Growth stocks are all the rage on the market right now, and that means a lot of value stocks have been overlooked by investors. Long-term, this could provide some opportunities for investors who are looking for less risky and more value-oriented stocks.

Value can be measured in a number of ways, but for my top value stocks I was looking for companies with profitable operations that trade at reasonable price to earnings multiples and have options for growth over the next decade. Given that criteria, General Motors (GM -0.81%), Verizon (VZ -0.91%), and Visa (V -0.86%) made the top of my list.

Image source: Getty Images.

General Motors

Traditional auto stocks have been overlooked over the last few years as investors have become enamored with anything related to electric vehicles. Even companies without revenue are getting multi-billion dollar valuations in today's market. That may make GM's large and profitable auto business downright boring -- but long-term investors should remember that the stock is cheap and offers potentially high growth over the next decade.

To start examining how cheap GM's stock is, let's pull out the asset I'm most excited about -- the company's stake in Cruise, which I'll discuss below. Based on a recent $2 billion fundraising round, GM's stake in Cruise is worth $23.4 billion, and is growing rapidly as the company prepares to launch a fully autonomous ride sharing business. With that in mind, GM's market cap excluding Cruise is only $53.9 billion.

GM Market Cap data by YCharts

That puts the adjusted price to earnings multiple at about 16. If we look at analyst estimates for $5.89 per share in earnings in 2021, shares trade for just 6.4 times 2021 estimates after pulling out the Cruise stake.

You may not be bullish on GM's traditional business long-term, but it's cheap at 6.4 times 2021 estimates, and now that the company has committed to being fully electric by 2035 it could be a leader in EVs as well. But a decade from now it's not the auto manufacturing business that could be driving GM's returns -- it's Cruise and the potential for fully autonomous ride sharing. In GM, we're getting two great businesses at a cheap price.

Verizon

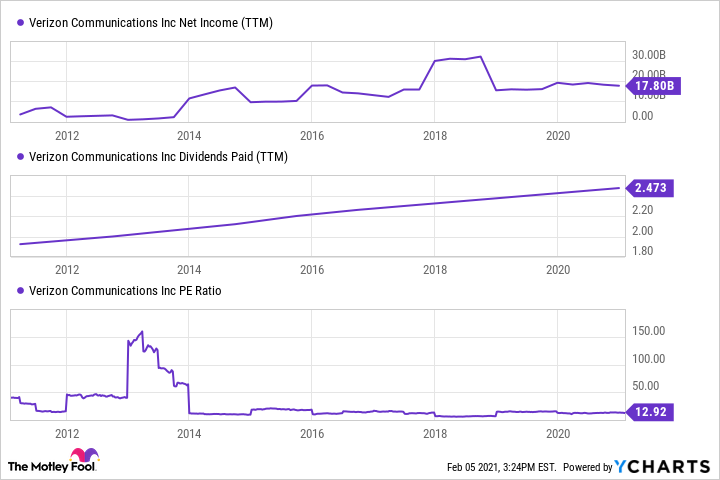

Investing in telecommunications stocks is a bit of a contrarian move right now, but that's why stocks like Verizon are a good value. Verizon generates consistent net income and pays a growing dividend that currently yields 4.5%, and you can see below that shares trade at about 12.9 time earnings. What's not to like about that value?

VZ Net Income (TTM) data by YCharts

Verizon will need to spend tens of billions of dollars to build out its 5G wireless network, but that could make it a growth stock once again. The current wireless business is a foundation for Verizon to build on, but the real future is in 5G. As new technologies like autonomous vehicles, edge computing, and virtual reality grow, they'll increase the number of 5G connections on Verizon's network.

If Verizon can keep a premium network in 5G, it could ride a wave of growth in wireless telecommunications that investors aren't giving much value right now.

Visa

Few companies have been as durable in the digital age as Visa. The company could have been disrupted by a number of digital payment upstarts, but instead it's become the center point of how digital payments are made today.

You can see below that Visa's revenue has grown steadily over the past decade as digital payments have increased, margins remain well above 70%, and net income has more than tripled over that time.

V Revenue (TTM) data by YCharts

Visa's shares are more expensive than the other two stocks mentioned here, with a price to earnings ratio of 43.1. But unlike GM and Verizon, Visa is in a growing business that's likely to continue growing as digital payments grow globally.

Visa is the kind of business that's worth paying a little bit of a premium for given its incredible strength. That's why it's still a cheap stock.

Built to last

Not only are GM, Verizon, and Visa great businesses today, they're trading at reasonable valuations and have the opportunity to grow long-term. That's why they're absurdly cheap in today's market, and could outperform some of the hottest growth stocks for patient long-term investors.