Investors had high hopes for Bed Bath & Beyond's (BBBY) third-quarter earnings report. While the specialty retailer has been struggling with weak sales trends, management's latest restructuring plan delivered improving results last quarter. The chain also seemed to turn the corner on growth thanks to surging demand in some of its key home furnishing niches.

This past week, Bed Bath & Beyond confirmed that positive momentum with several key growth and financial wins. But the business still has a long way to go before investors can call this a successful rebound story.

Let's dive right in.

Image source: Getty Images.

Sales are still shrinking

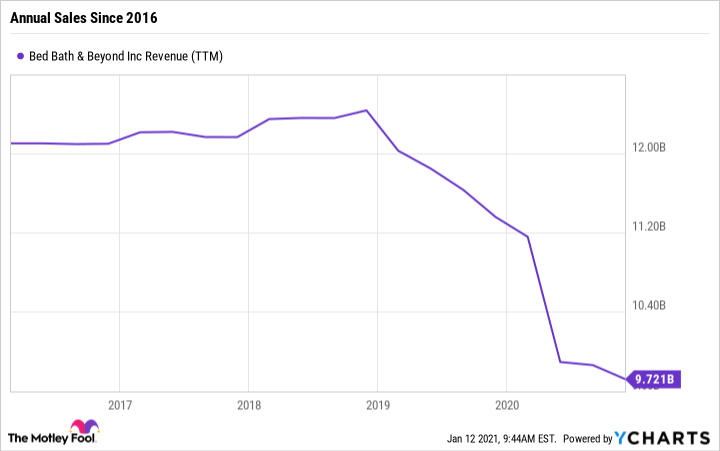

Bed Bath & Beyond executives celebrated the fact that comparable-store sales rose 2%, the second straight quarter of growth in that metric. The chain did capitalize on the surging demand for home supplies and furnishings. The prior quarter's increase, meanwhile, was the first time the chain had expanded sales since late 2016.

BBBY Revenue (TTM) data by YCharts. TTM = trailing 12 months.

But a closer look at growth suggests investors shouldn't get too excited about that result. Sales gains slowed significantly since the 6% boost Bed Bath & Beyond notched in the summer months, for example. And the 2% recent comps uptick doesn't factor in store closures or the brands that the company has recently sold.

Overall sales fell 5% to $2.6 billion. Executives said there were some big pressures on revenue, including declining customer traffic and COVID-19 related shipping disruptions.

Profitability is rising

The news was better on the financial front, where Bed Bath & Beyond made progress at boosting efficiency. Gross profit margin jumped thanks to higher prices in popular categories like home organization and kitchen food preparation. Expenses fell, too, which would have put the business in positive profit territory this quarter if it weren't for a few large, one-time charges.

Cash flow was solidly positive at $244 million, meaning the retailer was free to direct resources toward paying down debt. Still, management spent more on stock repurchases over the last three months and signaled accelerated buybacks to come.

Looking ahead

Bed Bath & Beyond issued a conservative outlook for the fourth quarter while citing major traffic declines during key shopping days like Black Friday. Overall revenue should fall by the low double digits, executives said.

Looking further out, the chain is targeting sales between $8 billion and $8.2 billion next year compared to over $11 billion in fiscal 2019. The business should be much stronger financially at that point, with more cash, lower expenses, and a slimmer fixed-cost profile.

Booming demand in home furnishing niches during the pandemic has helped Bed Bath & Beyond navigate a soft landing as it completed its portfolio transformation. Now it's up to the company to show that it can attract shoppers in a competitive industry. Until it does, investors might want to avoid buying the retailer's stock while they look for a clear path back to sustainable sales growth.