What happened

Silver and gold miner Pan American Silver (PAAS +5.76%) fell as much as 12% on Aug. 11. The stock started the day lower and continued to slide until roughly 12 p.m. EDT, when it was down around 11%. It recovered a few percentage points before starting to fall anew in the early afternoon, resting at around a 12% loss at 2 p.m. What soured investors on the shares was most likely an update from Deutsche Bank.

So what

CEO Michael Steinmann started Pan American Silver's Aug. 6 second-quarter earnings conference call by explaining that "the global COVID-19 pandemic had a significant impact on our operations over the second quarter." Higher precious metals prices helped soften the blow, allowing the company to earn $0.10 per share in the quarter, up from $0.09 in the second quarter of 2019. However, the impact of mine closures resulted in Pan American Silver trimming its full year 2020 silver production guidance by around 40% with gold production pegged to be lower by 15%. With precious metals prices high today, that's not a great outcome.

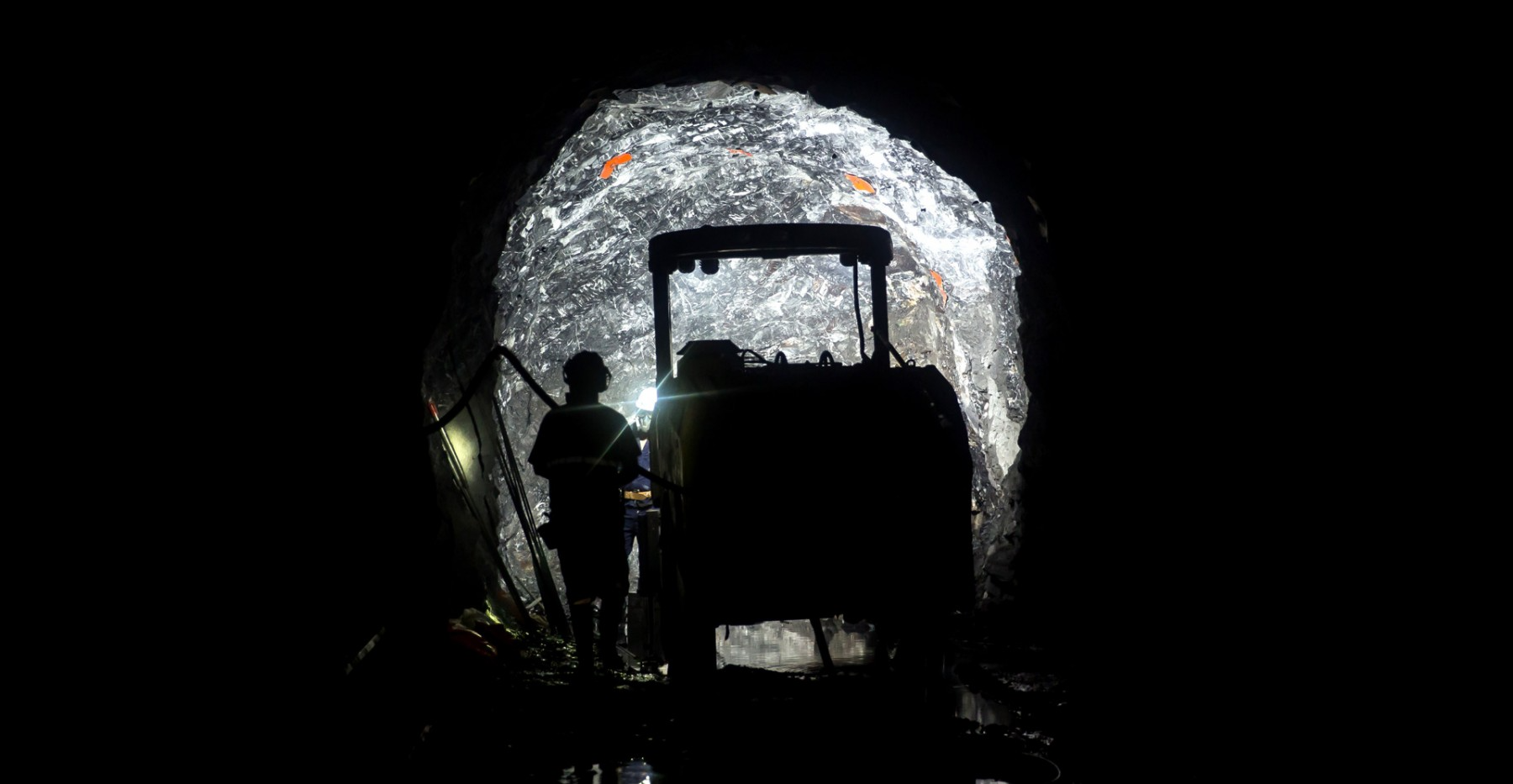

Image source: Getty Images.

It was the production guidance update that prompted Deutsche Bank to shift the precious metals miner from the buy list to the hold list. That said, the move came with an increase in the stock's target price to $34 per share, from the previous level of $28. The stock's swift drop took the shares a couple of dollars below the updated target. The main takeaway, however, is that the impact of COVID-19 on Pan American Silver's business will linger throughout 2020.

Now what

Pan American Silver is facing production headwinds at a time when silver and gold prices are high. That's good because elevated commodity prices will help offset the weaker-than-expected production. However, it's also bad because the company won't be able to take full advantage of the price increases in the often volatile precious metals market. Worse, based on the fact that the company's production guidance change was tied to the impact of COVID-19, any worsening of the pandemic could potentially lead to further mine performance issues.