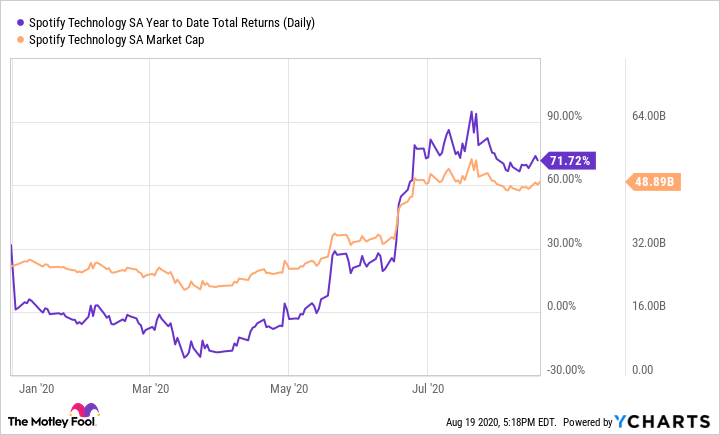

Spotify (SPOT -1.30%) has clearly been deemed a winner of the COVID-19 stay-at-home economy. The stock has been on a torrid run this year, up a whopping 71.7% for 2020 thus far, and receiving a market cap of nearly $50 billion dollars.

At first glance, that may seem like quite a lofty valuation. Spotify's price-to-sales ratio of six times isn't very high; many high-growth software companies sport P/S ratios multiples higher than that.

SPOT Year to Date Total Returns (Daily) data by YCharts

However, unlike many high-growth software companies, Spotify currently sports rather low gross margins. Last quarter, gross margins came in at just 25.4%, and the company recorded an operating loss of $167 million. Revenue growth also hasn't been anything to write home about, coming in at just 13% last quarter, as advertising-related declines weighed on otherwise solid subscription growth of 17%.

Still, investors have bid up the stock this year. This is likely due to two things. One, Spotify continues to rack up monthly active users at a higher rate than revenue. In the recent quarter, MAUs were up 29%, including 27% premium subscriber growth and 31% ad-supported MAU growth. Secondly, investors likely envision higher margins in the future.

The hope isn't totally misplaced, as management has outlined several steps Spotify is taking to boost margins in the years ahead. Over the next five years, investors should keep an eye on these margin-boosting initiatives that will likely make or break Spotify's stock.

Image source:Getty Images.

Going exclusive on the podcast front

It's no secret that Spotify is now paying up big to get exclusivity for leading podcasts. The most prominent example is Spotify's recent $100 million-plus multiyear licensing deal with Joe Rogan's podcast, which will hit Spotify exclusively next month. Spotify has also bought entire podcast companies in the recent past, including Bill Simmons' The Ringer. Spotify followed these up last quarter with deals with AT&T's subsidiaries Warner Bros. and DC Comics for exclusive narrative scripted podcasts going forward.

In the music streaming arena, Spotify is up against the FAANG companies, which are some of the biggest technology giants in the world. Spotify therefore needs to find ways to differentiate itself. Exclusive podcasts are certainly an answer, and the investments are beginning to yield results. In the second quarter, 21% of MAUs listened to podcasts, up from 19% in the first quarter. According to management, podcast consumption is up over 100% year over year.

If podcasts become successful on Spotify, they could help boost subscribers, retention, and ad revenue.

Speaking of ad revenue...

Management sees a much brighter future for its ad revenue, which only made up 7% of overall revenue last quarter at $131 million. However, the global ad market across radio, podcasts, and streaming music is much bigger, and forecast to reach roughly $50 billion by 2022, according to PricewaterhouseCoopers.

Certainly, new podcasts will help, as popular hosts read ads in the midst of their shows. In addition, Spotify has recently rolled out its new strategic ad insertion (SAI) technology for its podcasts in January. SAI offers advertisers more targeted in-podcast advertising based on a person's musical tastes and demographic data. Another feature puts an embedded link within a podcast to an advertiser's website with promo code already loaded, so that it only takes one touch or click to go to the offer.

Look for these new tools to gain traction and boost Spotify's advertising revenue and profitability, especially as the overall ad market recovers.

A new marketplace for labels and artists

High licensing fees are among the highest costs Spotify pays to big music labels, which wield considerable power. However, Spotify is lightening its load by offering labels and artists the chance to promote their own music on the platform. Last year, the company launched its "two-sided-marketplace," which allows artists of all types to promote their music to listeners on Spotify's massive distribution platform.

Basically, this is a hyperefficient way for artists and labels to market their latest tracks to consumers. On the recent conference call, CEO Daniel Ek noted that marketing and promotion are the largest costs to labels these days. Therefore, the more effective Spotify's in app-promotion tools are, the more labels benefit, and the more Spotify can increase its margins. Management noted that the marketplace was used not just by up-and-coming artists, but also bigger names such as John Legend, The 1975, and Lady Gaga in recent months. Marketplace revenue, which is actually recorded as a decrease in licensing costs, apparently benefited last year's gross margin by about $30 million, and management expects a 50% greater uplift from the marketplace this year.

What about ARPUs?

Average revenue per user is another area that can help Spotify increase margins. Spotify's average ARPU has been trending down as it expands to more developing nations, with many users opting for family plans where the subscription cost is spread over several family members.

On the recent earnings release, management was a bit cagey on the potential to improve ARPUs in the near term, only saying, "Our expectation is that ARPU will moderate in terms of declines and start to move higher. But, for now, it's really been about market share gains over near-term profitability."

I expect much of the ARPU gains in the future will come from advertising revenue improvement due to the aforementioned ad tools, as Spotify still operates within a highly competitive environment for streaming subscription prices. Nevertheless, ARPU is definitely a metric shareholders should watch over the next five years, as eventually MAU growth will slow due to the law of large numbers.