Is it better to buy an individual stock or an entire index like the Nasdaq Composite (^IXIC 1.02%)? If you ask different people, you'll invariably receive totally different answers. Candidly, there is no one-size-fits-all response.

Many investors prefer to take big swings at high-growth stocks over settling for index returns. Today, we'll look more closely at the prospects of a high-flying cybersecurity company like CrowdStrike Holdings (CRWD 3.61%) with an eye toward deciding if it's a better pick than the Nasdaq as a whole.

Image source: Getty images.

Reasons to go with the Nasdaq Composite

Investing is a time-consuming endeavor. To give yourself the best chance to succeed, it's imperative to know the ins and outs of every single detail for a stock in question. This ideally takes reading earnings reports and company presentations, as well as frequently monitoring the competitive landscape facing an organization.

Not all of us have the time or the desire to do this, and that's OK! Those of us who want stock market exposure but don't want to devote so much time and energy to investing will find owning an exchange-traded fund (ETF) with all of the Nasdaq's companies to be a great choice.

This gives investors ownership of iconic companies such as Apple, NVIDIA, Tesla, and so many more innovators that are financially thriving today.

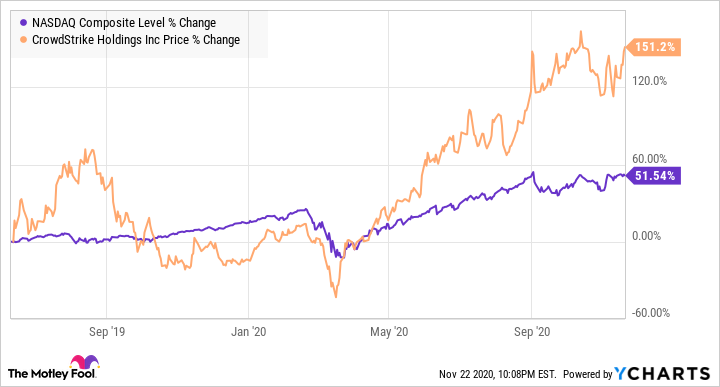

Investing in the entire Nasdaq is less time consuming, and it's also less volatile than investing in a single stock. Our specific stock in question -- CrowdStrike -- has been far more prone to sharp pops and dips in its brief time trading as a public company.

Sure, it feels good when a company you researched and chose to invest in excels, but even the best companies will almost certainly experience sharp pullbacks in share price. This is not fun for anyone to deal with, and for many the emotional distress these pullbacks cause is simply not worth the hassle.

The Nasdaq's broad diversification means no one specific company can drastically harm the index's performance or your investment. While more upside is nice for some, this safety net is also quite appealing.

Reasons to stock-pick with CrowdStrike

Not all companies perform in lockstep with the competition. With more than 3,300 companies traded on the entire Nasdaq, some will surely perform better than others.

For example, CrowdStrike's recent quarter boasted both positive free cash flow and 84% year-over-year revenue growth. The momentum does not appear to be slowing either. Customers for CrowdStrike soared by 91% in its most recent report highlighting continued need for its services. Furthermore, 57% of its users today have adopted at least four of the company's cybersecurity modules, and the company keeps adding more available modules all the time.

Users adding more modules costs CrowdStrike virtually nothing, meaning this accomplishment feeds the company's margin expansion and profitability further. A combination of a growing user base and increasing adoption per user is encouraging to say the least.

The space CrowdStrike operates in is also more attractive than other types of businesses traded on the Nasdaq. CrowdStrike's cybersecurity industry is set to enjoy a brisk 10% compounded annual growth rate (CAGR) through the year 2027, according to Grand View Research.

When looking at the semiconductor industry (another space with several companies traded on the Nasdaq) we find a CAGR of just 4.7% over the same time period. More rapid industry growth is certainly a plus for the players operating in cybersecurity, and stock-picking allows us to take advantage of this discrepancy.

If you have the time, the drive, and the stomach to own individual stocks, sifting through mediocre competition to find the diamonds in the rough can be a rewarding experience. Success will not be enjoyed linearly, and there is far more stress associated with owning an individual stock like CrowdStrike. Still, the upside can be immense for those who want to go down the stock-picking road.

What is right for you

The correct choice for you depends entirely on your specific circumstances. If digging in to a company's fundamentals and accepting incrementally more risk sounds appealing, then picking high-quality stocks is the way to go. For those who favor tranquility and free time, owning the entire Nasdaq is your way forward.