The stock market hit a new all-time high on Wednesday as President Joe Biden took the oath of office. The S&P 500 index is now up more than 42% since the start of 2018. The stock price for several big-name companies has more than doubled from March 2020 lows. Many others have posted even bigger gains.

All those gains have made it harder to find bargain stocks to invest in. But there are still some to be found if you know where to look.

Investors looking for stock bargains could do well with United Parcel Service (UPS -1.16%), Johnson & Johnson (JNJ 0.24%), and Clorox (CLX 0.16%). Here's what makes these large-cap dividend stocks a great value right now.

Image source: Getty Images.

1. UPS

United Parcel Service has been one of the least talked about winners of 2020. Along with its rival, FedEx, the two package delivery stocks benefited from a surge in e-commerce and shipping. Sure, folks chose to shop more online than in-store. But people also shopped more in general.

Shockingly enough, consumer spending rose during 2020, savings increased, and household debt decreased for the simple fact that people spent less money on vacations and experiences. Much of the money that would have been spent on airfare, food, and entertainment was instead spent on things like home goods, athleisure clothing, and Peloton bikes. And UPS can ship all that and more.

UPS's earnings benefited from the e-commerce spike. But UPS expects the trend to last for years to come. In fact, it made long-term investments into e-commerce in 2019 by expanding its fleet and shipping offerings and partnering with online platforms and payment providers. It also has a lot more going for it than just e-commerce, like its growing healthcare business, international segment, and rising revenue from small and medium-sized businesses. In sum, UPS is in its best position ever. The stock also sports a 2.6% dividend yield and consistent dividend growth.

UPS Dividend data by YCharts

2. Johnson & Johnson

A couple of months ago, it was Pfizer and Moderna that got serious investor attention with their COVID-19 vaccine approvals. Soon it will be Johnson & Johnson (J&J). J&J has been in its phase 3 trial of its COVID-19 vaccine since September. But just last week, the New England Journal of Medicine published early results that suggested a favorable outcome. J&J's one-dose vaccine gave participants an immune response that lasted for at least 71 days (the time between when the vaccine was taken and when the study was concluded). J&J's chief scientist had previously announced that the U.S. could authorize special emergency approval of the company's vaccine by February. That timeline is now looking more and more likely.

J&J is now the latest "vaccine stock." And there's an argument that it could be the best coronavirus vaccine stock. J&J's vaccine candidate has advantages over existing vaccines, namely that it requires only a single dose. Pfizer's and Moderna's vaccines require two doses at intervals of 21 days and 28 days, respectively. Another hassle is that users must get their second shot from the same brand as their first shot, which can create logistics problems.

Despite its progress, it's probably a bad idea to buy stock in the company solely for its COVID-19 vaccine. After all, J&J is a $425 billion company with more than 50% higher sales than Pfizer. COVID-19 vaccine sales are inherently going to have less of an effect on a diversified conglomerate like J&J than on a more pure-play company like Moderna.

Rather, the vaccine should be seen as just another product that fits well into the company's broad range of healthcare solutions. J&J is one of the safest ways to invest in a vaccine stock while also collecting a rock-solid dividend. The company has increased its dividend for 58 consecutive years, earning it a spot on the very select list of Dividend Kings. With a yield of 2.5%, J&J is also an ideal stock for building retirement wealth.

3. Clorox

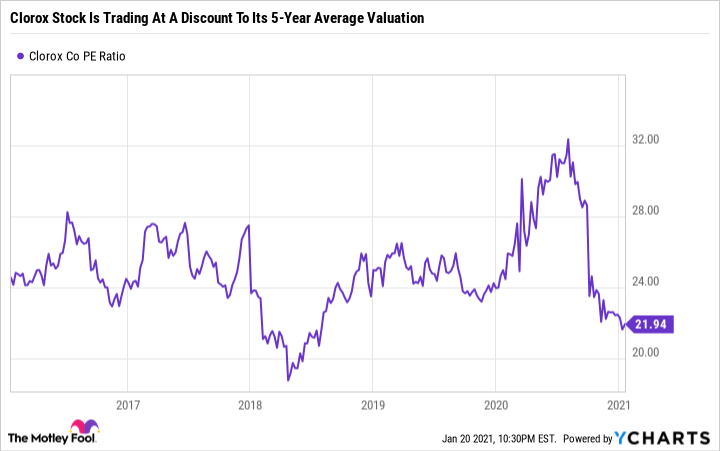

After an initial surge, shares of Clorox are now trending lower as Wall Street loses interest in the consumer staple giant. The sell-off has pushed Clorox's dividend yield back up to an attractive 2.3%. There's no denying that Clorox's sales benefited from increased demand for cleaning products like bleach and disinfecting wipes. And those tailwinds could very well result in record annual earnings for the company. But management expects that 2021 could be an even better year than 2020, as Clorox implements cost-saving measures and continues to grow organically. There could also be behavioral shifts toward germ prevention that last for years after the majority of the population is vaccinated.

CLX PE Ratio data by YCharts

Vaccine or not, Clorox could be a good bargain stock to buy for its recession-resilience, balanced portfolio, and stable and growing dividend. Like J&J and UPS, Clorox has a long streak of dividend raises. The company is a tenured veteran on the list of Dividend Aristocrats. Although not as impressive as Dividend Kings, Dividend Aristocrats are members of the S&P 500 that have raised their annual dividend for at least 25 consecutive years.

Excellent long-term buys

UPS, J&J, and Clorox have all been affected by the COVID-19 pandemic in different ways. UPS is posting record numbers as e-commerce and international sales growth drive its performance. J&J is Wall Street's latest vaccine stock. And Clorox is now selling off because the vaccine could stunt its sales growth in 2021. Despite these short-term movements, all three companies look to be a bargain based on their long-term growth potential and attractive dividend payments. It's easy to get caught up in the noise -- especially in today's market. Large mature businesses whose track records are charted in decades, not days, can be some of the best investments for value and dividend investors alike.