What happened

Shares of Ultra Clean Holdings (UCTT 8.02%) popped on Thursday after the company reported revenue growth and profits exceeding expectations. The stock was up 23% as of 2:30 p.m. EDT, and is now beating the market in 2020.

Beating the market is what this sleepy semiconductor company has done over the past five years. Ultra Clean Holdings was ranked No. 11 on Fortune's 100 Fastest-Growing Companies in 2018, a list that looks back three years, acknowledging its outperformance.

So what

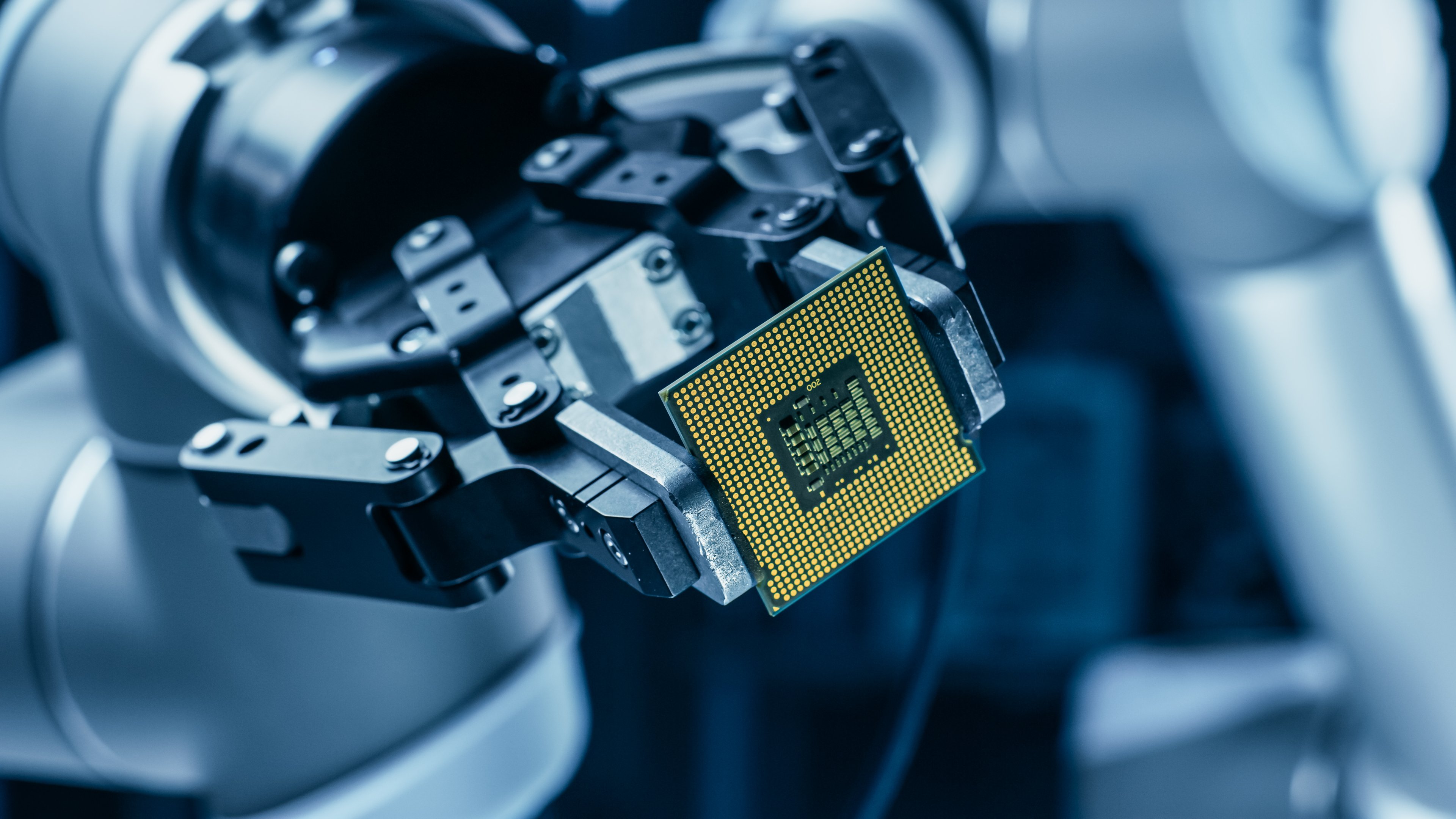

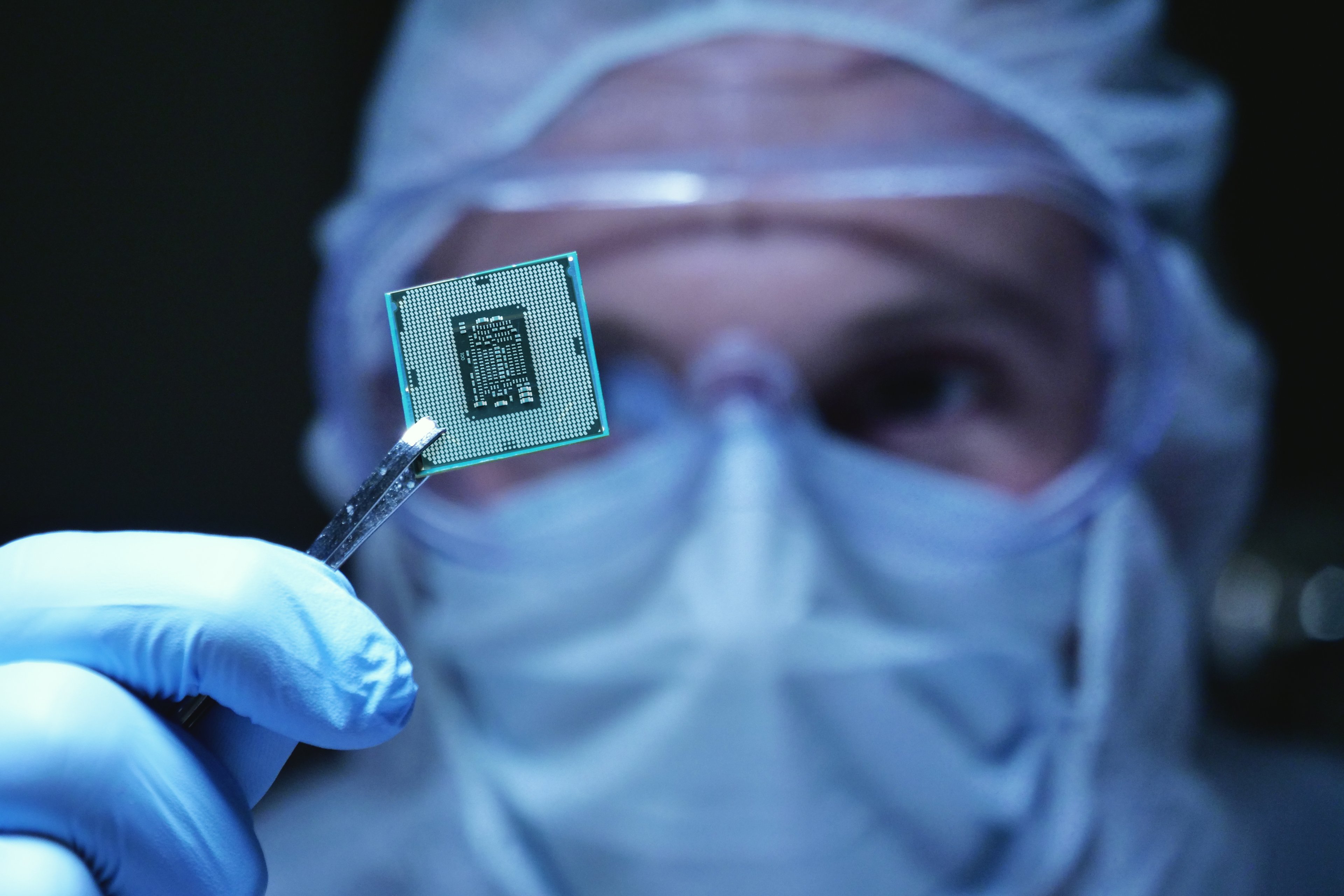

There are many layers to the semiconductor industry, including manufacturing. Ultra Clean Holdings provides critical subsystems (parts) to semiconductor manufacturing equipment companies like Lam Research and Applied Materials. These subsystems, as the company's name implies, help keep everything clean -- crucial when manufacturing sensitive microchips.

Ultra Clean Holdings has operations in China and was negatively impacted by the coronavirus in the first quarter. At the time, the company provided second-quarter revenue guidance of $290 million to $330 million, and earnings per share (EPS) guidance of $0.40 to $0.56. However, Q2 revenue exceeded guidance; it generated $345 million. And EPS was toward the high end of guidance at $0.52 per diluted share.

Ultra Clean Holdings benefited from a quick recovery in manufacturing after an initial coronavirus shutdown.

Image source: Getty Images.

Now what

Next quarter, Ultra Clean Holdings expects to generate revenue between $320 million and $360 million and EPS between $0.56 and $0.72. Those are wide ranges, and reflect the ongoing uncertainty from COVID-19. However, even the low end of guidance reflects a marked improvement from the third quarter of last year. In Q3 of 2019, it reported revenue of $254 million and EPS of $0.01.

Ultra Clean Holdings shareholders should be aware of a risk that isn't unique among critical subsystem companies. A full 67% of the company's revenue comes from just two customers: Lam Research and Applied Materials. Granted, these are enormous customers that account for a lot of market share, and it's not as dependent on them now as in years past. However, losing either customer to a competitor would be devastating.

But that doesn't appear to be an imminent possibility. In fact, Ultra Clean Holdings is expanding. Along with today's earnings release, the company announced it's expanding into Malaysia. This facility could increase its overall capacity by 50% in the long run and places it in close proximity to customers. The move bodes well for Ultra Clean Holdings' future prospects.