institutions. The second one is the real estate investment trust (REIT) sector, and more specifically the mall REITs. The mall REITs were already in a precarious place, even before the coronavirus pandemic closed most of their tenants. As a result, these two sectors contain stocks that are some of the most likely to enact dividend cuts.

Financial institutions take action and hope for sustained recovery

While many of the banks have voluntarily agreed to suspend stock buybacks for the time being, that hasn't enough for politicians worried that they might have to enact politically unpopular bailout actions or for environmental, social, and governance (ESG) funds worried about investing in companies that aren't operating responsibly and in the best interests of the country rather than just in the best interests of their investors.

Image source: Getty Images.

Most big European banks have suspended dividends until Oct. 1, and there continues to be a drumbeat for U.S. banks to follow suit. Luckily for the banks, they entered the coronavirus pandemic with strong balance sheets, so they are in a much better position to weather a recession than they were in 2008-09. But the banks could be in trouble if there is a substantial increase in coronavirus cases that spook the markets further. If state and federal governments that have started allowing much of the country to start reopening for business are forced to reimpose any sort of national lockdown, the banks may have to take further steps to preserve capital, further hurting their earnings.

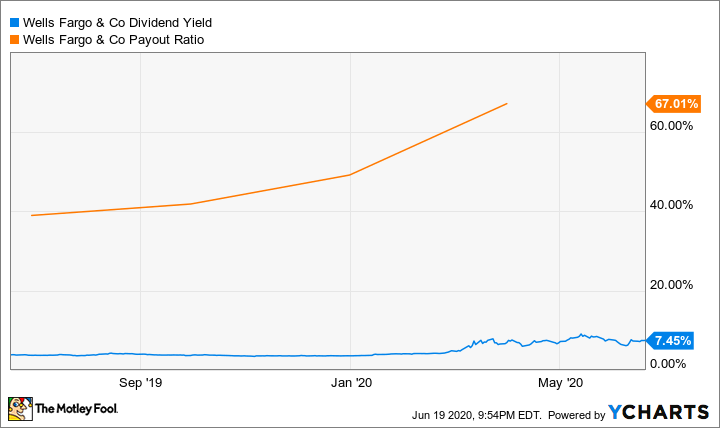

Wells Fargo's (WFC 1.42%) dividend yield and payout ratio have increased markedly over the past year. Wells Fargo is a bit of a special case, given that it is still working through some prior scandals and will still be a political target. If you look at the payout ratio and dividend yield over the past 25 years, the last time these financial metrics were in the same area was the 2008-09 financial crisis.

While some of Wells Fargo's payout ratio is due to the big regulatory-driven writedowns at the beginning of the year, not all of the big banks have moved so dramatically. JPMorgan Chase's payout ratio percentage is in the low 40s, and it has a 3.6% dividend yield. That big yield of 7.5% tells you the market is discounting at least some probability of a cut.

WFC Dividend Yield data by YCharts.

Mall REITs are draining cash

The next stock that is looking dicey is Simon Property Group (SPG 0.54%). The pandemic closed every shopping mall in the U.S. at some point, and many have yet to begin the reopening process. In the first quarter, Simon paid a $2.10 per share dividend on diluted funds from operations (FFO) of $2.78 per share, which works out to a 75% payout ratio compared to 69% in 2019. Simon will have a tough second quarter, and will also be dealing with the failed merger with Taubman Center. While the most likely outcome of Simon pulling out of the $3.6 billion deal to buy Taubman is a renegotiated deal at a lower price, it will be a drain on Simon's cash. Merger agreements are tougher to break than people think, and the chance of Simon being able to simply walk away is not very likely.

Simon's payout ratio and dividend yield graph look a lot like Wells Fargo's at the moment. While pretty much every REIT is experiencing the same thing, Simon has the added headache of the Taubman situation. While the mall REITs entered the pandemic in a difficult situation to begin with, the pandemic is making things much worse. Note that some of the bigger REITs like Realty Income are trading with mid-single-digit percentage yields. The chart below shows Simon's payout ratio based on earnings per share and not FFO per share.

SPG Dividend Yield data by YCharts.

What's an investor to do?

The banks will probably withstand the drumbeat for dividend cuts if the economy keeps on its current open-for-business trajectory. The REITs, on the other hand, are going to be ripe for some dividend cuts.

Every stock in the mortgage REIT sector has cut or eliminated its dividends already. The retail REITs may come to that point, even if we don't have a second wave of the coronavirus. If consumers stay home for fear of getting sick, that could put pressure on these companies to cut their dividends and that is not going to please investors.