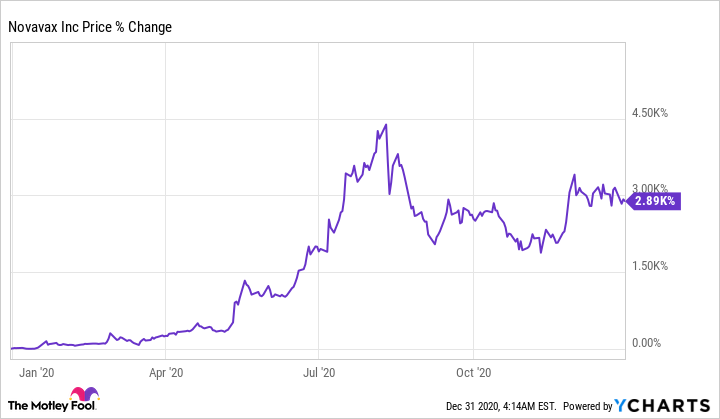

You have to be brave to make 2,900% in a year.

Novavax (NVAX 0.59%) started off 2020 in a deep, dark hole. That's because 2019 was a horrible year for the company. When the biotech reported disappointing results from its phase 3 trial for ResVax, a vaccine for respiratory syncytial virus (RSV) in babies, the market whacked the stock. Shares traded for pennies. Novavax's valuation fell so hard, the company had to do a 1-for-20 reverse split in order to keep trading on the Nasdaq Stock Market. By Dec. 31, 2019, the stock had fallen to $4 a share.

What a difference a year makes!

Image source: Getty Images

At the beginning of the year, Novavax's hopes were riding on NanoFlu, a vaccine for influenza. Success! Not only did it report fantastic data from its phase 3 flu trial, but simultaneously the small biotech emerged as one of the leaders in the race to vaccinate the world against a new threat, COVID-19.

The small biotech received almost $2 billion in funding from government and nonprofit sources. And then Novavax reported positive data from an early trial for its COVID-19 vaccine. This development sent shares soaring incredibly high.

Now it's December 2020. Investors are waiting on phase 3 trial results from the coronavirus vaccine. Positive data will send Novavax shares soaring even higher, while any bad news will crash the stock.

And yet long-term shareholders can actually relax. Novavax is now flush with cash, and Food and Drug Administration approval for its flu vaccine is highly likely. So investors have a nice safety net if the coronavirus vaccine disappoints, while the potential upside is incredible.