Luxury jewelry maker Tiffany & Co. has never held a sale in its corporate history. Demand for the company's premium wares and the iconic little blue box has been enough to maintain high prices -- and profit margins -- for almost 200 years.

Similarly, great companies rarely go on sale. But unlike luxury jewelry, their stock prices sometimes fall in concert with the overall market. As traders indiscriminately sell to avoid further losses, they sacrifice ownership stakes in wonderful businesses for the comfort of cash. If you are an investor with a multiyear time horizon, this is the perfect time to buy stock in the most outstanding companies.

Image source: Getty Images

A good way to identify these resilient businesses is to look for consistent sales growth and strong market position. Companies with these attributes tend to strengthen during weak economic environments; they invest in new products, hire the best people away from competitors, and build stronger relationships with customers. The next time the market has a big drop, and the best companies are being sold along with weaker ones, these three healthcare-related companies should be great bargains.

1. Intuitive Surgical

Although the pandemic-induced reduction in elective procedures led to a 22% fall in sales in the most recently reported quarter, Intuitive Surgical (ISRG -2.66%) has consistently grown revenue and expanded the list of procedures available for its robot-assisted surgeries over the past decade. It's done this in a time of historic uncertainty in healthcare regulation and rapid consolidation in hospital systems -- both issues that would seem likely to make customers balk at spending millions of dollars on the company's da Vinci robots.

This growth is partly thanks to a sales mix that heavily favors recurring items. In fact, only 30% of the company's sales are da Vinci systems; the bulk is made up of of instruments, accessories, and services. Additionally, the company is globally diversified, with 30% of sales coming from outside the U.S. As elective procedures rebound in the U.S., Intuitive Surgical is poised to regain the strength it showed coming into 2020. Robotic-assisted surgery will continue to grow, and Intuitive looks to be the prime beneficiary, as it boasts more than 80% market share.

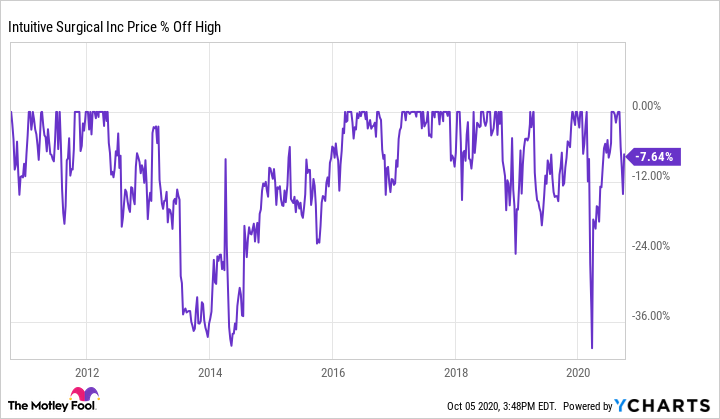

The stock has had precipitous falls in the past, only to recover on the back of strong revenue growth; it typically stays within 15% of its all-time high. Patient investors should take advantage the next time shares in the company dip to that level.

ISRG Revenue (Annual) data by YCharts.

ISRG share-price data by YCharts.

2. Illumina

Illumina (ILMN -0.80%), a maker of genome-sequencing machines, also dominates its market. Over 90% of the world's genome-sequencing data is generated using Illumina instruments. Like Intuitive Surgical, the company entrenches itself in customer operations by selling technologically unrivaled equipment, then generating significant profit from recurring sales of consumables. In Illumina's case, these make up about 18% of sales.

The company recently announced the $8 billion acquisition of GRAIL, a liquid biopsy company using fragments of cancer DNA to create screening tools for early detection. GRAIL was spun out of Illumina in 2016, and bringing it back in opens up a broader market opportunity thanks to the merit demonstrated by its technology, which is now being reimbursed by insurance companies and Medicare. There is no doubt the future of healthcare will be more personalized, which may include leveraging our genomes to better understand, detect, and treat diseases. It's hard to imagine Illumina anywhere but at at the forefront of that trend in the coming decade.

In another similarity with Intuitive Surgical, the stock has experienced a few sharp declines over the years but revenue has continued to grow, eventually resulting in a share-price recovery to new all-time highs. With little foreseeable competition in a rapidly expanding market, investors could use any sell-off of 30% or more to build a position, as these have historically been excellent opportunities.

ILMN Revenue (Annual) data by YCharts.

ILMN share-price data by YCharts.

3. Veeva Systems

Veeva Systems (VEEV -2.05%) is a provider of cloud software to the life-sciences industry. The company is organized into two segments with roughly equal revenue: Veeva Commercial Cloud, a customer relationship management (CRM) platform, and Veeva Vault, a content and data manager. Veeva's solutions help customers oversee everything from clinical trials and regulatory oversight to customer communication and shop-floor efficiency.

Its CRM business has become the industry standard, with about 80% market share among global pharmaceutical companies. The data management business, though not as dominant yet, has the advantage of competing against legacy offerings that can't match the ease of use and functionality of the cloud.

As artificial intelligence has gained widespread adoption, having a lot of data has become an increasing advantage in every industry. There may be nowhere this is more true than in life sciences and drug development. Veeva's solutions are designed from the ground up to leverage data across its various applications. By automating manual processes, enhancing safety, and improving analysis of adverse events, management is positioning Veeva as a necessity for companies managing scientific product development.

The company is even beginning to creep outside the pharmaceutical industry, developing applications for consumer packaged goods, chemicals, and cosmetics companies. A cloud services company with such value that it has come to dominate one industry and is growing into a larger addressable market sounds like it's in the early innings of a decades-long growth story.

As with Intuitive Surgical and Illumina, even given consistent revenue growth, shares of Veeva will occasionally appear on the market at a discount. In the past few years the stock has quickly rebounded when it has traded more than 20% from its all-time high. When this happens, savvy investors should consider pouncing on the opportunity.

VEEV Revenue (Annual) data by YCharts

VEEV share-price data by YCharts.

Put a ring on it

Given a global population that's living ever longer and the increasing automation of tasks through robotics and artificial intelligence, it doesn't take a crystal ball to realize Intuitive Surgical, Illumina, and Veeva Systems are well-positioned for the future.

Investors often outsmart themselves during a market sell-off by trying to guess which beaten-down companies will survive. This is a little like going on eBay to buy jewelry and guessing which pieces are real. If Tiffany had a sale on diamond rings for the same price as those on eBay, would you need to look any further? Next time a first-rate company is marked down by wild market swings, make the commitment and invest in the best.