What happened

Shares of Gevo (GEVO 3.92%) continued to soar last month as the renewable fuel company gained on optimism about the Biden administration's green energy policies and as it took steps forward in its new Net-Zero 1 project in South Dakota.

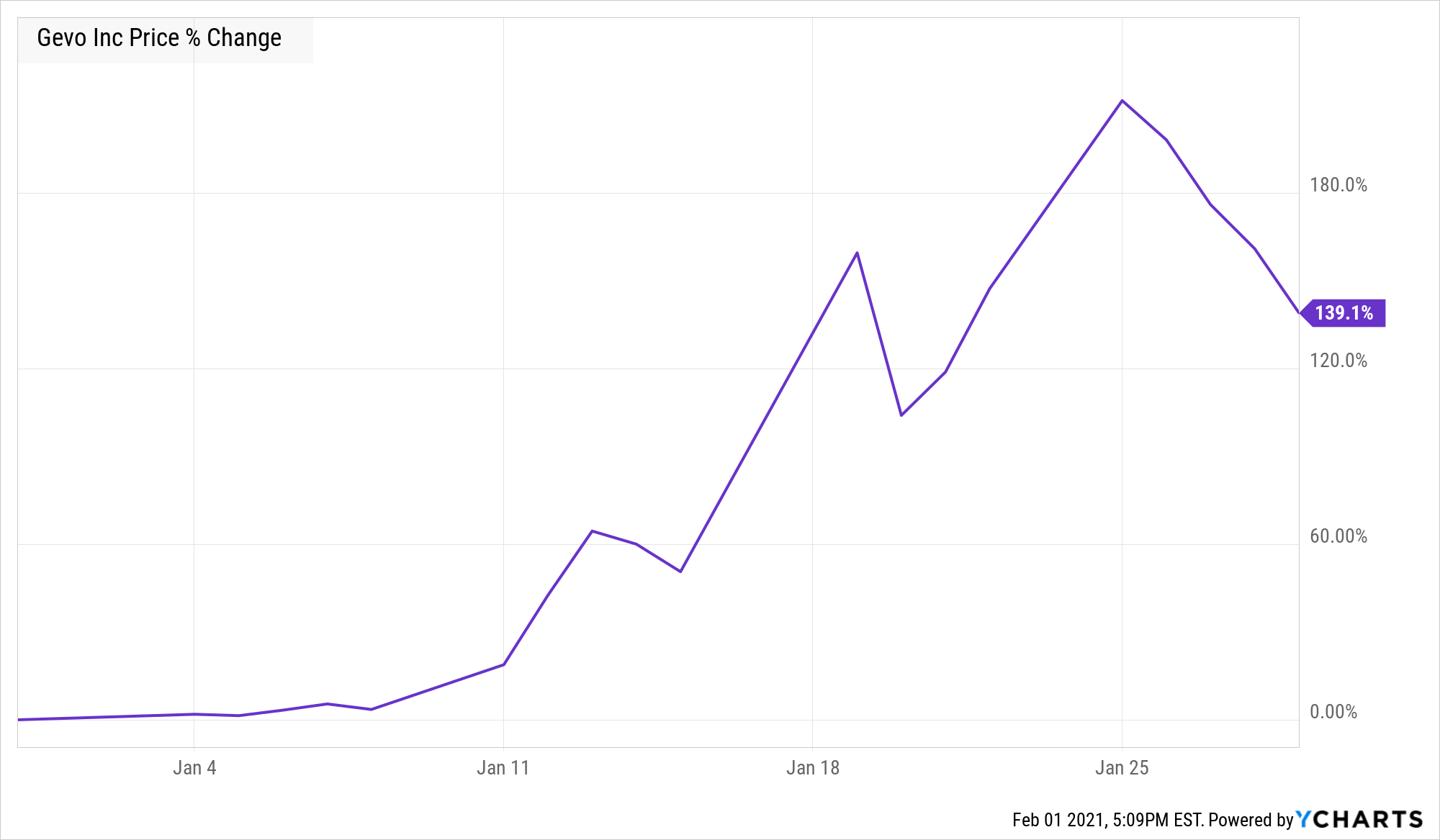

According to data from S&P Global Market Intelligence, the stock jumped 139% last month, popping on several different occasions. The chart below shows the stock's trajectory for the month.

So what

Following a breakout in December after announcing the new project in South Dakota, Gevo shares continued to gain last month. The stock first popped in January, gaining 15% on Jan. 11 after the company unveiled the new Net-Zero concept. In a press release, the company said the project would convert renewable energy sources into conventional liquid fuel products like gasoline and jet fuel. The announcement was not exactly new, as the company had made similar comments when it announced the land purchase in December. Still, the branding of the South Dakota project as Net-Zero 1 seemed to excite investors and indicated management is thinking big.

Image source: Gevo.

The stock continued to rally over the next two days, adding 59% in just a three-day span. On Jan. 19, it surged again, climbing 72% after the Biden administration named Gevo co-founder Frances Arnold to the President's Council of Advisors on Science and Technology. Though Arnold no longer holds a position with Gevo, her new role is a credit to the company and gives it a direct channel to the president.

Shares pulled back after that surge, but then gained the following week as it closed a $350 million stock offering, giving it adequate liquidity to fund Net-Zero 1.

Now what

While Gevo's technology certainly sounds promising, investors should be aware that the company was founded in 2005 and has consistently struggled as a publicly traded company, diluting early shareholders significantly after its IPO in 2011. Through the first three quarters of 2020, it brought in just $5 million in revenue, though its market cap is now near $2 billion.

In other words, high expectations are now baked into the stock, and investors seemed unsure of how to interpret the most recent business update last week, which implied that the construction on Net-Zero 1 would not begin until 2022 at the earliest. If the technology takes off, this renewable energy stock certainly looks like a winner, but it's a risky play at the current price.