The year 2020 was a pivotal one for Sea Limited (SE -6.21%). The stock flew under most investors' radar after its late 2017 U.S. IPO, but e-commerce demand sent the company's Shopee app into the stratosphere during the pandemic. As a result, with just weeks left in 2020, Sea Limited shares are up nearly 400% on the year -- valuing the company at a market cap of nearly $100 billion.

Sea has made early investors a lot of money, but it's far from too late to climb aboard this millionaire-maker stock if an investor is looking at the ultimate potential at least a few years down the road.

E-commerce is a mind-boggling opportunity

Total global retail purchases are expected to clock in at more than $23 trillion this year and exceed some $26 trillion in 2022 by some estimates as effects of COVID-19 ease. That is a staggering dollar figure to comprehend, and it explains why e-commerce stocks are flying so high this year. Even after over a decade-plus of rapid expansion, digital retail is still a minority share of consumer spending in even the most technologically advanced economies. In emerging markets like Southeast Asia, e-commerce is a single-digit percentage tally of the total. Suffice it to say the opportunity is massive.

Image source: Getty Images.

Speaking of Southeast Asia specifically, that's exactly the geography that Sea calls home. And though this is a large enterprise at this point, Sea and its Shopee app are far from a daily spending tool for the vast majority of the nearly 700 million residents of the region. The same goes for almost equally populous Latin America, the next market Sea is targeting (and where it will duel against the local favorite MercadoLibre (MELI -4.11%)), and India's nearly 1.4 billion people. As big a business as Sea is, the fact remains that digital shopping is still an exception rather than the rule in emerging markets.

That's what has so many investors excited about Sea. Adoption of its online selling and shopping tools has picked up steam this year. In the third quarter of 2020, the gross value of merchandise sold on the company's platform was $9.3 billion -- just over double the value from a year ago, but nonetheless a small figure when the whole pie is measured in trillions. Add in a best-in-class video game development and esports platform that's also doubling in value from a year ago, and it's no wonder optimism is running high. Toss into the mix a digital payments service primarily geared to help the many millions of consumers who don't have a banking relationship -- including a recently awarded full-blown digital banking license in Sea's home country of Singapore -- and it seems the potential for this e-commerce stock is far from spent.

Far from too late in the game for e-commerce

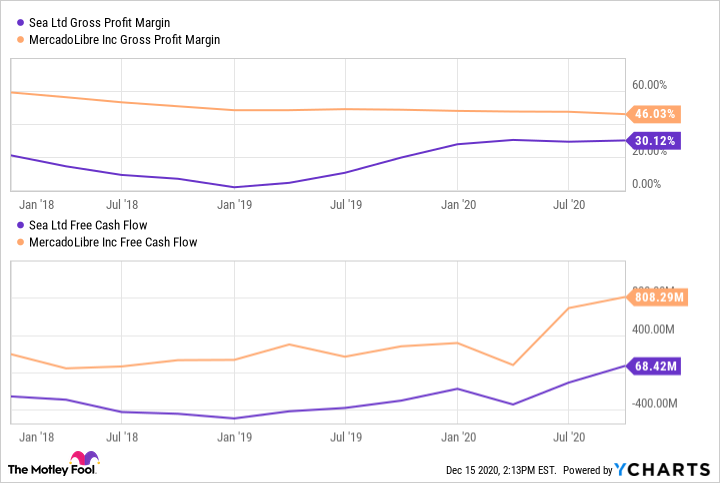

It isn't hard to imagine Sea growing into the "next" Amazon (AMZN -0.10%) or Alibaba (BABA -0.10%) given its trajectory and the massive market opportunities before it -- if such comparisons are your thing. Granted, Sea is a very different type of business at this juncture and has yet to really hit a profitable scale (although profit margins are not static, and Sea's margins are quickly improving). The company is also barely in free cash flow positive territory at just $68 million over the last trailing 12 months. Those metrics trail behind some of its digital commerce peers like MercadoLibre.

Data by YCharts.

I'd also hesitate to say this is simply a repeat opportunity on an Amazon or Alibaba story. Amazon had the benefit of operating in the world's wealthiest economy. Alibaba is potentially a closer approximation to Sea, as mainland China is also an emerging market -- but Alibaba had the benefit of a centrally planned economy where massive funding has been plowed into technology development. Sea doesn't have either of the advantages going for it that Amazon or Alibaba had in the diverse countries in Southeast Asia -- and now Latin America -- that it operates in.

Nevertheless, MercadoLibre has demonstrated how successful e-commerce can be in a similarly fragmented emerging market region like South and Central America. Sea appears to be on a similar trajectory. And with online shopping only increasing in importance during the COVID-19 pandemic, the potential is massive given how few people still use online shopping tools on a daily basis in Sea's home markets. Sea is already a large business, but it has plenty of potential left in the decade ahead and beyond for investors with time to wait patiently.