When considering stocks for your retirement portfolio, you want reliable companies that can deliver years of success. It's even better when those companies pay dividends. Yet in the uncertain economic environment created by the novel coronavirus pandemic, previously successful companies are now struggling.

The key is finding companies with sustainable business models. These three stocks are great for your IRA. Each possesses strengths that give it the ability to deliver results for years to come, and all three provide steady income streams through their dividends. Let's take a closer look and see if they might be a good fit for your IRA stock portfolio.

Image source: Getty Images.

1. Visa: 0.62% dividend yield

Visa (V +0.31%) is a household name, but that's not the only reason it's a great stock for your IRA. Technology continues to play an expanding role in our society, including in the fintech arena. The fintech market is estimated to grow at a compound annual rate of 22% over the next five years to $305 billion by 2025.

Visa is already well-positioned in the payments space, and it strengthened that position with the impending acquisition of Plaid, a company that created technology to connect digital payment apps to financial institutions. According to Visa, Plaid's network "opens new market opportunities for Visa" and will "enable Visa to work more closely with fintechs through all stages of their development and drive growth in Visa's core business."

Today, that business is doing well even amid the coronavirus pandemic. In Visa's fiscal second quarter, which ended March 31, revenue was up 7% year over year to $5.9 billion. The pandemic creates economic uncertainty, so Visa pulled its full-year guidance (as many other companies have done), but its track record of consistent revenue growth is likely to continue in a post-pandemic environment where cashless payments become more common.

Data by YCharts.

Visa also exited the second quarter with a strong balance sheet. Its total assets of $72.8 billion dwarfed total liabilities of $38.2 billion, and the company had $9.7 billion in cash and equivalents, up from the previous quarter's $7.8 billion. Combined with a low dividend payout ratio of 22%, investors are assured Visa can continue funding its dividend, making it a solid stock for your retirement.

2. McDonald's: 2.74% dividend yield

One of the companies hit hard by the pandemic is McDonald's (MCD +1.24%). Despite this, McDonald's remains an attractive investment because of its business model: Of the nearly 39,000 McDonald's restaurants at the end of Q1, 93% were franchised.

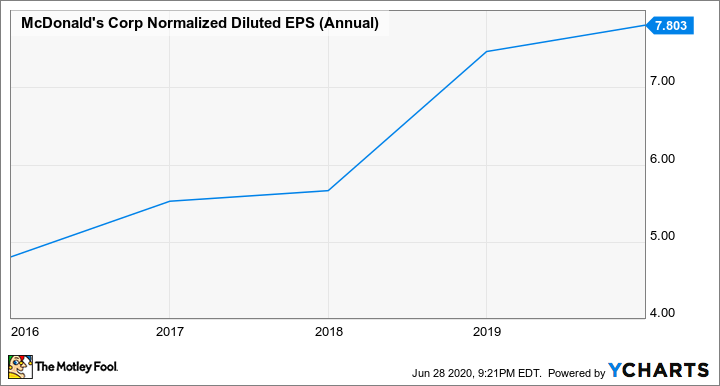

The company generates revenue by collecting fees and rent from the franchise owners, without incurring the costs of running these restaurants. This model helped McDonald's consistently increase earnings per share (EPS) over time.

Data by YCharts.

This trend may change in 2020 due to the pandemic. McDonald's saw global comparable restaurant sales drop 3.4% and total revenue decreased by 6% year over year in the first quarter as some restaurants were forced to temporarily close. The situation started improving in May when restaurants began to reopen, and as of mid-June, 95% of global restaurants were open.

Post-pandemic, the company's business model should allow McDonald's to remain resilient. It ended Q1 with $5.4 billion in cash and equivalents, and it generated free cash flow of $5.7 billion in 2019, a 36% year-over-year increase.

The company has also raised its dividend for 43 consecutive years. A payout ratio of 65% indicates McDonald's can maintain its dividend even amid the pandemic.

3. Microsoft: 1.02% dividend yield

What makes Microsoft (MSFT +0.81%) a great retirement stock is its position in the growing cloud computing space. Research firm Gartner forecasts overall total market services revenue to rise from $196.7 billion in 2018 to $354.6 billion in 2022.

Microsoft has been reaping the rewards of this growth. In its fiscal third quarter, which ended March 31, Microsoft generated $35 billion in revenue, a 15% year-over-year increase. Its Azure cloud product grew an impressive 59% in year-over-year revenue.

The company also transitioned its iconic Office software to a cloud-based subscription model called software-as-a-service (SaaS), which allows Microsoft to generate recurring revenue. The move led to double-digit year-over-year Q3 revenue growth across its cloud-based software products.

That's not all. Microsoft continues to strengthen its Azure offering. It recently announced the acquisition of CyberX, a security company, as it deepens its push into the Internet of Things (IoT), another multi-billion-dollar technology trend.

The company's efforts translated into steadily increasing revenue over the past three years, and it's poised for more long-term growth given its cloud and IoT investments. A low dividend payout ratio of 34% ensures the dividend will remain intact. Coupled with its solid revenue growth, Microsoft is a sound retirement investment.