Coca-Cola (KO 0.55%) is an ideal example of a blue-chip stock. The well-known global brand innovates, and in recent times it has been more focused on diversifying its offerings. It grew organic sales by 6% in 2019, and net income per share by 9%.

The beverage giant is a decades-long top holding of famed investor Warren Buffett's Berkshire Hathaway, which maintains an ownership stake over 9% today. But Coca-Cola isn't the same company it was decades ago. It now has more than 500 brands, with a portfolio that includes water and hydration products, coffee and teas, juices, dairy, plant-based beverages, and energy drinks. Having several different avenues of growth is just one of the reasons why buying shares now could be a good move for your portfolio.

Image source: Getty Images.

Growth drivers

Coca-Cola is aiming to make gains through the trend toward eating healthier. As of 2019, 45% of its beverage portfolio is low-sugar or no-sugar, and 18 of its 20 top brands at least offer variants with those options. In 2019, the company's organic revenue (which excludes currency impacts, acquisitions, or divestitures) grew by between 3% and 13% in its four global geographic regions. In the second quarter of 2020, disruption due to the COVID-19 pandemic caused revenue to drop by 26%, but management said it expects a rebound for the remainder of the year.

Prior to the pandemic, the company was achieving growth in its trademark Coca-Cola brand through offerings including Coca-Cola Zero Sugar, which grew volume at a double-digit percentage rate in 2019. Innocent, a juice and smoothie brand, is also expanding sales.

The company recently announced plans to enter the popular hard seltzer market with an alcoholic version of its Topo Chico sparkling mineral water. It will introduce it in Latin America later this year, then bring it to the U.S. in 2021, where it will compete in the category currently dominated by the White Claw brand and Boston Beer's (SAM -1.95%) Truly Hard Seltzer.

A reliable investment

One likely reason that Buffett has made Coca-Cola one of his "forever" holdings is its reliability. Besides the steady sales of its popular products and the business itself, the company consistently increases its return to shareholders. When it boosted its dividend for a 58th straight year earlier in 2020, it held onto its place not just among the Dividend Aristocrats, but among the even more elite class of the Dividend Kings.

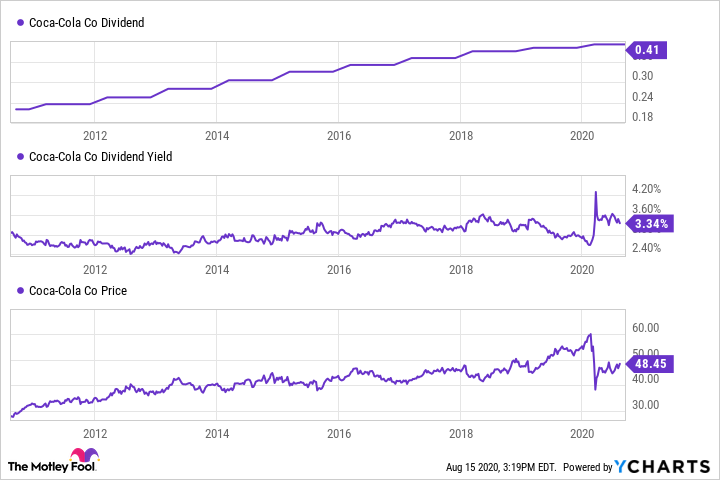

A 10-year look back shows Coca-Cola's consistent dividend growth, and its steady, slowly growing, share price.

KO Dividend data by YCharts

Those long-term views help more clearly illustrate the income opportunity that investors have with Coca Cola due to the pandemic-related disruptions to its business. Its current dividend yield of more than 3.3% is close to its highs of the past decade. Particularly in today's low-interest-rate environment, investors looking for good returns coupled with a low-to-moderate risk to their capital might find Coca-Cola a compelling buy.